China’s June Cotton Yarn Imports Down 17.6% MoM

Imported cotton yarn arrivals to China

According to May export data of major cotton yarn import origins and initial research of cotton yarn arrivals of China, June cotton yarn imports of China is estimated at 102.5kt, down 30.08% on the year and down 17.6% on the month. The orders were mostly placed in mid- to late March and delivered in May, with a few deliveries delayed to June. After mid- to late March, as international cotton price moved up further and the exchange rate of US dollar against RMB ascended, many traders reduced or cancelled ordering plans temporarily, so June arrivals of imported cotton yarn will be much less than May ones.

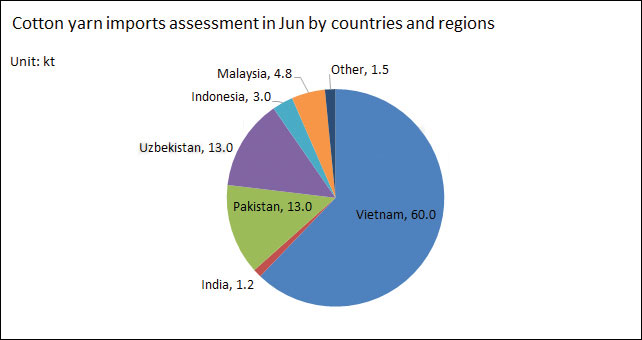

Vietnam was the largest supplier of cotton yarn to China. Vietnam’s total cotton yarn exports were to the tune of 140 kt, of which 60kt found its way into China, down 17.8% MoM. India’s cotton yarn exports to China were at a record low of 1200 MT. Exports from India were impacted due to the skyrocketing cotton prices in April. Pakistan’s exports of cotton yarn to China in June are estimated at 13KT. Similar quantity of yarn was also imported from Uzbekistan. Uzbekistan is becoming an important supplier to China, as quality of its yarn improves consistently.

Imported cotton yarn stocks

Currently, it is estimated that China has around 80KT of imported cotton yarn stocks. However, imports could be lower in the coming months due to a number of reasons. Lower prices of Chinese cotton yarns has squeezed the market for imported yarns. Moreover, Chinese exporters expect autumn and winter textile and apparel orders to be reduced, hindering trade and the market for cotton yarns.

Vietnam was the largest supplier of cotton yarn to China. Vietnam’s total cotton yarn exports were to the tune of 140 kt, of which 60kt found its way into China, down 17.8% MoM. India’s cotton yarn exports to China were at a record low of 1200 MT. Exports from India were impacted due to the skyrocketing cotton prices in April. Pakistan’s exports of cotton yarn to China in June are estimated at 13KT. Similar quantity of yarn was also imported from Uzbekistan. Uzbekistan is becoming an important supplier to China, as quality of its yarn improves consistently.

Imported cotton yarn stocks

Currently, it is estimated that China has around 80KT of imported cotton yarn stocks. However, imports could be lower in the coming months due to a number of reasons. Lower prices of Chinese cotton yarns has squeezed the market for imported yarns. Moreover, Chinese exporters expect autumn and winter textile and apparel orders to be reduced, hindering trade and the market for cotton yarns.

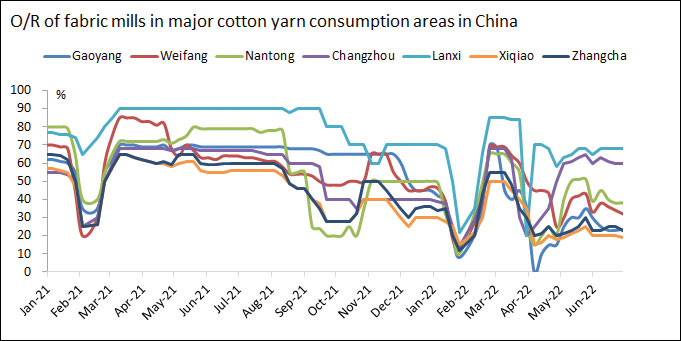

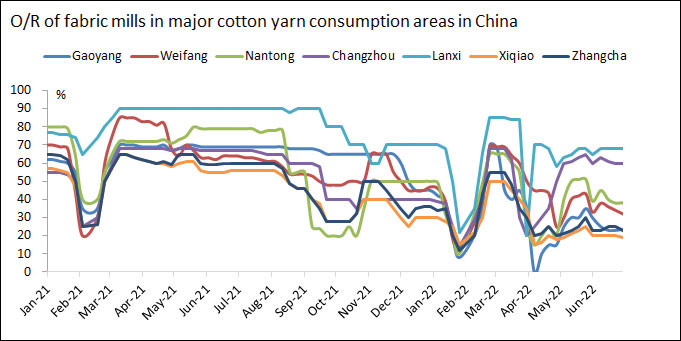

Weaving operating rates are down

The operating rate of weavers mainly using imported cotton yarn has been revising down since June. Despite eased control on the pandemic, the shrinkage of export orders in the first half year and the sharp contraction of apparel consumption in China’s local market toughened the operation of downstream fabric mills. In the future, the sales of imported cotton yarn may face challenges. Take Lanxi as an example. The inventory of local fabric mills has averaged at over two months, and still in accumulation. If the inventory is consumed at a low speed later and restrains the demand for cotton yarn, the shortage of orders will spread all around. As the peak of electricity usage comes, downstream weavers increasingly cut or suspend production.

Weaving operating rates are down

The operating rate of weavers mainly using imported cotton yarn has been revising down since June. Despite eased control on the pandemic, the shrinkage of export orders in the first half year and the sharp contraction of apparel consumption in China’s local market toughened the operation of downstream fabric mills. In the future, the sales of imported cotton yarn may face challenges. Take Lanxi as an example. The inventory of local fabric mills has averaged at over two months, and still in accumulation. If the inventory is consumed at a low speed later and restrains the demand for cotton yarn, the shortage of orders will spread all around. As the peak of electricity usage comes, downstream weavers increasingly cut or suspend production.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.