US Textile And Apparel Imports Recover, Back To 2019 Pre-Lockdown Levels

US textile and apparel imports have shown a strong recovery in 2021, according to OTEXA data. China’s share in the US market continues to fall, while India, Bangladesh, Pakistan, Turkey and countries from other regions register higher exports to this market.

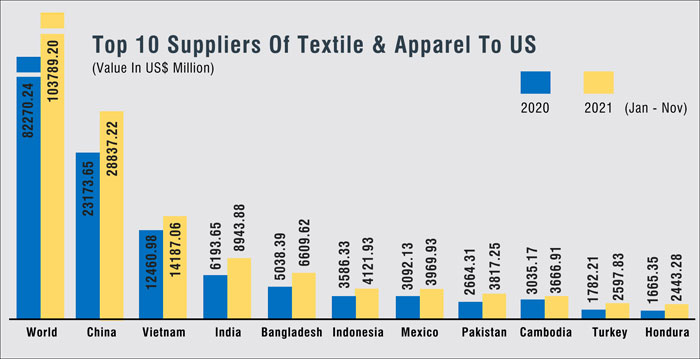

US textile and apparel imports are on the rise, with imports touching US$ 103789.20 during January-November, 2021, a growth of 26.16% compared to Jan-November 2020, according to the latest OTEXA data.

2020 was a year of disruptions however, and does not therefore lend itself to a relevant comparison. However, US imports have surpassed 2019 levels by a small margin, which is an indication that the situation has improved to pre-lockdown levels.

