China Remains Top Apparel Supplier To The US, But Is Slowing Down

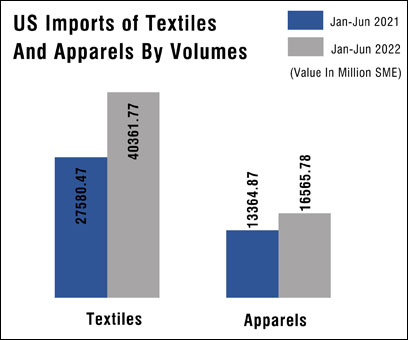

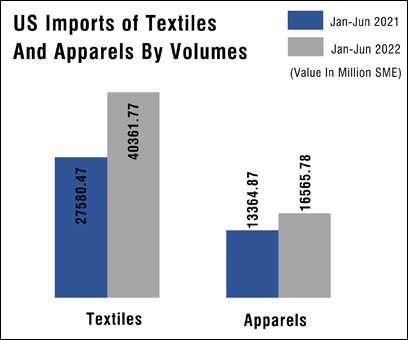

US imports of textiles and apparel during Jan-June 2022, went up by 39.03% to 56927.55 million SME, compared to the same period of the previous year.

US imports of textiles were up by 46.34%, while imports of apparel were up by 23.95% during the period. Given the very high prices of cotton, it is no surprise that cotton textile and apparel imports showed only a growth of 9.64%, when compared to other fibre varieties.

Imports of MMF products registered a growth of 49.31%, wool 49.17%, and silk and veg fibre products grew by 30.48%.

US imports of textiles and apparel during Jan-June 2022, went up by 39.03% to 56927.55 million SME, compared to the same period of the previous year.

US imports of textiles were up by 46.34%, while imports of apparel were up by 23.95% during the period. Given the very high prices of cotton, it is no surprise that cotton textile and apparel imports showed only a growth of 9.64%, when compared to other fibre varieties.

Imports of MMF products registered a growth of 49.31%, wool 49.17%, and silk and veg fibre products grew by 30.48%.

US apparel imports

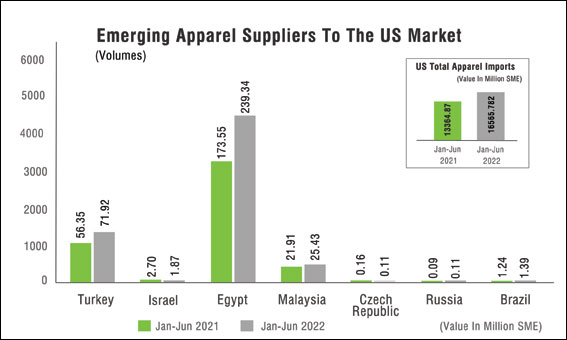

US imports of apparel during the first half of 2022 went up by almost 24%, despite spiralling inflation from March/April.

Imports rose from Jan-March, but started to fall in May and June. Monthwise figures show a drop of 19.58% in apparel imports in May compared to April, to 492.65 SME, and a drop of 10.57% in June compared to May, to 440.58 SME.

US apparel imports

US imports of apparel during the first half of 2022 went up by almost 24%, despite spiralling inflation from March/April.

Imports rose from Jan-March, but started to fall in May and June. Monthwise figures show a drop of 19.58% in apparel imports in May compared to April, to 492.65 SME, and a drop of 10.57% in June compared to May, to 440.58 SME.

