2021/22 U.S. Exports Fall On Lower Supplies

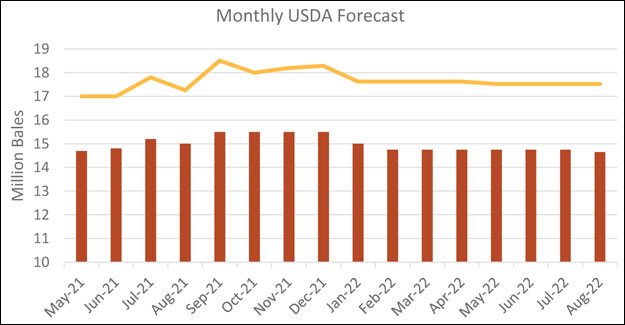

2021/22 U.S. exports are estimated to have fallen more than 1.7 million bales from the previous year to 14.7 million bales, owing to less exportable supplies.

Despite higher production, beginning stocks in August 2021 were more than 4.0 million bales lower than a year earlier, and depressing export volumes in the first half of the marketing year. Higher domestic consumption and logistical constraints also constrained shipments.

According to USDA Export Sales Reporting (ESR), total 2021/22 shipments were 14.0 million bales, 700,000 bales lower compared with the USDA forecast. Since the 2017/18 marketing year, USDA computes official exports as the mid-point between ESR and US Census Bureau shipments. From August through June, Census exports exceeded ESR by more than 1.0 million bales.

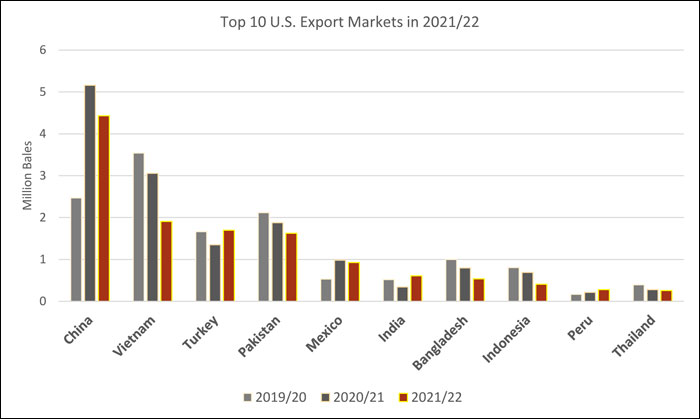

For the second consecutive year, China was the largest export market and accounted for roughly one-third of US shipments according to ESR data. Most exports to China were intended for state reserves. Of the top ten export markets in 2021/22, Turkey, India, and Peru witnessed higher exports relative to the previous year.

2022/23 US exports are forecast to fall more than 2.5 million bales because of significantly less exportable supplies compared with the previous year. Production in 2022/23 is forecast to fall roughly 5.0 million bales to 12.6 million because of drought, particularly in Texas which normally accounts for more than one-half of US plantings.

2022/23 Outlook

Global production is lowered 3.1 million bales with the decline attributed to the United States. Global use and ending stocks are down 800,000 and 1.5 million bales, respectively. Global trade is down 1.8 million bales led by a 2.0-million-bale reduction in US exports to 12.0 million, and China imports lowered 1.0 million bales to 9.0 million. Imports were also lowered for Bangladesh, India, Pakistan, Turkey, and Vietnam.

The US balance sheet shows significantly lower production, exports, and ending stocks. Production is lowered nearly 3.0 million bales and due to historically high abandonment in the US Southwest; ending stocks are forecast at their lowest level in nearly 100 years to 1.8 million bales. The projected US season-average farm price is forecast up 2 cents at 97 cents per pound.

2021/22 Outlook

Global production is lowered over 262,000 bales from last month due to a decline in Brazil. Global use is down 575,000 bales, and ending stocks are up over 685,000 bales. Global trade is down with a 342,000-bale-drop in imports and 642,000-bale drop in exports.

Notable decreases in imports are observed in Bangladesh, China, and Pakistan; exports are down in Australia, Brazil, India, and the United States.

The projected US season-average farm price is unchanged at 92 cents per pound. Global cotton prices were mixed compared with last month’s WASDE. The A-Index fell because it now reflects the 2022/23 marketing year and new-crop deliveries. Prices on the Intercontinental Exchange (ICE) were up reflecting more than 60% of the US crop in areas experiencing drought. Spot prices in China declined and are now below the US spot price for the first time in well over a decade. Prices in India surged due to concerns regarding the new crop.

For the second consecutive year, China was the largest export market and accounted for roughly one-third of US shipments according to ESR data. Most exports to China were intended for state reserves. Of the top ten export markets in 2021/22, Turkey, India, and Peru witnessed higher exports relative to the previous year.

2022/23 US exports are forecast to fall more than 2.5 million bales because of significantly less exportable supplies compared with the previous year. Production in 2022/23 is forecast to fall roughly 5.0 million bales to 12.6 million because of drought, particularly in Texas which normally accounts for more than one-half of US plantings.

2022/23 Outlook

Global production is lowered 3.1 million bales with the decline attributed to the United States. Global use and ending stocks are down 800,000 and 1.5 million bales, respectively. Global trade is down 1.8 million bales led by a 2.0-million-bale reduction in US exports to 12.0 million, and China imports lowered 1.0 million bales to 9.0 million. Imports were also lowered for Bangladesh, India, Pakistan, Turkey, and Vietnam.

The US balance sheet shows significantly lower production, exports, and ending stocks. Production is lowered nearly 3.0 million bales and due to historically high abandonment in the US Southwest; ending stocks are forecast at their lowest level in nearly 100 years to 1.8 million bales. The projected US season-average farm price is forecast up 2 cents at 97 cents per pound.

2021/22 Outlook

Global production is lowered over 262,000 bales from last month due to a decline in Brazil. Global use is down 575,000 bales, and ending stocks are up over 685,000 bales. Global trade is down with a 342,000-bale-drop in imports and 642,000-bale drop in exports.

Notable decreases in imports are observed in Bangladesh, China, and Pakistan; exports are down in Australia, Brazil, India, and the United States.

The projected US season-average farm price is unchanged at 92 cents per pound. Global cotton prices were mixed compared with last month’s WASDE. The A-Index fell because it now reflects the 2022/23 marketing year and new-crop deliveries. Prices on the Intercontinental Exchange (ICE) were up reflecting more than 60% of the US crop in areas experiencing drought. Spot prices in China declined and are now below the US spot price for the first time in well over a decade. Prices in India surged due to concerns regarding the new crop.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.