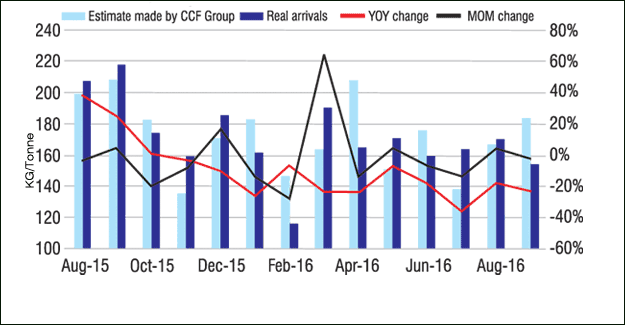

China's October Cotton Yarn Imports May Rise 7.94% M-O-M To 166.2 kt

Traders' reflection

Around 42% of Chinese traders under survey reflected that arrivals of imported cotton yarn in October were higher than September, around 32% of traders expected October arrivals to be flat with September, and around 26% of traders expressed that October arrivals were smaller than September. As for estimate for November arrivals, around 44% of traders expect November arrivals to rise compared with October, around 28% of traders anticipate November arrivals to be flat with October, and around 28% of traders express November arrivals to decline on the month. November arrivals of imported cotton yarn is likely to rise on the month given current survey.

Estimate of arrivals

After surveys, October arrivals of imported cotton yarn are assessed to rise by 7.94% on the month to 166.2kt, down by 4.65% compared with the same period of last year. Around 42% of companies under survey expect November cotton yarn imports to increase on the month, which is likely to pose pressure on the price of spot goods.?

Regional estimate

Arrivals in Guangdong in October is expected to rise by around 13.48% compared with September. Spot goods of imported cotton yarn increased in October in Guangdong and downstream demand remained lackluster. Price of imported siro-spun low-count cotton yarn was in weak correction. Spot Pakistani grade-A siro-spun 10S stayed at around 19,000-19,300yuan/mt. Inventory of imported cotton yarn may inch up in November in Guangdong and price is expected to keep fragile.

Arrivals of imported cotton yarn are anticipated to increase by 9.30% on the month in Fujian. Stocks of imported cotton yarn were not ample in October in Fujian and demand kept meager. Price of imported cotton yarn in Fujian was more stable than other markets. Transactions of imported cotton yarn may remain slack in November in Fujian and price is likely to change little. Arrivals in Zhejiang and Jiangsu in October are supposed to accumulate by 5.71% m-o-m. Inventory of imported cotton yarn inched up in Zhejiang and Jiangsu in October and price of imported cotton yarn slipped after increased earlier.

Spot Indian carded 32S for airjet rebounded to as high as around 22,800 yuan/mt from the monthly lowest at 22,000 yuan/mt. By the end of October, price of it slipped to around 22,000 yuan/mt with rising inventory and weaker feedstock market.

Price of imported cotton yarn is estimated to be weak in November in Zhejiang and Jiangsu and decline partially.

Arrivals of imported cotton yarn in North China in October may rise by 2.35% on the month. Stocks were not ample in October in North China, and price slipped. The highest and lowest price of Indian carded 32S for airjet was around 22,800 yuan/mt and 22,000 yuan/mt in October, and by the end of October, price of it dropped to around 21,800yuan/mt. Inventory of imported cotton yarn may keep low in November in North China, and price may be fragile on the whole or decline partially.

Inventory assessment

October imports of cotton yarn may rise on the month, downstream demand turned slightly better. Inventory of imported cotton yarn inched up at major China ports, staying at around 90kt. Imports in November may increase slightly compared with October, inventory of imported cotton yarn may be in upward correction, and price may be divided. Price of imported carded 32S for weaving may rise after reduced, and that of other descriptions may be weak.

Market outlook

According to arrivals assessment for cotton yarn, spot inventory of traders and downstream demand, inventory of imported cotton yarn may inch up in November, operating rate of downstream weavers is likely to be stable, supply is not expected to be tight, and price is likely to be weak. Price of Indian carded 32S for air-jet may rebound.

Cotton yarn imports shrink

Cotton yarn imports in in Jan-Sept, 2016 amounted to around 1451kt, down 20.5% on the year. Imports of cotton yarn (Hs code: 5205, including more than 85% of cotton) in September totaled around 146.2kt, and imports in Jan-Sept, 2016 stayed at around 1368kt, down by around 20.7% compared with the same period of last year. The following analysis is for cotton yarn contains more than 85% of cotton, under Hs code 5205.

Vietnam, Pakistan and India remained the major cotton yarn (Hs code: 5205) suppliers for China in September, totally sharing around 71.5%.

Vietnam ranked the first place with price and tariff advantage, and Pakistan was on the second position with stable demand for low-count carded cotton yarn and siro-spun cotton yarn from Chinese buyers, while India declined to the third position in September amid slanting high price.

Carded single cotton yarn was major cotton yarn imported in Jan-Sep, 2016, and carded 8-25S/1 ranked first, staying at around 706.3kt, sharing around 48.7%.

The next was carded 30-47S/1, accounting for around 15.7% and staying at around 228kt, followed by combed 30-47S/1, which occupied around 9.6% and staying at around 139.5kt.

Major imported cotton yarn supplier

Suppliers for carded 8-25S/1

India was the third largest supplier for imported carded 8-25S/1 in Jan-Sept, 2016. Imports of Indian carded 8-25S/1 were huge in the first half of 2016, far higher than that of Taiwanese one, but were lower than that of Taiwanese ones since August.

Vietnam surpassed Pakistan to be the biggest supplier for carded 8-25S/1 since April and kept rising. In September, Vietnam still ranked first while India declined to the fourth position after Taiwan China.

Major suppliers for carded 30-47S/1

Vietnam, India and Uzbekistan were major import origins for carded 30-47S/1 in Jan-Sept, 2016, sharing around 40%, 30.1% and 17.4% respectively.

Imports of carded 30-47S/ from India surged since Jul, almost flatting with Vietnamese ones, plunged in Aug and kept falling in Sep, close to that from Uzbekistan.

Major suppliers for combed 30-47S/1

India was the largest import origin for combed 30-47S/1 in Jan-Sept, 2016, sharing around 50.2%, as price of Indian combed 30-47S/1 enjoyed absolute advantage. Vietnam was the biggest suppliers in August 2016.

India owned absolute advantage, with proportion far higher than other markets, but was surpassed by Vietnam in August and climbed up again in September.

Import unit price of cotton yarn increased in September

Import unit price of major cotton yarns moved up in recent months, and increment of combed cotton yarn was bigger than carded ones in September.

M-o-m increment of combed 8-25S multiple plied yarn was the biggest in September, staying at around 8.7%, and increment of combed 25-30S multiple plied yarn was the smallest, staying at around 1.8%.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.