Over A Fourth Of MSMEs Lost More Than 3% Market Share Last Fiscal : CRISIL

CRISIL’s SME report shows half of them also saw margin contraction

More than a quarter of India’s micro, small and medium enterprises (MSMEs) lost market share of over 3% due to the Covid-19 pandemic, and half of them suffered a contraction in their earnings before interest, tax, depreciation and amortisation (Ebitda) margins because of a sharp rise in commodity prices last fiscal, compared with the pre-pandemic (fiscal 2020) level, CRISIL Research’s SME Report 2022 reveals.

“To be sure, assessing the impact on MSMEs has been a real challenge because of information asymmetry and lack of high-frequency data points in this space,” said CRISIL.

The CRISIL report plugs this hole by covering 69 sectors and 147 clusters that logged aggregate revenue of Rs 47 lakh crore, representing 20-25% of the gross domestic product (implying two-thirds coverage of the MSME universe), Says Pushan Sharma, Director, CRISIL Research, “SMEs in several sectors saw market share loss of over 3% and Ebitda margin erosion compared with fiscal 2020 last fiscal. For instance, the pandemic-induced supply chain disruptions impacted small pesticides manufacturers more. On the other hand, large ones leveraged their global presence to procure raw materials, so could eat up a huge chunk of the SME pie.”

Says Elizabeth Master, Associate Director, CRISIL Research, “Amid the pandemic and ongoing geopolitical crisis, sectors such as textiles and pharmaceuticals have offered a ray of hope for exports. Cotton yarn exports have benefited from the US ban on Xinjiang, China-made items, apart from the China+1 policy. The readymade garment industry, with 70% MSME share, gained from supply constraints in China, and from emerging global opportunities. Pharma exports soared on pandemic-related demand, even as the domestic industry was struggling with lower volume demand. Going forward, Tirupur-based MSME garment manufacturers could benefit from export orders diverted from an economically floundering Sri Lanka.”

Interestingly, around 40% of the SMEs hardly lost market share because of their ‘essential’ nature, such as pharmaceutical/ agricultural millers, or by virtue of commanding a high share, such as the brass industry.

Surging input costs weighed heavy on sectors that operate in low-margin products and have limited pass-through. CRISIL sees sectors such as transport operators, edible oil, gems and jewellery to be the most vulnerable to Ebitda losses owing to wafer thin margin of less than 3% and limited input cost pass-through of under 60%.

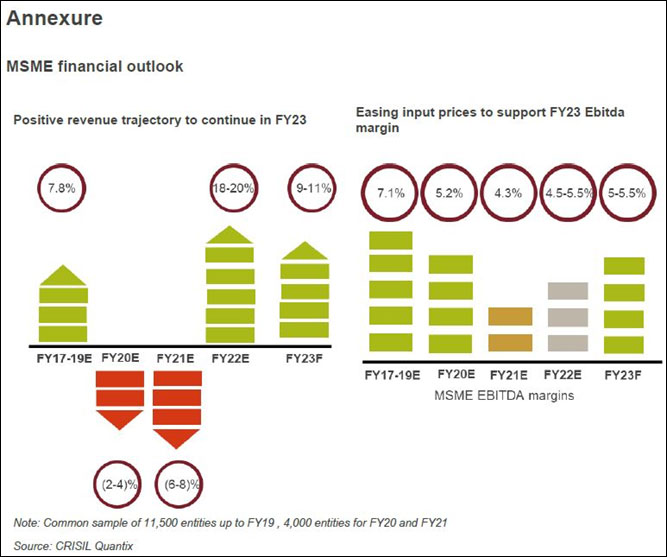

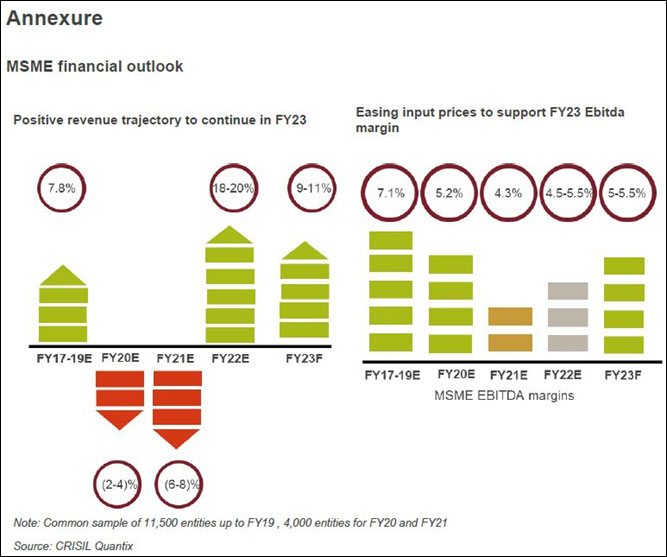

Despite a rise in freight rates, Ebitda margin of small fleet transport operators was impacted by 50 bps in fiscal 2022, over fiscal 2020, due to limited cost pass-through (~50%) of rising fuel cost that forms about half of the total cost. In the milieu, MSMEs should see revenue increase 9-11% this fiscal to 1.25 times the fiscal 2020 level, though Ebitda margin is likely to remain range-bound at 5-5.5%.

While the industry Ebitda margin is expected to touch the pre-pandemic level this fiscal, MSMEs in more than half the sectors will buck the trend. The performance is also underwhelming in the context of overall corporate India, which is expected to log a 10-14% increase in revenue and Ebitda margin of 19-20%.

Says Elizabeth Master, Associate Director, CRISIL Research, “Amid the pandemic and ongoing geopolitical crisis, sectors such as textiles and pharmaceuticals have offered a ray of hope for exports. Cotton yarn exports have benefited from the US ban on Xinjiang, China-made items, apart from the China+1 policy. The readymade garment industry, with 70% MSME share, gained from supply constraints in China, and from emerging global opportunities. Pharma exports soared on pandemic-related demand, even as the domestic industry was struggling with lower volume demand. Going forward, Tirupur-based MSME garment manufacturers could benefit from export orders diverted from an economically floundering Sri Lanka.”

Interestingly, around 40% of the SMEs hardly lost market share because of their ‘essential’ nature, such as pharmaceutical/ agricultural millers, or by virtue of commanding a high share, such as the brass industry.

Surging input costs weighed heavy on sectors that operate in low-margin products and have limited pass-through. CRISIL sees sectors such as transport operators, edible oil, gems and jewellery to be the most vulnerable to Ebitda losses owing to wafer thin margin of less than 3% and limited input cost pass-through of under 60%.

Despite a rise in freight rates, Ebitda margin of small fleet transport operators was impacted by 50 bps in fiscal 2022, over fiscal 2020, due to limited cost pass-through (~50%) of rising fuel cost that forms about half of the total cost. In the milieu, MSMEs should see revenue increase 9-11% this fiscal to 1.25 times the fiscal 2020 level, though Ebitda margin is likely to remain range-bound at 5-5.5%.

While the industry Ebitda margin is expected to touch the pre-pandemic level this fiscal, MSMEs in more than half the sectors will buck the trend. The performance is also underwhelming in the context of overall corporate India, which is expected to log a 10-14% increase in revenue and Ebitda margin of 19-20%.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.