Blood On The Assembly Line

Bangladesh’s economy, long anchored by its textile and

ready-made garment (RMG) sector, is facing an unprecedented convergence of

crises, reeling under immense pressure from labour unrest, human rights

concerns, financial instability, policy uncertainty, and a deteriorating

macroeconomic environment. These challenges are not isolated; they intersect to

threaten the very foundation of Bangladesh’s export-driven economy.

The tragic lynching of garment worker Dipu Chandra Das in

Mymensingh has thrust worker safety and factory accountability back into the

global spotlight. Employed at Pioneer Knitwears (BD) Limited, Das was allegedly

accused of blasphemy, forced to resign, and then handed over to a mob that beat

him to death and set his body on fire. The incident reverberates far beyond

human tragedy, jeopardising Bangladesh’s reputation with major global buyers

such as H&M, Zara, Gap, Walmart, Nike, Adidas, and Uniqlo, at a time when

ethical sourcing is under increasing scrutiny.

Simultaneously, Bangladesh’s textile mills are struggling to

survive. Over US$ 23 billion in investments across spinning, weaving, and

processing now face collapse amid weak demand, rising costs, and import

competition. The Bangladesh Textile Mills Association (BTMA) warns that nearly

58 units have partially or fully shut down, jeopardising around two million

jobs. Millers are calling for urgent policy interventions, including extended

export incentives, longer import credit periods, and safeguards for local yarn

sourcing.

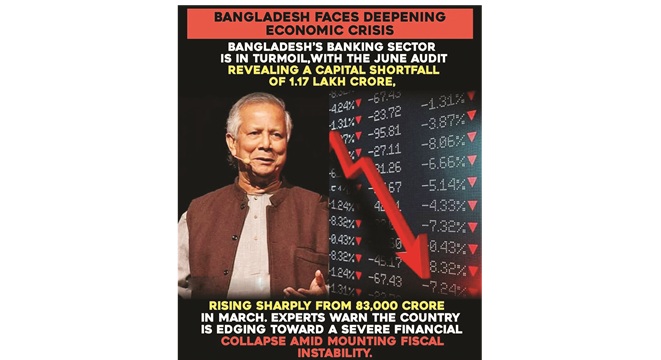

The banking sector, a critical support system, is itself

under stress. National Bank now carries NPLs of 75.46% of its loan book, and

liquidity pressures persist despite central bank support. High-profile

corporate failures, including the near-collapse of Beximco Textiles, underscore

systemic risks. Against this backdrop, Bangladesh’s foreign exchange reserves

have fallen sharply, the taka remains artificially supported, and investor

confidence is waning, creating fertile ground for competitors - most notably

India - to capture global orders.

Bangladesh’s textile-led growth model stands at a

crossroads. Labour safety, financial stability, governance, and policy

coherence are no longer separate challenges, they are interconnected threats.

How the country responds now will determine whether it can sustain its global

position or watch a critical industry, and national growth, slip away.

Bangladesh’s textile mills are struggling to survive. Over US$ 23 billion in investments across spinning, weaving, and processing now face collapse amid weak demand, rising costs, and import competition. The Bangladesh Textile Mills Association (BTMA) warns that nearly 58 units have partially or fully shut down, jeopardising around two million jobs. Millers are calling for urgent policy interventions, including extended export incentives, longer import credit periods, and safeguards for local yarn sourcing.

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.