US imports reached pre-lockdown levels in 2021

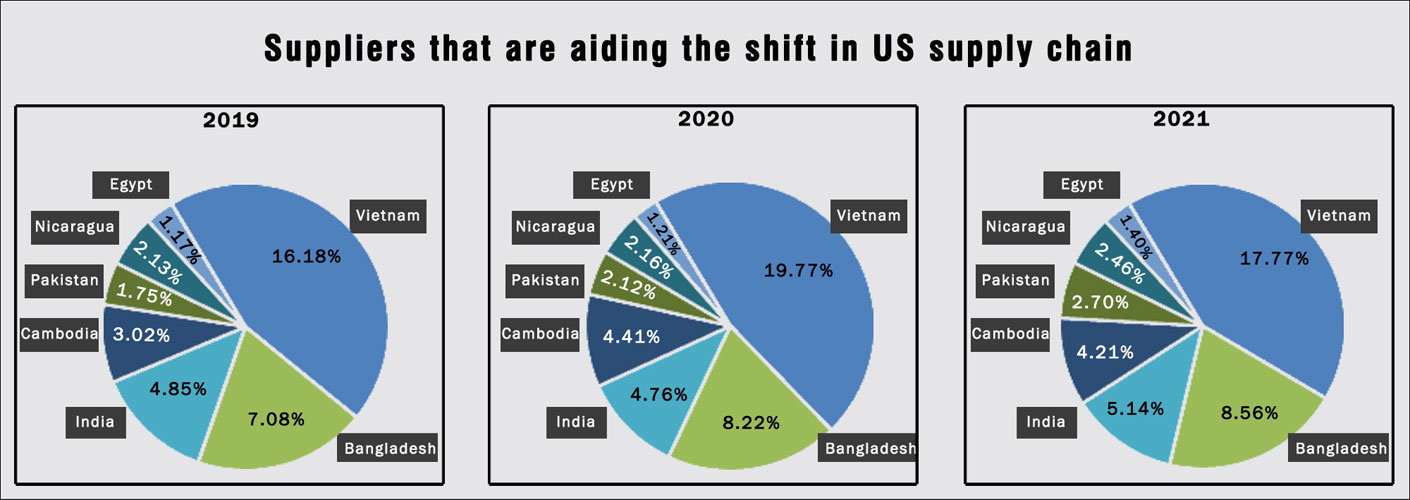

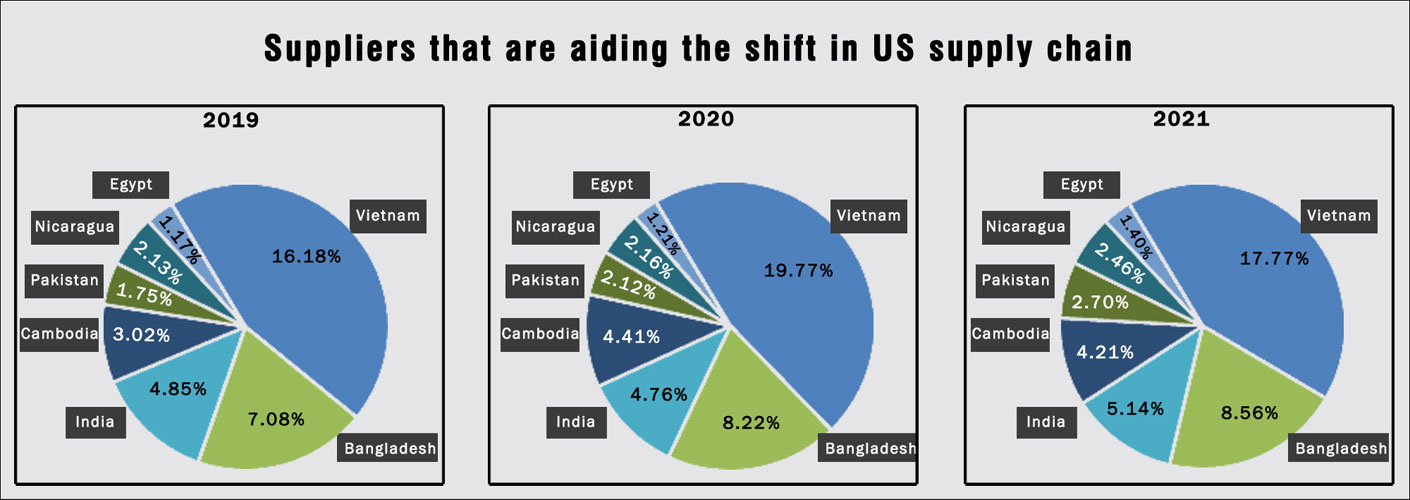

In fact, data indicates that many countries' exports to the US in the eleven months of 2021 have far surpassed full year 2019 exports to the US. For instance, India's exports of textiles and apparel to the US in January-November 2021 at US$ 8943.33 million, is 11.19% higher than full year 2019 imports. Similarly, Bangladesh's exports at US$ 6609.62 million surpassed full year 2019 exports by 8.14%.

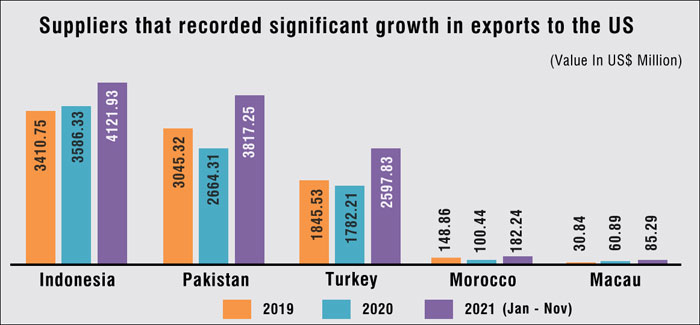

Turkey's 11-month 2021 exports are 40.76% higher than 2019 exports, Pakistan's are 25.35%, Cambodia's 19.81% higher.

