Global Textile Industry Is Optimistic About Business Environment

- Companies see mostly a good business situation and anticipate an even more favorable business in six months’ time.

- Some differences between regions and segments persist.

- Rate of vaccination in a country is impacting business optimism

- Upstream segments are faring better than downstream segments

- Order intake has significantly improved

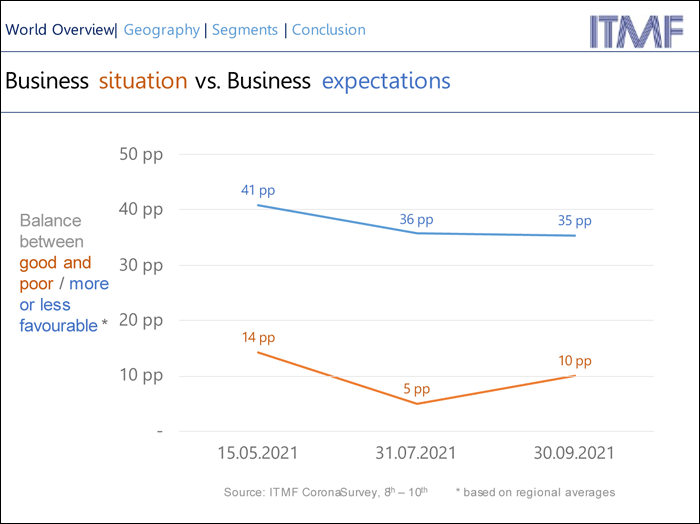

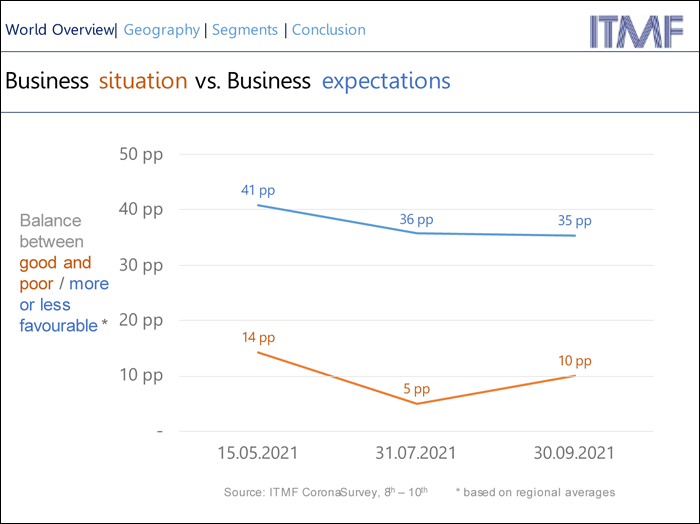

Companies’ have a more optimistic business expectation compared to earlier months. Forty-eight percent of companies are expecting more favorable business, and only 13% a less favorable business environment, which results in a positive balance of +35 pp (48% minus 13%).

Rate of vaccination impacts optimism

Looking at regions it can be observed that those regions with a slow vaccination campaign are lagging those with high vaccination rates when it comes to business situation and expectations.

Upstream segments are doing better

As for the segments, upstream segments have been faring somewhat better since the recovery is under way than the downstream ones, but the latter seem to be catching up. One important reason for this is the supply chain disruptions the industry is faced with. Further down the value chain the disruptions are felt more pronouncedly due to the cumulative effects in delays of raw and intermediate materials.

Improved order intake

Compared to May and July, order intake has increased significantly in September on a global level and companies anticipate a further increase in the next six months. A look at the order backlog since May 2021 reveals that companies have a stable order backlog on average of around 2.4 months. Differences between regions and segments remain.

Companies’ have a more optimistic business expectation compared to earlier months. Forty-eight percent of companies are expecting more favorable business, and only 13% a less favorable business environment, which results in a positive balance of +35 pp (48% minus 13%).

Rate of vaccination impacts optimism

Looking at regions it can be observed that those regions with a slow vaccination campaign are lagging those with high vaccination rates when it comes to business situation and expectations.

Upstream segments are doing better

As for the segments, upstream segments have been faring somewhat better since the recovery is under way than the downstream ones, but the latter seem to be catching up. One important reason for this is the supply chain disruptions the industry is faced with. Further down the value chain the disruptions are felt more pronouncedly due to the cumulative effects in delays of raw and intermediate materials.

Improved order intake

Compared to May and July, order intake has increased significantly in September on a global level and companies anticipate a further increase in the next six months. A look at the order backlog since May 2021 reveals that companies have a stable order backlog on average of around 2.4 months. Differences between regions and segments remain.

Textile Excellence

Subscribe To Textile Excellence Print Edition

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.