US Shoppers Are Resisting Price Increases

US apparel retailers and department stores are bumping up against pockets of price resistance, a sign that consumers are curtailing spending as inflation remains at the highest level in four decades.

Macy’s Inc. tried to raise prices on some mattresses and sofas by US$ 100, but shoppers pushed back, Chief Executive Jeff Gennette said. Clothing brand Bella Dahl raised prices on its T-shirts by about US$ 20, then sales fell and the company rolled back the price increase. “There was a revolt,” said Steven Millman, its chief brand officer. “If we go any higher, we’ll do half the sales.”

With inflation at a 40-year high, companies across the spectrum have been charging more to offset rising costs with little resistance from consumers. That trend is starting to change, especially on lower-priced apparel and furniture, according to industry executives, analysts and consumers.

Retail sales slowed in February compared with January, according to the US Commerce Department. Compared with February 2021, sales are up 17.7%, but a large chunk is due to rising prices. In some categories, such as gasoline and food, all the gains were driven by inflation, according to research firm GlobalData. In apparel, there is “some trading down with more shoppers turning to value players for some of their purchases,” according to Neil Saunders, a GlobalData managing director. “This is likely in response to squeezed budgets.”

Unit sales of general merchandise goods such as apparel, footwear, toys and sports equipment declined in nine of the 10 weeks from December 26 through March 5 compared with the same period a year ago, according to market research firm NPD Group. Roughly 43% of consumers surveyed by NPD in February said that if prices continue to rise, they will delay less-important purchases to stick to a budget.

“We are seeing less demand as consumers pay higher prices,” said Marshal Cohen, NPD’s chief retail industry adviser. “Price sensitivity is starting to show up. There is a threshold that consumers don’t want to go over.”

Shoppers who had been spending freely throughout the pandemic, have started cutting back in the past two months as higher prices and a stock market made volatile by Russia’s invasion of Ukraine have them feeling less affluent.

Apparel retailers have been among the biggest beneficiaries of consumer spending as Covid-19 restrictions ease and people refresh their wardrobes in anticipation of more in-person meetings and social events. Chains from Macy’s to Target Corp. reported strong holiday sales, and many have curtailed promotions and raised prices, a departure for an industry that had been in a deflationary spiral for decades. Crocs Inc.’s finance chief Anne Mehlman told analysts in February that the company’s average selling price rose nearly 19% last year because of price increases and fewer discounts.

But as Citigroup Inc. analyst Paul Lejuez noted in a recent report about the impact of inflation on apparel companies, despite a strong job market and rising wages, consumer “wallets are not infinite.”

What’s also eating into disposable incomes is a shift back to spending on services like dining out and travel. The pushback from consumers varies across categories and brands. Luxury players have been jacking up prices with no visible collapse in demand. Items that are scarce because of supply-chain shortages also can command higher prices. And shoppers are more willing to pay up for fashion items like spring dresses than basic T-shirts, executives said.

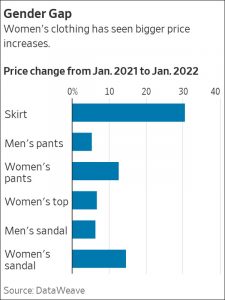

Analytics company DataWeave Inc. found wide disparities in the price increases by item and gender. The average price of skirts is up 31% compared with a year ago, while pants cost only 8.6% more. Women on average are paying an extra 13% for pants, while men are paying an additional 5.3%.

Retailers are trying to figure out how far to push prices without losing customers and developing workarounds when price increases aren’t feasible, the executives said.

Some brands are reducing costs by using lower-grade leather, lighter-weight cotton or cheaper trim, said Brian Ehrig, a partner in the consumer practice of consulting firm Kearney. Others are switching to less-expensive manufacturing techniques such as single-brushed instead of double-brushed fabrics — the difference being that rollers only fluff the fibres on the outside to make them softer, not on both sides, said Jackie Ferrari, CEO of clothing manufacturer American Fashion Network.

Premium brands are taking the opposite tack, by adding quality to products in the hope that consumers will pay more. When Coach introduced the latest version of its Tabby 26 handbag last spring, which is made of softer, fluffier leather than the original, it raised the price by US$100. “Consumers could really see the additional value,” said Todd Kahn, CEO of the Coach brand, which is owned by Tapestry Inc.