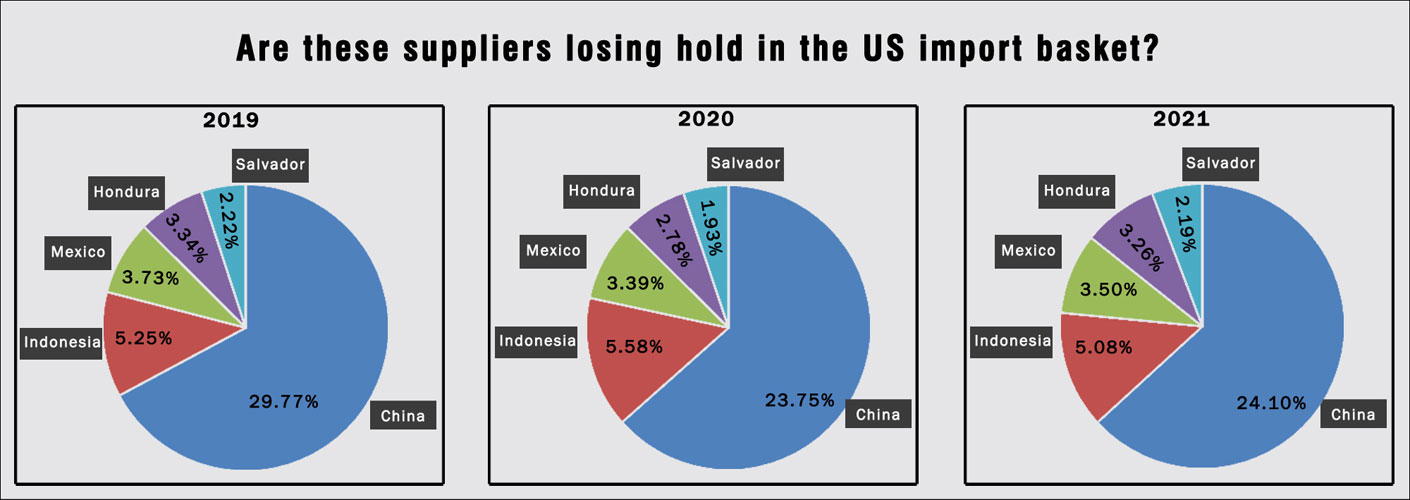

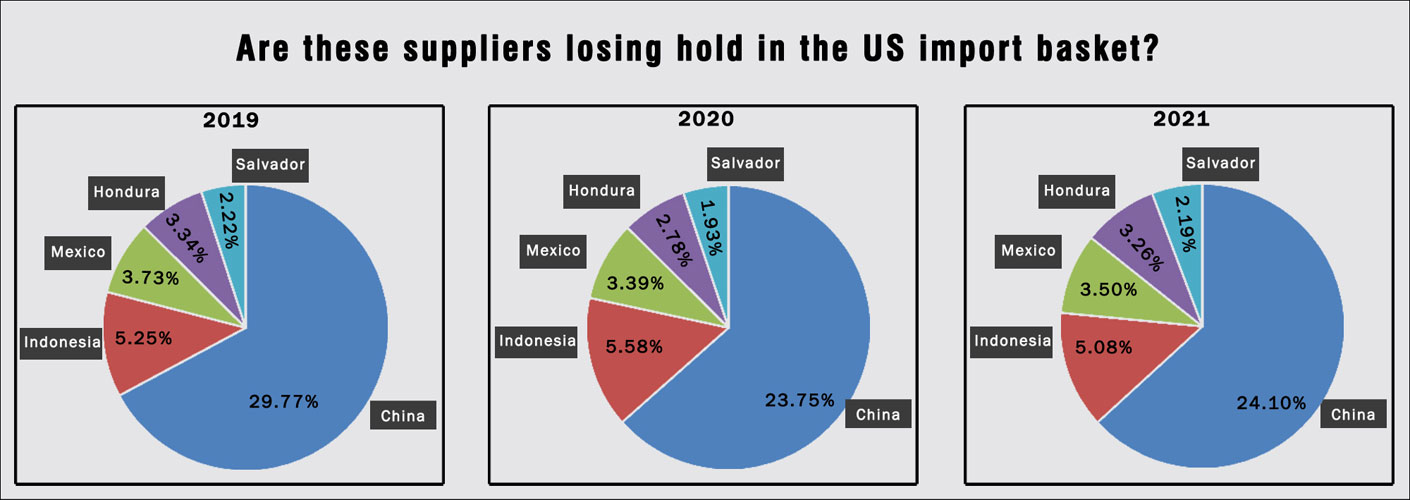

China’s share dwindles across all categories

China remains the largest supplier of textiles and apparel to the US market, but is' share in total US imports has been steadily falling, from 32.8% in 2019, to 28.17% in 2020, and 27.78% in 2021. Vietnam, the second largest exporter in this segment, accounts for a share of 13.67% in total US imports in 2021, down from 15.15% in 2020.

US imports reached pre-lockdown levels in 2021

In fact, data indicates that many countries' exports to the US in the eleven months of 2021 have far surpassed full year 2019 exports to the US. For instance, India's exports of textiles and apparel to the US in January-November 2021 at US$ 8943.33 million, is 11.19% higher than full year 2019 imports. Similarly, Bangladesh's exports at US$ 6609.62 million surpassed full year 2019 exports by 8.14%.

Turkey's 11-month 2021 exports are 40.76% higher than 2019 exports, Pakistan's are 25.35%, Cambodia's 19.81% higher.

China’s share dwindles across all categories

China remains the largest supplier of textiles and apparel to the US market, but is' share in total US imports has been steadily falling, from 32.8% in 2019, to 28.17% in 2020, and 27.78% in 2021. Vietnam, the second largest exporter in this segment, accounts for a share of 13.67% in total US imports in 2021, down from 15.15% in 2020.

India's share has been steadily improving in the last three years, from 7.25% in 2019, to 7.53% in 2020, and 8.62% in 2021. Similar is the case with Bangladesh. Its share in total US imports has gone up from 5.51% in 2019, to 6.12% in 2020 to 6.37% in 2021. Pakistan, despite facing various challenges in terms of costs and logistics, has also managed to improve its standing in the US market.