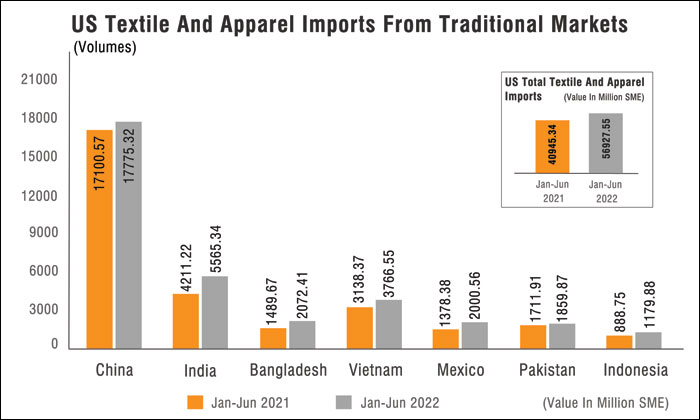

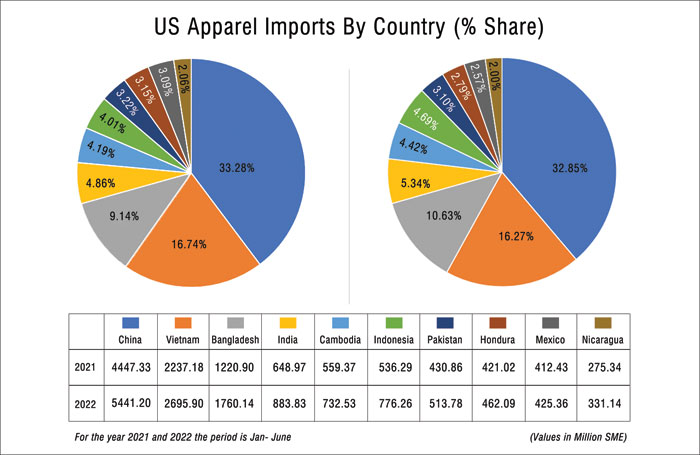

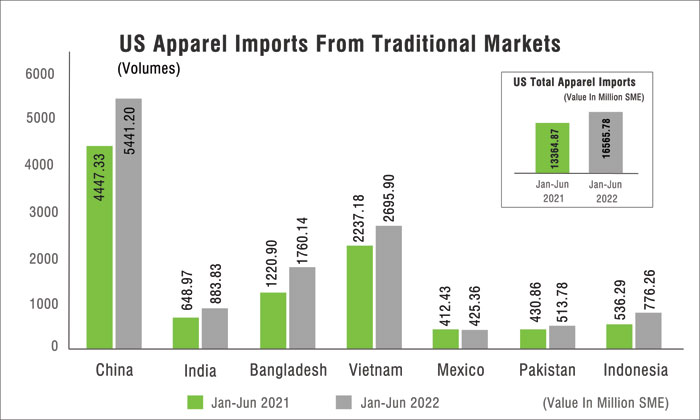

Countrywise, China, as expected, remained the top supplier of apparel to the US market, accounting for a share of 32.8%%.

Followed by Vietnam, with a share of 16.27%, Bangladesh with a share of 10.63%, and India with a share of 5.34%. These top suppliers have managed to slightly increase their shares in US apparel import basket.

Countrywise, China, as expected, remained the top supplier of apparel to the US market, accounting for a share of 32.8%%.

Followed by Vietnam, with a share of 16.27%, Bangladesh with a share of 10.63%, and India with a share of 5.34%. These top suppliers have managed to slightly increase their shares in US apparel import basket.

And the preference for MMF is clearly getting stronger. The top 10 apparel suppliers to the US market account for 84.65% of total imports by the US.

And the preference for MMF is clearly getting stronger. The top 10 apparel suppliers to the US market account for 84.65% of total imports by the US.

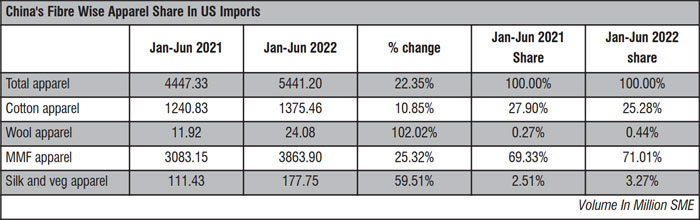

China

Imports from China continue to slow down, recording a growth of just under 4%.

As expected, China's share has visibly come down in the first six months of 2022, by almost 10%, to 31.22%, compared to CPLY. It's share of apparel went up to 30.61%, compared to 26% earlier. While the share of textiles went down by similar percentage points.

China

Imports from China continue to slow down, recording a growth of just under 4%.

As expected, China's share has visibly come down in the first six months of 2022, by almost 10%, to 31.22%, compared to CPLY. It's share of apparel went up to 30.61%, compared to 26% earlier. While the share of textiles went down by similar percentage points.

The share of cotton products has come down slightly to 13.69% from 13.99% earlier. MMF accounts for a major share of 83.37% of total textile and apparel exports of China to the US. The share of silk and viscose textiles and apparel has gone up slightly to 2.78%C from 2.17% earlier. We can anticipate the share of cotton products going down further, given the blanket ban on Xinjiang cotton.

