Gokaldas Exports Posts Robust Revenue Growth In Q1FY25

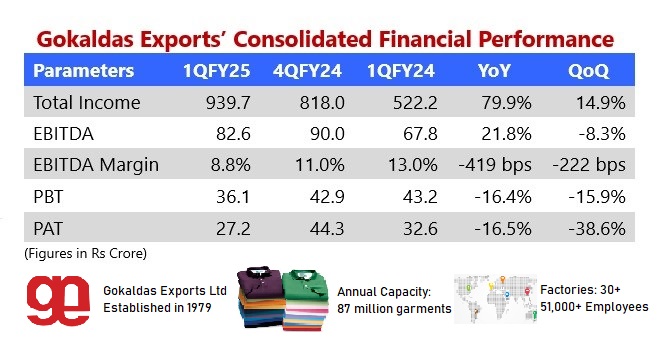

Gokaldas Exports Limited has posted robust revenue

growth for the quarter ended June 30, 2024. The Company reported a consolidated

revenue of Rs. 939.7 Crore for Q1FY25 compared to Rs. 522.2 Crore in the same

quarter last year. On quarter to quarter basis, revenue grew 14.9 percent from

Q4FY24 revenue of Rs 818 Crore. In the recently announced quarterly results,

the company reported consolidated profit after tax of Rs 27.2 Crore compared to

Rs 32.6 Crore in the previous quarter.

Commenting on the company’s performance, Sivaramakrishnan

Ganapathi, Vice Chairman and Managing Director of Gokaldas Exports said, “We

were able to sustain the revenue growth momentum during the quarter but missed

on profitability front. The company

witnessed several headwinds starting from a disruption of our production in a

majority of our factories in April and May leading to delays in shipment

incurring extra costs in overtime and airfreight, huge ramp up of employees in anticipation

of volume growth in the second half of the year, slower ramp up of our new

units, and continuing airfreight costs at Atraco. Some of these impacts will be

offset in the quarters ahead.”

“We are making good progress towards integrating the

operations of our newly acquired entities to secure better operating leverage. Our

strategic investment in BTPL, a fabrics processing unit, allows us to derive

utmost benefit through vertical integration into critical raw materials, adding

an edge in terms of speed, quality, and cost”.

Recently, Gokaldas Exports has acquired two companies

through a combination of debt and equity and raised equity capital of Rs 600 Crore

through QIP in April 2024. The Company has a net cash of Rs 58 Crore as of June

30, 2024 and has robust vertically integrated operations with over 30+

production units in multiple geographic locations, strong customer base to

support growth opportunities. It is aiming significant growth in the future.

We were able to sustain the revenue growth momentum during the quarter but missed on profitability front. The company witnessed several headwinds starting from a disruption of our production in a majority of our factories in April and May leading to delays in shipment incurring extra costs in overtime and airfreight, huge ramp up of employees in anticipation of volume growth in the second half of the year, slower ramp up of our new units, and continuing airfreight costs at Atraco. Some of these impacts will be offset in the quarters ahead.”

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.