Macy’s has been able to charge more for expensive items but not less-expensive models. The chain raised the price of a US$ 2,000 sectional sofa to US$ 2,200. But it was unable to charge US$ 100 more for a US$ 499 sofa. It ran into the same problem when it tried to raise the price of a US$ 499 mattress. “We tried to raise the price, and the customer pushed back on that,” Gennette said in an interview last month.

The same applies to clothing. Gennette told analysts in February that the chain can charge more for fashion but not for basic tank tops, t-shirts and shorts. In the case of basics, “we could be working short,” Gennette said, meaning that Macy’s is making less of a profit or sometimes taking a loss.

Retail sales slowed in February compared with January, according to the US Commerce Department. Compared with February 2021, sales are up 17.7%, but a large chunk is due to rising prices. In some categories, such as gasoline and food, all the gains were driven by inflation, according to research firm GlobalData. In apparel, there is “some trading down with more shoppers turning to value players for some of their purchases,” according to Neil Saunders, a GlobalData managing director. “This is likely in response to squeezed budgets.”

Unit sales of general merchandise goods such as apparel, footwear, toys and sports equipment declined in nine of the 10 weeks from December 26 through March 5 compared with the same period a year ago, according to market research firm NPD Group. Roughly 43% of consumers surveyed by NPD in February said that if prices continue to rise, they will delay less-important purchases to stick to a budget.

“We are seeing less demand as consumers pay higher prices,” said Marshal Cohen, NPD’s chief retail industry adviser. “Price sensitivity is starting to show up. There is a threshold that consumers don’t want to go over.”

Shoppers who had been spending freely throughout the pandemic, have started cutting back in the past two months as higher prices and a stock market made volatile by Russia’s invasion of Ukraine have them feeling less affluent.

Apparel retailers have been among the biggest beneficiaries of consumer spending as Covid-19 restrictions ease and people refresh their wardrobes in anticipation of more in-person meetings and social events. Chains from Macy’s to Target Corp. reported strong holiday sales, and many have curtailed promotions and raised prices, a departure for an industry that had been in a deflationary spiral for decades. Crocs Inc.’s finance chief Anne Mehlman told analysts in February that the company’s average selling price rose nearly 19% last year because of price increases and fewer discounts.

But as Citigroup Inc. analyst Paul Lejuez noted in a recent report about the impact of inflation on apparel companies, despite a strong job market and rising wages, consumer “wallets are not infinite.”

What’s also eating into disposable incomes is a shift back to spending on services like dining out and travel. The pushback from consumers varies across categories and brands. Luxury players have been jacking up prices with no visible collapse in demand. Items that are scarce because of supply-chain shortages also can command higher prices. And shoppers are more willing to pay up for fashion items like spring dresses than basic T-shirts, executives said.

Analytics company DataWeave Inc. found wide disparities in the price increases by item and gender. The average price of skirts is up 31% compared with a year ago, while pants cost only 8.6% more. Women on average are paying an extra 13% for pants, while men are paying an additional 5.3%.

Retailers are trying to figure out how far to push prices without losing customers and developing workarounds when price increases aren’t feasible, the executives said.

Some brands are reducing costs by using lower-grade leather, lighter-weight cotton or cheaper trim, said Brian Ehrig, a partner in the consumer practice of consulting firm Kearney. Others are switching to less-expensive manufacturing techniques such as single-brushed instead of double-brushed fabrics — the difference being that rollers only fluff the fibres on the outside to make them softer, not on both sides, said Jackie Ferrari, CEO of clothing manufacturer American Fashion Network.

Premium brands are taking the opposite tack, by adding quality to products in the hope that consumers will pay more. When Coach introduced the latest version of its Tabby 26 handbag last spring, which is made of softer, fluffier leather than the original, it raised the price by US$100. “Consumers could really see the additional value,” said Todd Kahn, CEO of the Coach brand, which is owned by Tapestry Inc.

Macy’s has been able to charge more for expensive items but not less-expensive models. The chain raised the price of a US$ 2,000 sectional sofa to US$ 2,200. But it was unable to charge US$ 100 more for a US$ 499 sofa. It ran into the same problem when it tried to raise the price of a US$ 499 mattress. “We tried to raise the price, and the customer pushed back on that,” Gennette said in an interview last month.

The same applies to clothing. Gennette told analysts in February that the chain can charge more for fashion but not for basic tank tops, t-shirts and shorts. In the case of basics, “we could be working short,” Gennette said, meaning that Macy’s is making less of a profit or sometimes taking a loss.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.