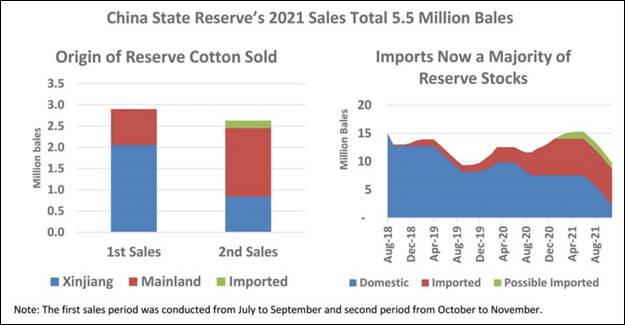

China State Reserve’s 2021 Sales Total 5.5 Million Bales

The first sales period was conducted from July to September and second period from October to November. China suspended sales from the State Reserve as of December 1, which operated in two separate periods from July to the end of November. The initial sales period ran from July 5 through the end of September, and the entire 2.9 million bales (630,000 tons) offered was sold. Over 95% of the cotton sold was from the 2011, 2012, and 2013 crops. All sales were domestic cotton with just over 70% Xinjiang origin and the remainder from outside the region. China announced in late September that sales would resume with no specific end date or quantity. During the second sales period (October– November), nearly 4.4 million bales (950,000 tons) were offered for sale, of which 2.6 million (572,400 tons) found buyers. Xinjiang cotton accounted for 32% of the sales, 61% was from the rest of China, and imported cotton filled the remaining 7%. As during the first period, all Xinjiang cotton was sold; however, just under half of the mainland cotton found buyers. Additionally, imported cotton was offered and was also sold out. Ten percent of the cotton purchased was from the 2019 and 2020 crops and the rest was from earlier seasons. The actual amount of cotton remaining in the State Reserve is unknown but is estimated at between 8.7 million and 9.8 million bales (1.9 and 2.1 million tons), likely the lowest since August 2019 and before China’s massive build-up of reserve stocks starting in 2011. Roughly 2.2 million bales (475,000 tons) of domestic cotton are estimated to be in the reserve. The amount of imported cotton held is believed to be at least 6.5 million bales (1.4 million tons) with the possibility of another 1.1 million (240,000 tons) being held by state trading or state-owned enterprises. The 2021 sales programme follows China’s reserve rotation policy, which has virtually eliminated the reserve stocks of domestic cotton from the 2011-2013 crops (which at one point approached 60 million). Remaining stocks of domestic cotton are largely from the 2019 crop while stocks of imported cotton are mostly from the 2018-2020 crops. It is anticipated that the State Reserve will again hold sales in 2022 and will also replenish reserves to maintain its stocks at the current level. The volume of future sales and purchases is difficult to estimate, in addition to origin (e.g., domestic or foreign) which will likely be driven in part by relative prices (e.g, China spot prices vs. A-index). As in the past, future purchases or sales by the State Reserve could have significant impacts on the global cotton market. 2021/22 Outlook Global production is down with a significantly smaller crop in Pakistan more than offsetting larger crops in Benin, Turkey, and Uzbekistan. Use is mostly unchanged. Ending stocks are down more than 1 million bales on fewer supplies in India, Pakistan, and China. Global trade is up slightly with higher imports for Pakistan and Vietnam more than offsetting lower projected volumes for China. US production is up marginally to 18.3 million. Exports and use are unchanged for the second consecutive month, with ending stocks also unchanged. The US season-average farm price is unchanged at 90 cents per pound. Global cotton prices fell since last month’s WASDE following downward movements on the Intercontinental Commodity Exchange’s March 2022 contract and new crop supplies arriving to major markets. An additional factor included the onset of the Omicron variant which negatively affected prices of major stock market indices and futures; for example, the December 3 S&P Retail Select Industry Index was 6% lower compared with the previous week. Rapid and volatile downward movements in major US stock indices incentivised speculators to liquidate their long positions and lowered open interest in the March 2022 contract. Nonetheless, the A-Index is nearly 40 cents above last year’s level, signifying prospects for robust global consumption relative to the previous year as 2021/22 global consumption is forecast up more than 3 million bales.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.