Other countries that are gaining ground in US textile and apparel imports include Turkey, Honduras, Italy, Portugal, France, Egypt, Morocco, and many others. While their total exports to the US are small, their shares are certainly improving, an indication that US buyers are shopping more from across the world, and not just China or Asia.

US apparel buyers widen their sourcing destinations

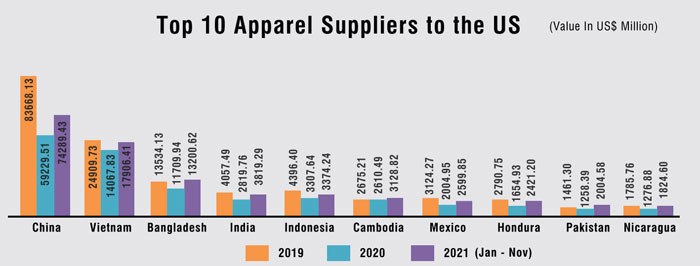

US apparel imports during January-November 2021 at US$ 74289.43 million were 25.43% higher than in the same period of 2020. But US 2021 apparel imports are around 3% lower than in 2019.

China, Vietnam, Bangladesh are the top three suppliers of apparel to this market. While imports from China in the eleven months of 2021 grew by 27.29%, Vietnam's exports to the US went up by 12.73% and Bangladesh's exports were up by 30.68% compared to the same period of 2020. Imports from Bangladesh in these eleven months were higher than full year 2019 US imports. Some other countries that have significantly surpassed 2019 export levels include Cambodia, Pakistan, Turkey, Morocco, Macau, Laos, among others.

India's share has been steadily improving in the last three years, from 7.25% in 2019, to 7.53% in 2020, and 8.62% in 2021. Similar is the case with Bangladesh. Its share in total US imports has gone up from 5.51% in 2019, to 6.12% in 2020 to 6.37% in 2021. Pakistan, despite facing various challenges in terms of costs and logistics, has also managed to improve its standing in the US market.

