Post Brexit, Indian Apparel Exporters Set To Face Tough Conditions In Its 3rd Largest Market

British finance minister George Osborne, in April, had warned households they would be 4300 pounds a year poorer by 2030 if they voted to leave the EU. So, starting now, they would be down by around 15 pounds every month. Which in itself may not be a big amount for most UK households. But the insecurity of how the economic scenario unfolds will rein in consumer spending further. Mastercard has reported that consumer spending over the weekend after the exit announcement has nosedived in UK.

In April, according to the latest retail performance reports available, low apparel sales were dragging down overall retail performance. The report states that household confidence faltered slightly in recent months in the run-up to the June 23 referendum on European Union membership.

Colder than usual weather has also dented spending in March and April, hurting demand for spring and summer clothes, according to the ONS and earlier surveys from the British Retail Consortium and the Confederation of British Industry. The ONS said clothing sales were 6.3% down on the year, the sharpest drop in four years, although they rose 1.3% on the month due in part to price reductions.

The CBI said retail sales in April fell at the sharpest rate in over four years. The BRC said retail spending in April was 0.9% lower than in 2015. A comparable figure from the ONS showed sales were up 1.2%, in part reflecting a 2.8% fall in the average price of goods sold. Market research company GfK said consumer confidence in April was its lowest since December 2014, due to concerns about the EU referendum.

These early reports are a precursor to what can happen in the days to come. Following the referendum result, BRC CEO, Helen Dickinson, said, "Keeping the cost of goods down for consumers and providing certainty for businesses must be at the heart of the Government's plans for life outside of the EU. In order to keep prices down and to deliver the best possible choice for consumers, retailers' top priority in the short term will be to ensure the continued ease and minimum additional costs of importing goods into the UK for sale to customers. A prolonged fall in the value of the pound will impact import costs and ultimately consumer prices, but this will take time to feed through. In its exit negotiations the Government should aim to ensure that the trade benefits of the Single Market (i.e. the absence of customs duties) are replicated in the UK's new relationship with the EU."

What this means for Indian apparel exporters

UK is India's third largest apparel market, after the US and UAE. India's clothing exports to the UK during 2015-16 amounted to US$ 1802.34 million, accounting for a share of 10.61%. Exports to the UK were 3.06% lower than in 2014-15, and the share has fallen too, from 11.04% in 2014-15.

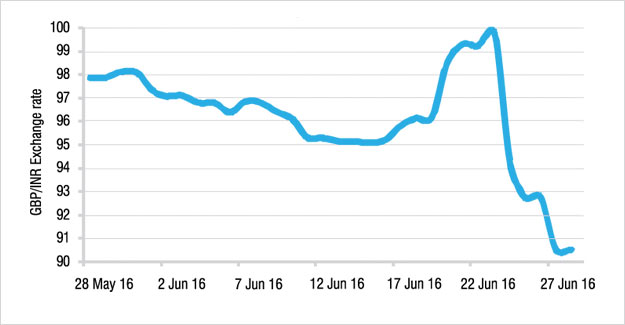

British sterling pound rates have been quite attractive for Indian exporters, and they would surely like to export more. But UK consumers could be spending much less on in the coming months, and this could further impact India's apparel exports to the UK. As Helen Dickson has pointed out, keeping costs low would be a priority for the government and also for the UK apparel retailers who have not been doing too well for some time now. This could mean harder bargains with Asian garment suppliers. There isn't much that India can do in terms of getting better bargains. For almost a decade, India's unit value realizations in apparel have remained stagnant and low. Indian apparel exporters with high exposure in the UK will do well to diversify their export base.

The trade and government are advocating a free trade agreement with the UK. But this is a very long term plan. UK's immediate priority is to invoke Article 50, and take care of the spiraling economic and political volatility at home. It will need to work out its economic and diplomatic relations with the rest of the EU. And then begin FTA negotiations, which are usually a long drawn process.

UK may lose jobs, investments

Snap polls and reports indicate that the UK may be faced with a prolonged period of economic uncertainty, further compounded by the political turmoil on in the country. This would hit confidence levels, investments, job creation.

A survey by Institute of Directors (IoD) reveals that, following Brexit, British businesses will trigger investment cuts, hiring freezes and redundancies as the consequences of leaving the European Union threaten to destabilise markets further in the coming weeks.

The IoD said a quarter of the members polled in a survey were putting hiring plans on hold, while 5% said they were set to make workers redundant. Nearly two-thirds of those polled said the outcome of the referendum was negative for their business. One in five respondents, out of a poll of more than 1,000 business leaders, were considering moving some of their operations outside of the UK.

Fears are spreading that an estimated 100,000 roles could be lost in the financial sector if banks press on with contingency plans to move jobs out of the UK. US bank JP Morgan has warned 4,000 jobs will go and HSBC has said 1,000 City jobs will move to France. Rumours are sweeping the City that alternative trading sites are being set up in a number of other financial centres, including Luxembourg. Banks are preparing to shift roles out of London amid the uncertainty about whether the UK can keep its "passporting" rights allowing them to operate across the EU.

In the poll, 36% of IoD members said Brexit would lead them to cut investment in their business whereas just 9% said the opposite was true. Just under half said it would not change their investment plans.

Three-quarters of members polled said they felt the priority for business leaders was to take steps to protect the economy from the negative reaction in financial markets, with securing a new trade arrangement with the EU coming second to that. Business lobby group the CBI has also said it was speaking to its members as the UK stared at several years of economic uncertainty.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.