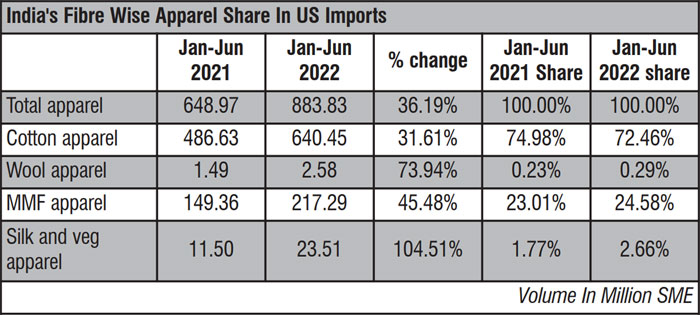

India

With a fairly significant fall in China's share of total US T&C imports, and the slowdown in exports from China to this important market, it was expected that India would garner a better share in the market.

That has not really happened, at least in the first six months of 2022. India's share has come down to 9.78% from 10.28%.

India's exports of T&C to the US market went up by 32.16% during the six months compared to CPLY. India's exports of apparel went up by 36.19%, while exports of textiles were up 31.42%.

The share of cotton products has come down slightly to 13.69% from 13.99% earlier. MMF accounts for a major share of 83.37% of total textile and apparel exports of China to the US. The share of silk and viscose textiles and apparel has gone up slightly to 2.78%C from 2.17% earlier. We can anticipate the share of cotton products going down further, given the blanket ban on Xinjiang cotton.

India

With a fairly significant fall in China's share of total US T&C imports, and the slowdown in exports from China to this important market, it was expected that India would garner a better share in the market.

That has not really happened, at least in the first six months of 2022. India's share has come down to 9.78% from 10.28%.

India's exports of T&C to the US market went up by 32.16% during the six months compared to CPLY. India's exports of apparel went up by 36.19%, while exports of textiles were up 31.42%.

Exports of fabrics were remarkably up by 79%, and of silk and viscose based apparel by 104%. In fabrics, nonwovens accounted for 56.41% of total exports to the US. In CPLY, nonwovens accounted for 44% of total fabric exports to the US. Exports of nonwoven fabrics in the first six months of 2022, at 1328.583 SME, was almost 130% higher than in CPLY.

Despite a well entrenched value chain across fibres, India remains a pre-dominantly cotton based apparel exporter. India's exports of cotton apparel went up by 31.61%, while the share came down slightly to 72.46% compared to 75% earlier.

MMF apparel exports grew 45.48%, while the share went up ever so slightly to 24.58% from 23%.

Exports of silk and other plant based fibre apparel went up by 104.51% to 23.512 SME, while the share improved to 2.66% from 1.77%. Fibre preferences in India may not change as much as in other countries, as India is the largest producer of cotton in the world.

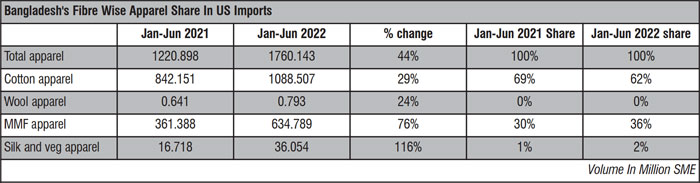

Bangladesh

US textile and apparel imports from Bangladesh registered a growth of 39.12% during Jan-June 2022. The country’s textile exports to the US went up by 16.18% and apparel exports by 44.17%.

Bangladesh, which is predominantly a cotton-based apparel exporter is also seeing a shift towards MMF. It's exports of MMF apparel went up by 75.65% compared with 29.25% growth in cotton apparel. And the share of MMF apparel in total apparel exports to the US went up to 36.06% from 29.60%. Share of cotton apparel went down to 61.84%, from 69% earlier.

Exports of fabrics were remarkably up by 79%, and of silk and viscose based apparel by 104%. In fabrics, nonwovens accounted for 56.41% of total exports to the US. In CPLY, nonwovens accounted for 44% of total fabric exports to the US. Exports of nonwoven fabrics in the first six months of 2022, at 1328.583 SME, was almost 130% higher than in CPLY.

Despite a well entrenched value chain across fibres, India remains a pre-dominantly cotton based apparel exporter. India's exports of cotton apparel went up by 31.61%, while the share came down slightly to 72.46% compared to 75% earlier.

MMF apparel exports grew 45.48%, while the share went up ever so slightly to 24.58% from 23%.

Exports of silk and other plant based fibre apparel went up by 104.51% to 23.512 SME, while the share improved to 2.66% from 1.77%. Fibre preferences in India may not change as much as in other countries, as India is the largest producer of cotton in the world.