Other countries that are gaining ground in US textile and apparel imports include Turkey, Honduras, Italy, Portugal, France, Egypt, Morocco, and many others. While their total exports to the US are small, their shares are certainly improving, an indication that US buyers are shopping more from across the world, and not just China or Asia.

US apparel buyers widen their sourcing destinations

US apparel imports during January-November 2021 at US$ 74289.43 million were 25.43% higher than in the same period of 2020. But US 2021 apparel imports are around 3% lower than in 2019.

China, Vietnam, Bangladesh are the top three suppliers of apparel to this market. While imports from China in the eleven months of 2021 grew by 27.29%, Vietnam's exports to the US went up by 12.73% and Bangladesh's exports were up by 30.68% compared to the same period of 2020. Imports from Bangladesh in these eleven months were higher than full year 2019 US imports. Some other countries that have significantly surpassed 2019 export levels include Cambodia, Pakistan, Turkey, Morocco, Macau, Laos, among others.

Vietnam, Egypt, Bangladesh emerging suppliers of fabric to US

US fabric imports show some interesting trends. US imports of fabrics during January-November 2021 at US$ 6512.77 million were 17.2% higher than in the same period of 2020. Interestingly, fabric imports were 5% higher than in full year 2019. China is the largest supplier in this category too, with exports of US$ 1350.21 million, a drop of 4.3% compared to the eleven months of 2020. Here too, China's share is gradually dwindling, from 23.45% in 2019 to 20.73% in 2021.

India is the second largest fabric supplier to the US market, and its exports in the eleven months of 2021 went up by 60.4% to US$ 716.58 million. India's fabric exports to the US in 2021 are already 51.3% higher than full year 2019 imports. India's share of total fabric imports by the US has improved from 7.64% in 2019, to 11% in 2021.

US imports from Vietnam are gradually increasing from US$ 271.34 million in 2019, to US$ 289.12 million in 2021 January-November. Vietnam now accounts for a share of 4.44% of total US fabric imports. US fabric imports from Egypt (37.69%) and Bangladesh (78.22%) have also increased manifold during the period under review. Other important suppliers include Mexico, Germany, Canada, among others.

Vietnam, Egypt, Bangladesh emerging suppliers of fabric to US

US fabric imports show some interesting trends. US imports of fabrics during January-November 2021 at US$ 6512.77 million were 17.2% higher than in the same period of 2020. Interestingly, fabric imports were 5% higher than in full year 2019. China is the largest supplier in this category too, with exports of US$ 1350.21 million, a drop of 4.3% compared to the eleven months of 2020. Here too, China's share is gradually dwindling, from 23.45% in 2019 to 20.73% in 2021.

India is the second largest fabric supplier to the US market, and its exports in the eleven months of 2021 went up by 60.4% to US$ 716.58 million. India's fabric exports to the US in 2021 are already 51.3% higher than full year 2019 imports. India's share of total fabric imports by the US has improved from 7.64% in 2019, to 11% in 2021.

US imports from Vietnam are gradually increasing from US$ 271.34 million in 2019, to US$ 289.12 million in 2021 January-November. Vietnam now accounts for a share of 4.44% of total US fabric imports. US fabric imports from Egypt (37.69%) and Bangladesh (78.22%) have also increased manifold during the period under review. Other important suppliers include Mexico, Germany, Canada, among others.

India, Pakistan, China lose share in US home textile imports

US home textile and home furnishings imports during January-November 2021 at US$ 10791.76 million, recorded a growth of 35.64% compared to CPLY. India is the largest supplier with exports of US$ 3771.19 million, growing almost 50% during the period. China's exports at US$ 2443.06 million grew by 18.71% during the period. And Pakistan, the third largest supplier in this category clocked a growth of 32.73% with exports of US$ 1459.17 million.

Shares of all three suppliers to the US have shown a slight decline.

