India Brings Textiles Under Carbon Market Compliance

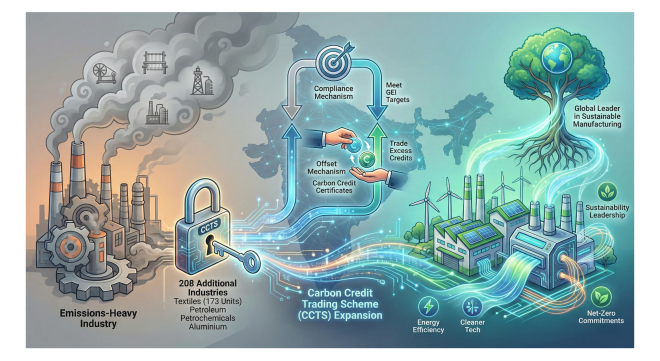

The Government of India has expanded its Carbon Credit

Trading Scheme (CCTS) to include 208 additional carbon-intensive industries,

notably textiles, petroleum refineries, petrochemicals, and secondary

aluminium. The notification now brings the total number of obligated entities

to 490, including 173 from the textile sector, across India’s most

emissions-heavy sectors.

For the textile industry, long a backbone of India’s

manufacturing and export ecosystem, this is a landmark move. Textile mills,

spinning units, and composite facilities will now be required to meet specific

Greenhouse Gas Emission Intensity (GEI) reduction targets, formally integrating

them into India’s carbon market framework. This is more than regulation, it is

a push towards cleaner technologies, energy efficiency, and sustainability.

The CCTS, introduced in 2023, operates through two

mechanisms:

- Compliance

Mechanism – where obligated entities must meet assigned GEI targets.

- Offset

Mechanism – which allows entities that exceed targets to earn Carbon

Credit Certificates, which can then be traded with industries falling

short.

Since its inception, the Indian Carbon Market (ICM) covered

sectors like aluminium, cement, chlor-alkali, and pulp & paper,

encompassing 282 entities. Bringing textiles into this fold is a major

milestone given the sector’s size, energy consumption, and role in industrial

output.

Officials say this expansion reflects years of technical

assessment and stakeholder engagement, ensuring the framework is practical for

diverse textile units, from large spinning mills to composite facilities. By

incentivising emission reduction while allowing trading flexibility, the scheme

aims to balance industrial growth with India’s net-zero commitments.

For textile businesses, the message is clear: adapt or face

rising costs. Mills and garment manufacturers can gain a competitive edge by

investing in energy-efficient machinery, cleaner processes, and leveraging

carbon credits as an additional revenue stream. Over time, this could position

India’s textile industry as a global leader in sustainable manufacturing.

India’s textile industry at a glance

The Indian textile sector is massive and fragmented:

- Over

15,000 textile mills nationwide, including spinning and composite units.

- Around

1,700+ cotton textile mills, primarily spinning and composite facilities.

- Millions

of handlooms and powerlooms in weaving.

- Tens

of thousands of processing and finishing units.

- Over

77,000 apparel manufacturing units engaged in garment production.

This decentralised network powers India’s industrial output

and employment but also creates challenges in standardising energy efficiency

and carbon compliance.

Why only 173 textile units are obligated

The CCTS notification lists 173 textile units as obligated

entities. This seems low compared to thousands of industry players, but there’s

logic behind it:

- Only

the largest, most energy-intensive facilities are covered initially - steam

boilers, thermal plants, electric kilns, and continuous dryers.

- Facilities

with the highest GHG emissions per unit of output are targeted first.

- Smaller

mills, independent weavers, most powerlooms, and many processing units

fall below mandatory reporting thresholds.

Regulatory focus begins with major emitters. Smaller

facilities may be added later, or incentivised through offset and aggregated

compliance schemes.

Perspective and key insight

- The

rules currently cover top-tier emissions contributors, not the entire

textile sector.

- Expansion

is expected as compliance and reporting systems mature.

- The

focus is on facilities where emission reductions deliver the greatest

measurable impact.

Bottom line: India’s textile sector faces a turning

point. The carbon compliance push is both a challenge and an opportunity, rewarding

innovation, energy efficiency, and sustainability leadership. Textile leaders

who act now will not only comply but can also position themselves as global

front-runners in the emerging low-carbon economy.

Faster CETP establishment improves treatment capacity and compliance. It also enables reuse of treated water, lowering freshwater costs for industrial clusters. Centralised treatment and professional operation lead to more efficient and sustainable industrial practices. By removing bottlenecks without compromising safeguards, the reform strengthens pollution control infrastructure, aligns with India’s sustainability goals, and positions industrial clusters, especially textile and SME-heavy regions, for responsible, compliant, and efficient growth.

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.