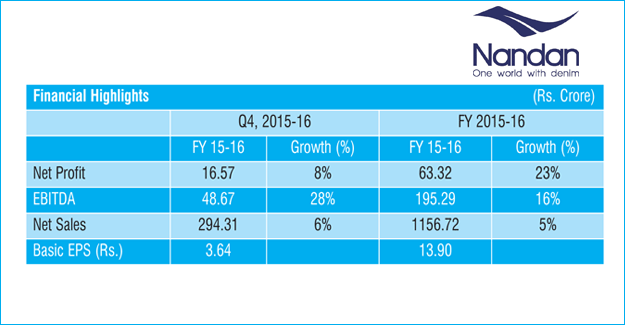

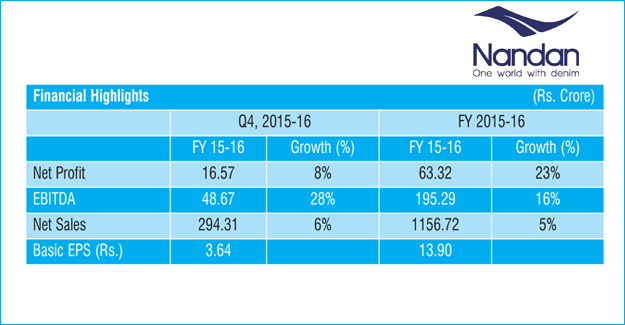

Nandan Denim's PAT Grew 23% To Rs. 63.32 Crore In FY 2015-16

Nandan Denim Limited (NDL), Asia's largest manufacturer of denim fabric has reported encouraging results for the FY 2015-16. Net profit of the company swelled to Rs. 63.32 crore for the recently concluded financial year as against Rs. 51.43 crore in FY 2014-15, with a rise of 23%. Net sales for FY 2015-16 stood at Rs. 1,156.72 crore which was higher by 5% over previous fiscal's net sales of Rs. 1,096.53 crore. Company reported healthy EBITDA and PAT margin in FY 16 at 16.9% and 5.5% respectively. Earnings per share (EPS) for FY 16 stood at Rs. 13.90 (Face value of Rs. 10 per share). For the fourth quarter of FY 2015-16, company reported a net profit of Rs. 16.57 crore against a net profit of Rs. 15.37 crore in the corresponding period last year, growth of 8%. Net sales in the quarter at Rs. 294.31 crore were higher by 6% compared to Rs. 278.31 crore in the same period in previous fiscal. For the quarter, EBITDA margin stood at 16.5% and PAT margin at 5.6%.

The Board of Directors declared 16% interim dividend for the year 2015-16. The company had made a preferential placement of 25,00,000 convertible warrants at a conversion price of Rs. 200 each. The accumulated sum of Rs. 50 crore from this exercise has been received and equity shares have been allotted to the investor. Deepak Chiripal, CEO, Nandan Denim Limited said, "Our financial performance validates that we are taking right steps in the right direction. With the type of tighter operating controls, prudent raw material sourcing and growing capacity utilisation that we have apart from concentrated efforts in moving up in the product segment, we are able to fetch superior financial returns for the investments. We are confident that post completion of the expansion plans, the company, with much larger production capacities and product baskets would be optimally placed in competitive market to cater to the larger demand arising from India and overseas markets."

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.