Strong demand for Indian apparel to further push exports: AEPC

India’s overall exports of readymade garments saw an increase of 22% to US$ 1.46 billion in December 2021 from US$ 1.20 billion in the same month of 2020. Total apparel exports stood at USD 11.13 billion during April-December 2021. Strong demand and healthy order books will further help in boosting the country's exports in the coming months, Apparel Export Promotion Council (AEPC) Chairman A Sakthivel believes.

India, Pakistan, China lose share in US home textile imports

US home textile and home furnishings imports during January-November 2021 at US$ 10791.76 million, recorded a growth of 35.64% compared to CPLY. India is the largest supplier with exports of US$ 3771.19 million, growing almost 50% during the period. China's exports at US$ 2443.06 million grew by 18.71% during the period. And Pakistan, the third largest supplier in this category clocked a growth of 32.73% with exports of US$ 1459.17 million.

Shares of all three suppliers to the US have shown a slight decline.

Strong demand for Indian apparel to further push exports: AEPC

India’s overall exports of readymade garments saw an increase of 22% to US$ 1.46 billion in December 2021 from US$ 1.20 billion in the same month of 2020. Total apparel exports stood at USD 11.13 billion during April-December 2021. Strong demand and healthy order books will further help in boosting the country's exports in the coming months, Apparel Export Promotion Council (AEPC) Chairman A Sakthivel believes.

"We have a fast-growing order book from brands and buyers across the world. With the help of strong demand conditions, Indian apparel exports will see historic highs soon in the next coming months," he said. "Indian apparels have also bounced back. This is despite the fact that local restrictions impacted operations in the first quarter during the second wave of the pandemic. Apparel exporters have done exceedingly well in spite of challenges," Sakthivel said.

He added that two mega schemes that will help India reclaim its global leadership position in textiles and apparels are PLI (Production Linked Incentive) and PM-MITRA (Mega Integrated Textile Region and Apparel). Further, fast tracking of trade deals with the US, UK, EU and UAE will make Indian apparels far more attractive, Sakthivel added.

Agrees Mr G.V. Aras, mentor, advisor, consultant to the textile industry. “I foresee good times for the Indian textile and apparel industry from here on. There are a lot of opportunities today in the world markets. Indian textile industry is seriously modernising to become world class players. Some interesting government schemes are in place. India will emerge an important textile and apparel supplier to the world,” he believes.

Mr Sanjiv Bhartia, Marketing Director, Dhanesh Weaving, echoes the same sentiments. “I expect 2022 to be a great year for the Indian textile and apparel industry. Most mills and apparel exporters are reporting full order books. Importantly, Indian industry is venturing into newer fibres and textiles, which will add more value to the export basket.”

"We have a fast-growing order book from brands and buyers across the world. With the help of strong demand conditions, Indian apparel exports will see historic highs soon in the next coming months," he said. "Indian apparels have also bounced back. This is despite the fact that local restrictions impacted operations in the first quarter during the second wave of the pandemic. Apparel exporters have done exceedingly well in spite of challenges," Sakthivel said.

He added that two mega schemes that will help India reclaim its global leadership position in textiles and apparels are PLI (Production Linked Incentive) and PM-MITRA (Mega Integrated Textile Region and Apparel). Further, fast tracking of trade deals with the US, UK, EU and UAE will make Indian apparels far more attractive, Sakthivel added.

Agrees Mr G.V. Aras, mentor, advisor, consultant to the textile industry. “I foresee good times for the Indian textile and apparel industry from here on. There are a lot of opportunities today in the world markets. Indian textile industry is seriously modernising to become world class players. Some interesting government schemes are in place. India will emerge an important textile and apparel supplier to the world,” he believes.

Mr Sanjiv Bhartia, Marketing Director, Dhanesh Weaving, echoes the same sentiments. “I expect 2022 to be a great year for the Indian textile and apparel industry. Most mills and apparel exporters are reporting full order books. Importantly, Indian industry is venturing into newer fibres and textiles, which will add more value to the export basket.”

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.