Stronger Rupee Poses Problems for Indian Cotton And Yarn Exporters

India’s local cotton prices witnessed some fluctuation during the first half of April. However, cotton prices remained high. Fibre prices fluctuated as the arrival has improved. The demand for fibre was healthy but high yarn prices have reduced the market sentiment. Lower uptake of yarn has resulted in subdued appetite for cotton. On the other hand, strong INR against US Dollar has made Indian cotton expensive in the export market.

This has created pressure on cotton exporters and availability of the fibre in the local market has improved. Also, there is speculation that INR could remain strong which might jeopardise the export of Indian cotton in the coming months. So, there are high expectations that local cotton prices would come down as the country has produced more cotton than the required local consumption.

Further, many spinning mills have imported the fibre while local prices were at their peak. On the arrival front, total cotton arrival in the country till date is estimated to be around 27.5 million bales and current arrival is estimated to be between 170,000- 180,000 bales per day across India. Current domestic price of benchmark Shankar-6 variety was recorded at around Rs. 43,100 per candy (355.6kg, on 13th April 2017) which is at the same level if compared to March end price. However, in the April first week Shankar-6 prices touched Rs 44,000 per candy mark before receding to current level.

On the global front, cotton prices fluctuated within a range and declined marginally. Better export trade data kept the momentum on for cotton in USA. However, prices declined as production forecast for next season increased substantially along with higher ending stock. The benchmark A index hovering well above 85 cents mark and even touched 88 cents mark.

The key data on the crop from the United States Department of Agriculture’s (USDA) latest forecast indicates world cotton production to be 106.3 million bales, up from earlier estimates to 105.7 million bales (of 480 lb, last season’s production was 96.7 million bales). Consumption estimates increased to 112.6 million bales from earlier forecast and ending stock revised upward to 90.9 million bales from the earlier figure of 90.5 million bales.

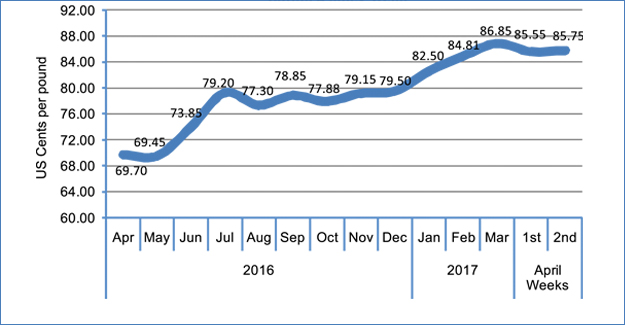

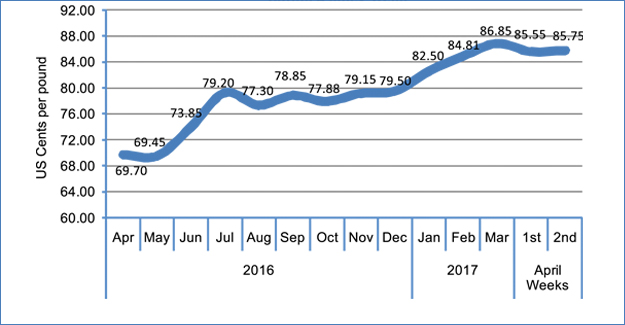

To look at the price trend, during April first half, ‘A’ index started moving upward and touched 88 cents per pound mark but later marginally declined and recorded at 85.75 US cents on 13th April. ‘A’ Index was at 78.55 US cents in December 2016 end and was at 69.55 US cents per pound during December 2015 end.

On the yarn front, cotton yarn prices increased as fibre prices remained strong. Also, stronger INR (against USD) has compelled suppliers to hike yarn prices against the buyer’s wishes. This has resulted in lower demand for Indian yarn in overseas markets.

Cotlook ‘A’ Index: 85.75 (As on 13th April 2017)

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.