Weak Demand May Increase Losses For Domestic Spinning Mills

Domestic cotton market is exploding now and prices have jumped to another high after reaching record levels. In the last one month, cotton prices have soared 17-18% in NCDEX spot market. And in the first week of April alone, prices went up a further 2.5-3.0%.

Mills under pressure

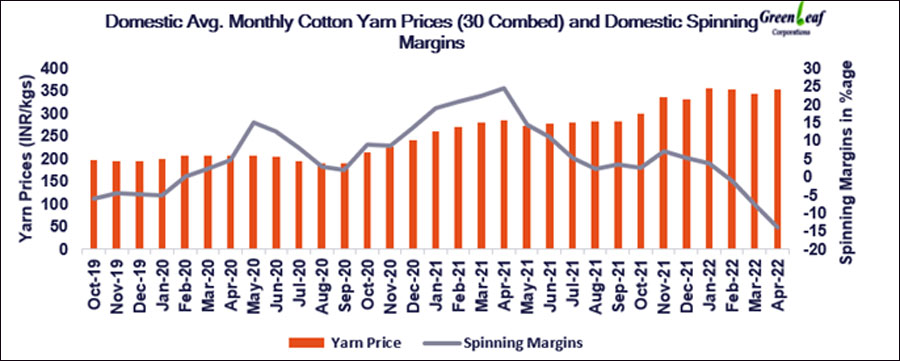

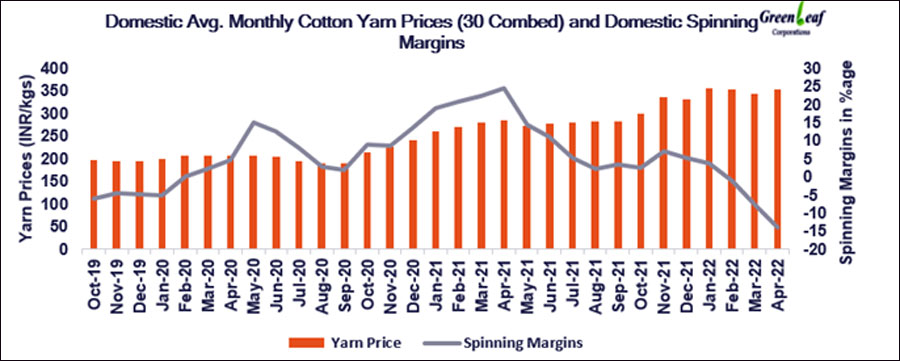

However, demand for cotton yarn and textiles is still not up to the levels seen last year. This has resulted in mills working at lower margins and spinning mills’ losses are rising now. There could be tough times ahead for the spinning mills as dwindling supplies are keeping mills under pressure. Spinning mills are looking to build higher cotton stocks otherwise they may find it difficult to get the cotton in later months.

There are still six months to go for the season and as per Textiles Ministry data, arrivals have already reached 26.2 million bales. We have only 7.3 million bales left to come in this season as per Cotton Association of India and mills will have difficult time to procure the cotton to run the mills at optimum capacities.

Ukraine-Russia war affecting market sentiments

Ukraine-Russia war seems to be extending for long now as Europe and America looks to help Ukraine by supplying arms to keep the war running. This is further hitting the sentiments in the international market and cotton yarn and textiles exports have been falling in the last few months.

Domestic demand is also comparatively lower keeping yarn prices in check. Spinning mills have tried to raise their yarn prices but at higher prices, yarn and textile mills are finding it difficult to compete at international levels and sales are getting limited.

