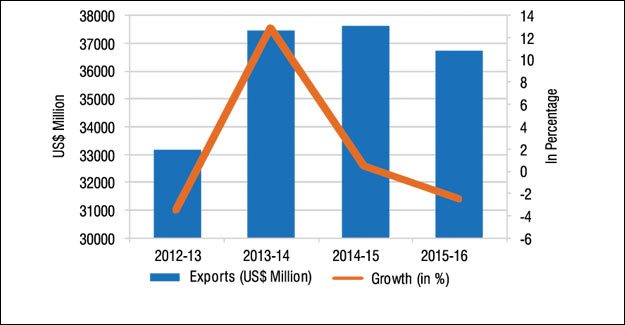

India's T&C Exports Dipped In FY 15-16

Textile and clothing share 7% in India's export segment

India's textile and clothing exports dipped 2.43% to US$ 36734.79 million in FY 2015-16 over the previous fiscal as per data released by Commerce Ministry. The figure is well below the target set by the government and a severe set back as the industry has been given several policy supports to boost production, employment and exports. The T&C exports accounted for about 14% of the country's total exports in the last fiscal, where in 2014-15 the sector accounted for 12%. Apparels have been dominating component in T&C export basket for quite a long time now and accounted for 46% share of the total T&C exports with a growth rate of 0.84% in 2015-16.

The United State of America (USA) remains the top export market for Indian textiles products. Exports to USA have improved with a growth rate of 5.10% amounting US$ 7518.74 million during 2015-16 with a share of 20% in India's T&C export basket. Followed by USA, in order of value other top export markets were U.A.E, U.K, Bangladesh, China, Germany, France, Pakistan, Spain and Italy. T&C exports to China have dropped by 24.05%, Italy by 9.89%, Germany 7.97% and France 6.75% in 2015-16. The severe decline in export to China was attributed by the low cotton and cotton yarn exports to that country in the last fiscal.

India's T&C import also retracted to US$ 5854.43 million and trade balance has shrunk by 2.48% during 2015-16. The country's total T&C foreign trade amount to US$ 42589.22 million and accounted for 7% share in India's total trade.

Cotton exports continues to fall

India's cotton exports have continued to follow a declining trend for the second fiscal in a row. In 2015-16 the cotton exports declined by 5.38% to US$ 7,302.02 million. China retained its spot as the largest importer of Indian cotton over the last four years. But in terms of the value, the cotton exports to China have dropped by 25.87% to US$ 1,688.53 million with a share of 23% from total cotton exports.

Bangladesh with a share of 22% remained the second largest market for Indian cotton and has registered a growth 5.9% to US$ 1,614.05 million during 2015-16. In the current scenario, Bangladesh would replace China as the largest importer of Indian Cotton in the current fiscal.

In terms of value, Pakistan has shown remarkable improvement in cotton procurement from India. The country has taken over Vietnam with the third spot and has 11% share in India's cotton exports. Pakistan's cotton procurement from India has registered a growth of 290% to US$ 782.12 million 2015-16.

Region wise, cotton exports to Asia have dropped by 3.06% to US$ 5,541.19 million in 2015-16 over the previous year. Similarly, cotton exports have declined by 10.80% to Europe, by 7.86% to Africa and by 20.25% America. Apart from cotton, man-made filament yarn export also registered a significant decline of 12.62% to US$ 2,090.35 million in 2015-16. Manufacturers are slowly making a move to manmade fabrics and yarn but the trend has been discouraging them.

Cotton yarn exports continue to fall

Cotton yarn which is a major commodity in the export basket, registered a declining trend as well. Cotton yarn exports have shrunk by 8.37% to US$ 3608.01 million in the last fiscal in value terms. In terms of volume, cotton yarn exports declined 4% while it declined 14% in value terms in 2014-15. China's demand for Indian cotton yarn slowing down due to competition and their policies on reserve cotton stock has created a vigilant outlook on India's cotton yarn exports. India Cotton yarn export to China fell by 2.74% to US$ 1,473.13 million in 2015-16, but has remained the top exporter of the commodity to the country. Bangladesh remained the second largest export market for Indian cotton yarn and registered a growth of 3.14%. Cotton yarn exports to Pakistan have perceived an exceptional growth of 45.81% to US$ 131.08 million in 2015-16.

Apparel exports increase nominally

Apparel exports have registered export value of US$ 16987.77 million in 2015-16 over previous fiscal. Woven apparels have ruled the basket with a lion share of 54% in the apparel exports, totalling to US$ 9323.62 million and was the seventh top exported commodity with a share of 4% in the country's total exports. Both the knitted and woven exports have slightly improved and their growth was 0.31% and 1.44% respectively. USA was India's leading market for knitwear exports with an exports value of US$ 1675.07 million followed by UAE, UK, Germany and France respective to their ranks. In knitwear, T-shirts, singlets and other vest items were exported the most totalling to US$ 2,790.56 million in value terms and 922.51 million pieces in volume.

In the woven apparel exports, again USA was India's leading market with an export value of US$ 2186.91 million in 2015-16 recording a growth of 9.63%. The other top export markets were UAE, UK, Germany and Spain. Here women's suits, dresses, skirts and jackets have been exported the most with total export value of US$ 2674.16 million. But items like men's singlet's, vest, and inner wears have improved with quite good growth of 74.95% over the previous fiscal.

To boost apparel exports, the Union Government has extended policy support through 3% Interest Equalisation Scheme so that manufacturer exporters get credit at a reasonable rate, 2% MEIS with a view to make Indian garment competitive in all countries, duty free import of trimmings and embellishments for value added exports as well as basic custom duty free import of certain fabrics. In the meantime, the government has set an exports target of US$ 20,000 million for garments during 2016-17.

T&C imports overall scenario

India's T&C imports have shrunk as the segment has registered has negative growth of 2.75% to US$ 5854.35 million over the previous fiscal. The T&C imports account for only 2% of the country's total imports in the last fiscal. In the segment, the man-made filaments have been ruling with stake of 13% followed by man-made staple fibres and coated or laminated textile fabric, both with 12% share in 2015-16. In the last fiscal, India's cotton imports have dropped by 19.09% to US$ 598.44 million.

(Data Source: DGCI&S, Kolkata)

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.