Bangladesh

US textile and apparel imports from Bangladesh registered a growth of 39.12% during Jan-June 2022. The country’s textile exports to the US went up by 16.18% and apparel exports by 44.17%.

Bangladesh, which is predominantly a cotton-based apparel exporter is also seeing a shift towards MMF. It's exports of MMF apparel went up by 75.65% compared with 29.25% growth in cotton apparel. And the share of MMF apparel in total apparel exports to the US went up to 36.06% from 29.60%. Share of cotton apparel went down to 61.84%, from 69% earlier.

Though small in numbers, exports of silk and other plant based fibre apparel went up by 115%, while the share increased to 2.05%, from 1.37% CPLY. With the cotton economy in a perennial state of flux, MMF textile and apparel may see a further climb in Bangladesh's T&C export basket.

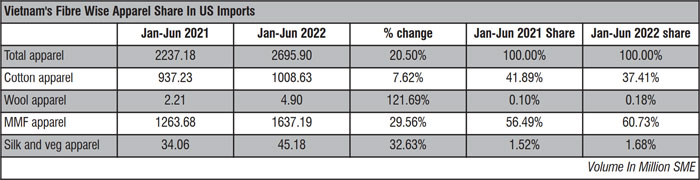

Vietnam

Vietnam's textile and apparel exports to the US went up by 20.02% during the first six months of 2022, compared with CPLY. Apparel exports grew by 20.50% and non-apparel exports by 18.81% during the period under review. However, Vietnam's share in total US T&C exports fell slightly to 6.62% from 7.66% earlier.

Though small in numbers, exports of silk and other plant based fibre apparel went up by 115%, while the share increased to 2.05%, from 1.37% CPLY. With the cotton economy in a perennial state of flux, MMF textile and apparel may see a further climb in Bangladesh's T&C export basket.

Vietnam

Vietnam's textile and apparel exports to the US went up by 20.02% during the first six months of 2022, compared with CPLY. Apparel exports grew by 20.50% and non-apparel exports by 18.81% during the period under review. However, Vietnam's share in total US T&C exports fell slightly to 6.62% from 7.66% earlier.

In Vietnam too, there is a further shift towards MMF apparel. US imports of MMF apparel from Vietnam went up by almost 30%, and the share in total US apparel imports from Vietnam during the first six months of 2022 went up to 60.73% compared to 56.5% earlier. The share of cotton apparel fell to 37.41% from 41.9% earlier.

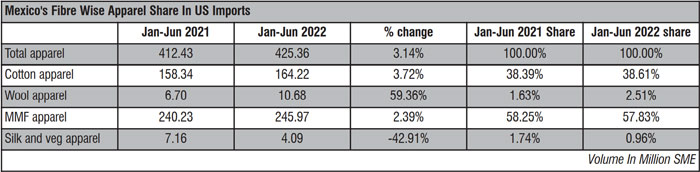

Mexico

For Mexico, the most striking was the increase in fabric exports to USA. US imported 1015.297 SME of fabric from Mexico during Jan-June 2022. This is 173% higher than in the previous period. Of this, 81.70% was accounted for by nonwoven fabrics. In CPLY, nonwoven fabrics accounted for 47% of total fabric exports to the US.

In Vietnam too, there is a further shift towards MMF apparel. US imports of MMF apparel from Vietnam went up by almost 30%, and the share in total US apparel imports from Vietnam during the first six months of 2022 went up to 60.73% compared to 56.5% earlier. The share of cotton apparel fell to 37.41% from 41.9% earlier.

Mexico

For Mexico, the most striking was the increase in fabric exports to USA. US imported 1015.297 SME of fabric from Mexico during Jan-June 2022. This is 173% higher than in the previous period. Of this, 81.70% was accounted for by nonwoven fabrics. In CPLY, nonwoven fabrics accounted for 47% of total fabric exports to the US.

The share of fabrics has almost doubled from 38.48% to 64.45%.

Mexico's exports of made-ups, including home textiles has gone down by 1.14% to 429.137 SME. India which is the largest exporter of home textiles to the US market has also reported a slowdown, following some very good performing months during the global lockdowns.

The share of fabrics has almost doubled from 38.48% to 64.45%.

Mexico's exports of made-ups, including home textiles has gone down by 1.14% to 429.137 SME. India which is the largest exporter of home textiles to the US market has also reported a slowdown, following some very good performing months during the global lockdowns.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.