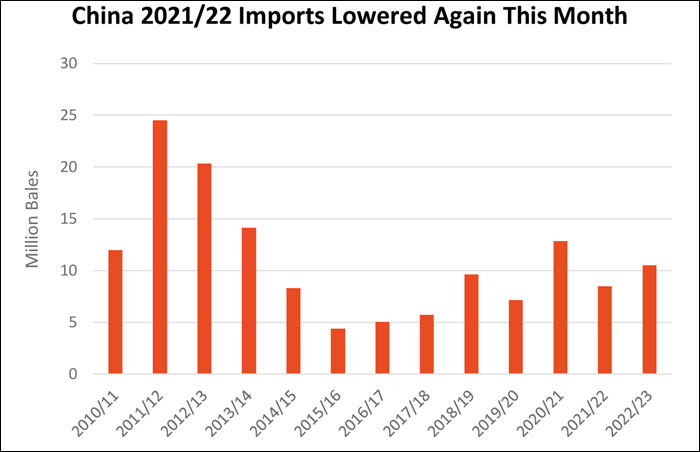

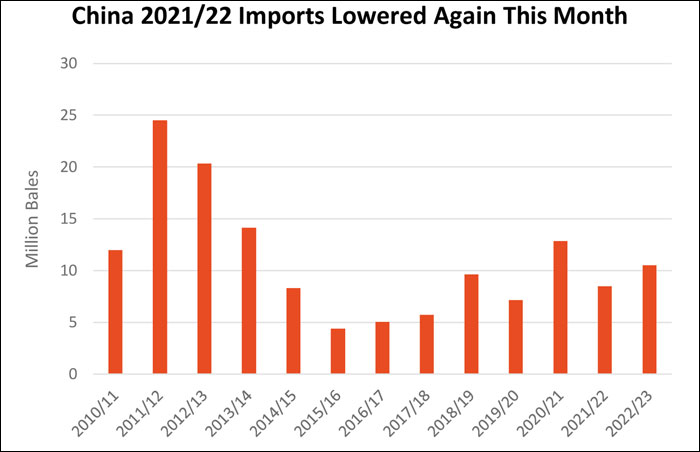

China 2021/22 Cotton Imports Lowered Again This Month

China 2021/22 cotton imports are forecast to fall more than 4.3 million bales from the previous year to 8.5 million, down 300,000 bales this month and significantly less than previous projections. This downfall can be attributed to four main factors:

- Massive earlier imports that remained in bonded warehouses at the start of the year

- Lower-than-expected consumption in China

- A sudden change in the price differential between imports and domestic cotton

- Lower demand from State-Trading Enterprises (STEs) relative to the previous year.

Roughly 10.0 million bales of foreign cotton are expected to clear in 2021/22, about 1.5 million bales lower than the previous year. Nonetheless, this is larger than the projected import level of 8.5 million. Lower-than-expected consumption has also reduced imports. China’s 2021/22 domestic use is forecast to fall 2.0 million bales compared with the previous year to 38.0 million bales, owing to higher costs and

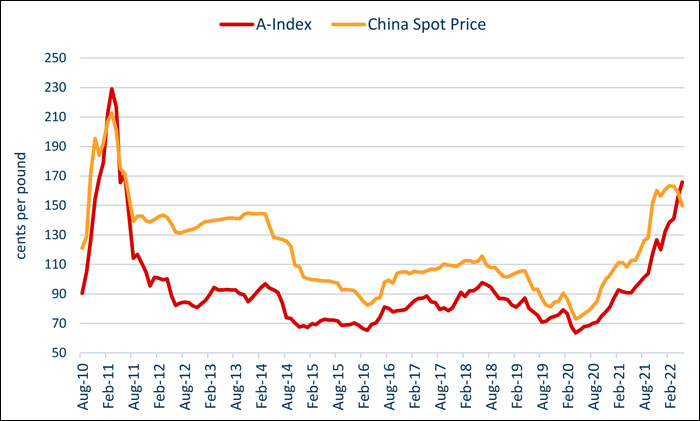

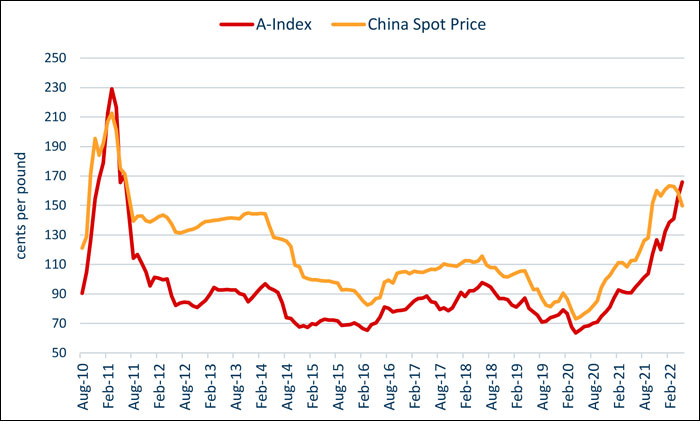

slowing economic growth. Unusually high cotton lint prices, general COVID-related lockdown orders, and large cotton yarn/fabric stocks continue to depress demand for lint. A depreciating yuan relative to the US dollar, record commercial stocks in China, and slowing demand for yarn continue to pressure China’s prices. As a result, spot prices in China have recently plunged relative to foreign cotton, making imports less attractive.

The A-index exceeded China’s spot prices for the first time in 11 years last month. Just 3 months ago, the A-Index was roughly 30 cents lower than domestic prices in China, signaling the drastic change in the relationship between international and China’s prices.

