MEG Port Inventory's Influence In China Waning With More Domestic Supply

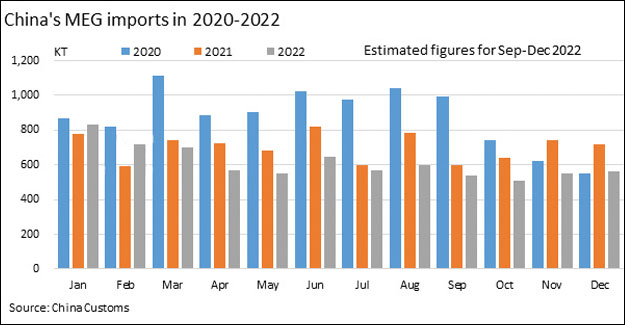

China has been importing less mono ethyleneglycol (MEG) since the startups of large MEG units in recent years. China's MEG import is expected to decrease by 12% year on year to around 7.4 million tons in 2022, with its ratio to total supply falling to around 35%. With the contraction in imports, MEG inventory in East China ports has also shown some changes.

Impact of port inventory on MEG prices weakens

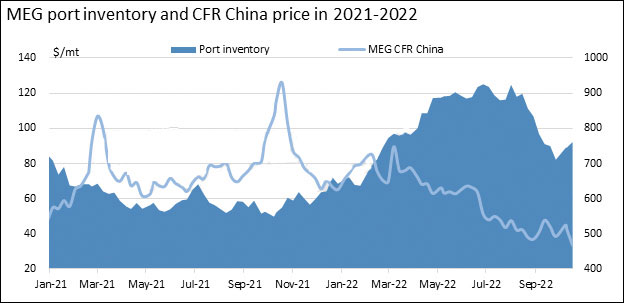

The demand for MEG cargoes in East China ports has apparently weakened with more domestic supply, lagging behind that in MEG producers. Previously, the change in MEG port inventory could apparently reflect the demand and buying sentiment of polyester plant, but this feature has gradually faded away since 2021 with more domestic supply available. Most domestic cargoes are directly shipped to downstream polyester plants, and polyester plants also prefer domestic cargoes on yuan depreciation and considering the import cargo shipping cycle. As a result, the impact of port inventory on MEG price change has also weakened.

In H1 2022, offtake in East China port has remained low and gradually increased in H2 2022 due to contraction in domestic supply on persistent low prices. As for supply-demand structure, the market could still see decline in total inventory in October. Inventory in MEG producers decreased by around 60-70kt in H1 October. However, MEG port inventory continued accumulating in H1 Oct and would decrease in H2 Oct with less cargo arrivals.

MEG turnover accelerates in contract cargo terminals

Besides directly shipping to downstream plants, domestic cargoes are also partly shipped to contract cargo terminals in Taicang, Ningbo and Changshu and a few to Zhangjiagang and Jiangyin. With the rise in domestic supply and contract in import, more cargoes will be shipped to those contract cargo terminals and the turnover in these ports will also accelerate.

In H1 2022, offtake in East China port has remained low and gradually increased in H2 2022 due to contraction in domestic supply on persistent low prices. As for supply-demand structure, the market could still see decline in total inventory in October. Inventory in MEG producers decreased by around 60-70kt in H1 October. However, MEG port inventory continued accumulating in H1 Oct and would decrease in H2 Oct with less cargo arrivals.

MEG turnover accelerates in contract cargo terminals

Besides directly shipping to downstream plants, domestic cargoes are also partly shipped to contract cargo terminals in Taicang, Ningbo and Changshu and a few to Zhangjiagang and Jiangyin. With the rise in domestic supply and contract in import, more cargoes will be shipped to those contract cargo terminals and the turnover in these ports will also accelerate.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.