M&S To Close All Foreign SM&S To Close All Foreign Stores And 30 Outlets In The UKtores And 30 Outlets In The UK

1. New CEO plans to close 30 UK outlets and exit 10 countries

2. Cuts won't address slide toward 'fashion irrelevance': analyst

3. M&S said it expects gross margins in clothing and home wares to expand by between zero and 0.5% points for the year. Had previously predicted an expansion of between 0.5 and 1% point

4. Underlying pretax profit fell 19% to 231.3 million pounds in the first half. That compared with the 218 million-pound estimate of 18 analysts surveyed by Bloomberg

5. Second-quarter clothing and home like-for-like sales fell 2.9%, compared with the average estimate for a 4% drop

Marks & Spencer Group Plc plans to close all its stores in 10 foreign countries and shutter 30 outlets at home in one of the biggest retreats in the British retailer's 132-year history. About a tenth of the UK store space dedicated to clothing and home wares will disappear over the next five years, Chief Executive Officer Steve Rowe said. M&S will shut 53 stores outside Britain and begin consultations with 2,100 workers in countries like China, France and the Netherlands, he said.

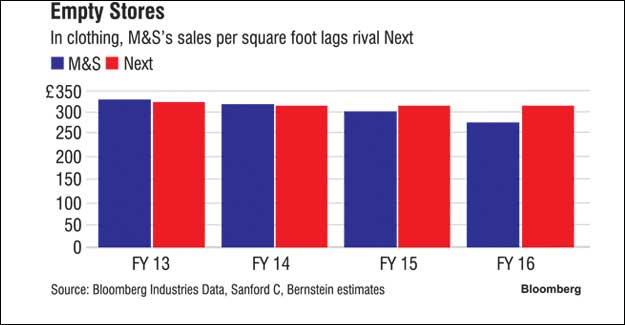

The downsizing marks a historic step by Rowe, a 27-year company veteran who replaced Marc Bolland as CEO earlier this year. M&S has struggled for years to cope with a welter of online and discount competition that has caused clothing sales to fall to levels last seen a decade ago. Rowe's actions also reflect losses in the company's international businesses amid weak demand in Europe and turbulent economic conditions in Asia and the Middle East.

"This is a big moment for M&S," said Richard Hyman, an independent retailing analyst. "Steve Rowe's changes go further than we all anticipated and that has to be a good thing." Investors disagreed, sending M&S shares down as the company also reduced its full-year margin forecast due to the weakness of sterling. The stock has declined 23% this year, heading for their worst annual performance since 2008.

The domestic store closures will cost about 350 million pounds, according to the London-based company, which has 304 UK clothing and home stores. It didn't disclose how many British jobs will be lost or which outlets will shut. M&S will also eliminate three sub-brands -- Indigo, Collezione and North Coast -- joining the likes of Burberry Group Plc in doing so. "These are tough decisions, but vital to building a future M&S that is simpler, more relevant, multi-channel and focused on delivering sustainable returns," Rowe said in a statement. The downsizing is symbolic of the retreat of a business that was once regarded as the bellwether of UK retailing and comes on the day that Hennes & Mauritz AB's Weekday chain announced plans to open its first UK store in London, adding to an already crowded fashion scene.

In addition to closing 30 M&S stores, some outlets will be switched to the more successful Simply Food format. Taken together, Rowe's actions will lead to the loss of 60 clothing outlets and increase the company's growing reliance on its upmarket food business, which now represents about 52% of sales, up from 46% in 2010. "Reallocating floor space from food to clothing should boost sales in the short-term, but won't address M&S's inexorable slide towards fashion irrelevance," said John Ibbotson, an analyst at consultant Retail Vision.

'Easy Win'

The majority of the international closures are in the retailer's European businesses, with M&S planning to completely exit Belgium, Hungary, Poland and the Netherlands. The retailer will also close seven stores in France and all of its 10 stores in China. The closures will take place over the next 12 months and result in costs of 150-200 million pounds.

International businesses that are fully owned by M&S recorded a loss of 31.5 million pounds last year, while its franchised businesses reported a profit of 87.3 million pounds. Outside its main market of the UK, M&S currently operates about 480 stores across 59 countries in Europe, Asia and the Middle East. "Shutting down the loss-making international businesses looks a relatively easy win," said Richard Marwood, who manages the Royal London UK Growth Fund, including M&S shares, for Royal London Asset Management.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.