For mills recently receiving 2022 calendar year import quota, this dynamic has now greatly reduced demand for foreign cotton. Lastly, less demand from STEs has also slowed import demand. Most STE purchases are intended for state-owned warehouses, and an already high level of foreign cotton in state reserves has suppressed this demand by roughly 1.0 million bales relative to 2020/21 imports.

Roughly 10.0 million bales of foreign cotton are expected to clear in 2021/22, about 1.5 million bales lower than the previous year. Nonetheless, this is larger than the projected import level of 8.5 million. Lower-than-expected consumption has also reduced imports. China’s 2021/22 domestic use is forecast to fall 2.0 million bales compared with the previous year to 38.0 million bales, owing to higher costs and

slowing economic growth. Unusually high cotton lint prices, general COVID-related lockdown orders, and large cotton yarn/fabric stocks continue to depress demand for lint. A depreciating yuan relative to the US dollar, record commercial stocks in China, and slowing demand for yarn continue to pressure China’s prices. As a result, spot prices in China have recently plunged relative to foreign cotton, making imports less attractive.

The A-index exceeded China’s spot prices for the first time in 11 years last month. Just 3 months ago, the A-Index was roughly 30 cents lower than domestic prices in China, signaling the drastic change in the relationship between international and China’s prices.

For mills recently receiving 2022 calendar year import quota, this dynamic has now greatly reduced demand for foreign cotton. Lastly, less demand from STEs has also slowed import demand. Most STE purchases are intended for state-owned warehouses, and an already high level of foreign cotton in state reserves has suppressed this demand by roughly 1.0 million bales relative to 2020/21 imports.

Remarkably high cotton prices and lower global 2021/22 exportable supplies have also contributed to reduced STE purchases. With the factors listed above, one can ascertain that the quantity imported does not equate to the level of foreign cotton consumed. On average, roughly one-fifth of China’s consumption is composed of imports.

China 2022/23 imports are forecast to rise 2.0 million bales to 10.5 million and remain the world’s largest for the third consecutive year. This projected level is attributed to greater demand from STEs and the replenishment of foreign cotton in consignment. Despite higher projected imports, the level of imports that clear customs is projected to remain unchanged.

2022/23 Outlook

Global production is increased marginally to 121.2 million bales with higher projected crops in Egypt and West Africa. Global use is down 450,000 bales due primarily to declines in Mexico and Vietnam, and ending stocks are unchanged. Global trade is also unchanged, with imports and exports of 47.5 million bales. The US balance sheet is unchanged from last month. The projected US season-average farm price is up 5 cents to a record 95 cents per pound.

2021/22 Outlook

Global production is lowered over 1.5 million bales from last month due to declines in Brazil and India. Global use is down 1.3 million bales, and ending stocks are down over 700,000 bales Global trade is down with a drop of 400,000 bales in India’s exports. Additionally, imports are down 300,000 bales in China and 200,000 bales each in Pakistan and Vietnam.

The projected US season-average farm price is unchanged at 92 cents per pound. Global cotton prices were mixed compared with last month’s WASDE, but all origins started trending lower. The A-Index dropped over 6 cents per pound to 156 cents, still over 60 cents above the same period last year.

Prices on the Intercontinental Exchange (ICE) have witnessed another volatile month with the July and December contracts lower, in part due to scattered precipitation in West Texas which has improved crop prospects. Weaker cotton demand also pressured prices this month. Spot prices in China continue trending below other origins, contrary to prior history. Prices in India and Brazil were above the previous month but have started to decline.

Remarkably high cotton prices and lower global 2021/22 exportable supplies have also contributed to reduced STE purchases. With the factors listed above, one can ascertain that the quantity imported does not equate to the level of foreign cotton consumed. On average, roughly one-fifth of China’s consumption is composed of imports.

China 2022/23 imports are forecast to rise 2.0 million bales to 10.5 million and remain the world’s largest for the third consecutive year. This projected level is attributed to greater demand from STEs and the replenishment of foreign cotton in consignment. Despite higher projected imports, the level of imports that clear customs is projected to remain unchanged.

2022/23 Outlook

Global production is increased marginally to 121.2 million bales with higher projected crops in Egypt and West Africa. Global use is down 450,000 bales due primarily to declines in Mexico and Vietnam, and ending stocks are unchanged. Global trade is also unchanged, with imports and exports of 47.5 million bales. The US balance sheet is unchanged from last month. The projected US season-average farm price is up 5 cents to a record 95 cents per pound.

2021/22 Outlook

Global production is lowered over 1.5 million bales from last month due to declines in Brazil and India. Global use is down 1.3 million bales, and ending stocks are down over 700,000 bales Global trade is down with a drop of 400,000 bales in India’s exports. Additionally, imports are down 300,000 bales in China and 200,000 bales each in Pakistan and Vietnam.

The projected US season-average farm price is unchanged at 92 cents per pound. Global cotton prices were mixed compared with last month’s WASDE, but all origins started trending lower. The A-Index dropped over 6 cents per pound to 156 cents, still over 60 cents above the same period last year.

Prices on the Intercontinental Exchange (ICE) have witnessed another volatile month with the July and December contracts lower, in part due to scattered precipitation in West Texas which has improved crop prospects. Weaker cotton demand also pressured prices this month. Spot prices in China continue trending below other origins, contrary to prior history. Prices in India and Brazil were above the previous month but have started to decline.

Textile Excellence

Subscribe To Textile Excellence Print Edition

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.