Indian cotton premiums jump record high of this season against ICE

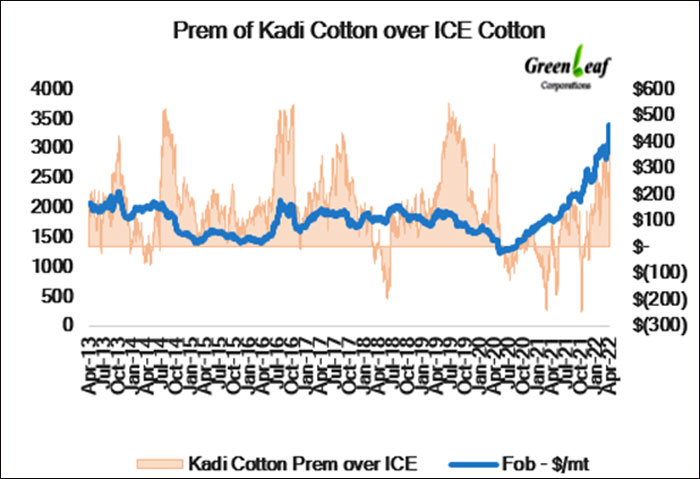

ICE cotton had been bullish and remained very volatile in the last fortnight. ICE-May prices have jumped very sharply from 120 to 138 cents level before settling down lower last week near to 132 cents levels. However, Indian domestic cotton prices continued to rise sharply and higher than ICE prices. It did not follow the bearish trends in ICE this week.

Domestic demand is also comparatively lower keeping yarn prices in check. Spinning mills have tried to raise their yarn prices but at higher prices, yarn and textile mills are finding it difficult to compete at international levels and sales are getting limited.

Indian cotton premiums jump record high of this season against ICE

ICE cotton had been bullish and remained very volatile in the last fortnight. ICE-May prices have jumped very sharply from 120 to 138 cents level before settling down lower last week near to 132 cents levels. However, Indian domestic cotton prices continued to rise sharply and higher than ICE prices. It did not follow the bearish trends in ICE this week.

This made Indian cotton costlier in the International market and it was available at very high premiums. Cotton premiums for Indian cotton are at more than US$ 400/MT against ICE-May. In basis terms of cents/lbs, Indian basis increased to 16-18 cents per pound.

These premiums are highest in this season and will keep exports in check in coming months. Traders and sellers are finding this as a great opportunity to sell their stocked cotton and are aggressively offering to buyers. We have already seen that cotton exports are down by 12-15% compared to last year as per DGCIS data. With only around seven million bales remaining to arrive in the market now till September, exporters will find it very difficult to export.

Mills push for duty-free cotton imports amid expectation of fall in cotton consumption

This made Indian cotton costlier in the International market and it was available at very high premiums. Cotton premiums for Indian cotton are at more than US$ 400/MT against ICE-May. In basis terms of cents/lbs, Indian basis increased to 16-18 cents per pound.

These premiums are highest in this season and will keep exports in check in coming months. Traders and sellers are finding this as a great opportunity to sell their stocked cotton and are aggressively offering to buyers. We have already seen that cotton exports are down by 12-15% compared to last year as per DGCIS data. With only around seven million bales remaining to arrive in the market now till September, exporters will find it very difficult to export.

Mills push for duty-free cotton imports amid expectation of fall in cotton consumption

Spinning mills are incessantly demanding that the government remove import duties on cotton, so that they can buy more competitively priced cotton.

Cotton imports are going very slow in the season 2021-22 as was the last year. Till February end, only 460,000 Indian bales have been imported as per DGCIS data. Most of the cotton imported is specialised cotton - high staple length for longer counts, or contamination-free cotton. Main imports as usual are from Egyptian origin. Other major origin is Cote de Ivoire and USA.

India, Australia FTA

Last week, India and Australia signed a free trade agreement making way for duty-free import of Australian cotton into the Indian market. However, at this moment premiums are very high for Australian cotton too and India will find it difficult to import from this origin.

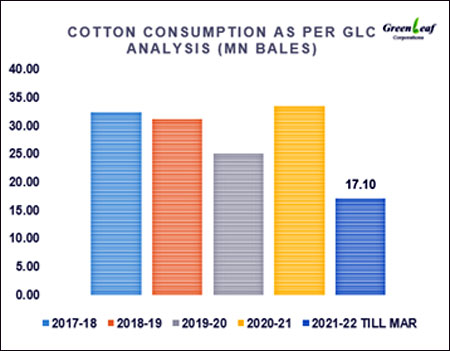

Indian mills will have to import cotton this season as Indian cotton size is very limited this year. Both USDA and CAI have reduced Indian crop size in its latest estimates to 33.8 million and 33.5 million bales respectively. Consumptions may be hit due to lower availability, moreover high demand could make cotton even costlier, and result in rising losses for spinning mills. Cotton consumption which was very high till now may fall in the rest of the months. Mills are already planning to reduce their consumption if losses remain high.

The central government seems to be considering the issue and to save textile mills from continuous losses, there may be some decision in the coming months. If it happens import volumes may rise.

Ginning margins at spot sales remain down, ginners facing losses

Spinning mills are incessantly demanding that the government remove import duties on cotton, so that they can buy more competitively priced cotton.

Cotton imports are going very slow in the season 2021-22 as was the last year. Till February end, only 460,000 Indian bales have been imported as per DGCIS data. Most of the cotton imported is specialised cotton - high staple length for longer counts, or contamination-free cotton. Main imports as usual are from Egyptian origin. Other major origin is Cote de Ivoire and USA.

India, Australia FTA

Last week, India and Australia signed a free trade agreement making way for duty-free import of Australian cotton into the Indian market. However, at this moment premiums are very high for Australian cotton too and India will find it difficult to import from this origin.

Indian mills will have to import cotton this season as Indian cotton size is very limited this year. Both USDA and CAI have reduced Indian crop size in its latest estimates to 33.8 million and 33.5 million bales respectively. Consumptions may be hit due to lower availability, moreover high demand could make cotton even costlier, and result in rising losses for spinning mills. Cotton consumption which was very high till now may fall in the rest of the months. Mills are already planning to reduce their consumption if losses remain high.

The central government seems to be considering the issue and to save textile mills from continuous losses, there may be some decision in the coming months. If it happens import volumes may rise.

Ginning margins at spot sales remain down, ginners facing losses

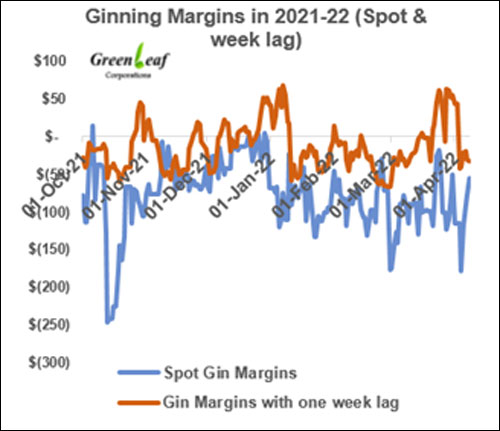

Indian ginners continue to bear losses as disparities remain in the spot sales for ginners. Ginners are facing negative margins since the start of the season 2021-22. Scarcity of kapas (lint+seed) in the open market has ensured its prices remain high. Kapas prices have further jumped 13-14% in the last one month. This is however strong encouragement for farmers to sow record planting area under cotton. Cotton seed is still steady to firm and this has kept ginners in disparities. Ginners’ margins have also been very volatile in the last month. Currently ginning mills are losing close to US$ 50/mt in spot sales.

Ginners, with one or two-week lag are however happy as rising prices in last few weeks have given some parities to them. Ginners continued to make profit in the season with few weeks’ lag. Ginning factories have started winding up their operations and are now working only for few hours in a day especially in Gujarat and Maharashtra. Most ginners have limited stocks of cotton bales. Morever ginners who had stocked for longer periods of time are now making huge profits.

(Vikas Narula is Research Head, Greenleaf Corporations.)

Indian ginners continue to bear losses as disparities remain in the spot sales for ginners. Ginners are facing negative margins since the start of the season 2021-22. Scarcity of kapas (lint+seed) in the open market has ensured its prices remain high. Kapas prices have further jumped 13-14% in the last one month. This is however strong encouragement for farmers to sow record planting area under cotton. Cotton seed is still steady to firm and this has kept ginners in disparities. Ginners’ margins have also been very volatile in the last month. Currently ginning mills are losing close to US$ 50/mt in spot sales.

Ginners, with one or two-week lag are however happy as rising prices in last few weeks have given some parities to them. Ginners continued to make profit in the season with few weeks’ lag. Ginning factories have started winding up their operations and are now working only for few hours in a day especially in Gujarat and Maharashtra. Most ginners have limited stocks of cotton bales. Morever ginners who had stocked for longer periods of time are now making huge profits.

(Vikas Narula is Research Head, Greenleaf Corporations.)

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.