Petro Derivatives Prices Remain Stable On Face Of Rising Crude Oil

Purified Terephthalic Acid (PTA)

PTA prices remained weak during the first half of April. However, the firmness in crude oil prices has lead to revision of petrochemicals prices which may boost market sentiments of PTA. Also, cost support has increased as PX prices have firmed marginally. Additionally, demand from the downstream polyester sector seems to be improving which may help PTA prices. On the other hand, supply of PTA is adequate and production may witness growth as few plants coming on stream. Current spot market offer prices for PTA are around US$ 645-665 per metric ton CFR CMP but buying prices are around US$ 640-650 per metric ton. Outlook for PTA prices indicates towards a fluctuating price trend in the coming fortnight.

Monoethylene Glycol (MEG)

MEG prices witnessed a weaker trend during first half of April. Though there has been upward movement in crude oil prices since the beginning of the month and prices across the petrochemical chains have got a boost, MEG prices have not shown positive sentiments. However, downstream polyester sector has shown signs of recovery and traded volumes have improved. Since, current MEG inventory level is low & consumption has shown improvement, there might be some positive price movement for the commodity in the coming weeks. Current spot offer prices of MEG are around US$ 760-770 per metric ton CFR China and traded prices are around US$ 745-755 per metric ton. MEG prices are expected to exhibit a fluctuating trend in the coming weeks.

Polyester Chips (PET Chips)

PET chips prices witnessed a stable price trend with a tendency to move up during April first half. As raw material prices were more or less stable, PET chips prices too demonstrated such trend. The demand for PET chips is passable while inventory levels are normal. However, supply of the commodity has improved. Prices may witness growth as the seasonal demand phase has arrived and petrochemical prices are moving north backed by stronger crude oil prices. Current Water Bottle Grade PET chips offer prices are around US$ 960-980 per MT FOB China while deals were done around US$ 950-960 per MT FOB China. Fibre grade chips quoted prices are around US$ 940-945 per MT FOB Korea. Chips prices are expected to move in line with raw material prices in the coming weeks.

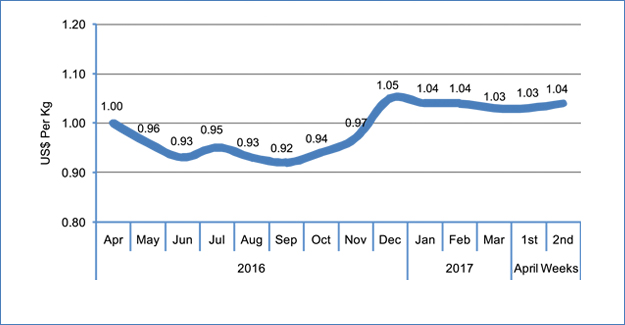

Polyester Staple Fiber (PSF)

PSF prices remained stable during first fortnight of April. However, stronger crude oil prices would provide cost support as raw material prices may harden gradually. Also, traded volume of PSF have shown improvement during April first half but the piled up inventory level would take some more time to recede. Since the demand growth for the fibre has been slow there would be pressure on fibre suppliers to get rid of the inventory.

This would keep PSF prices weak unless there is substantial increase in raw material prices. Another reason for weaker fibre prices is that the spun yarn sector has not been performing well.

In Chinese local markets, trading activities for PSF has witnessed improvement and prices are low. In Indian local markets, PSF prices were stable after but spun yarn spinners have been asking for better prices. Current offered price for 1.4 denier raw white semi dull PSF is around US$ 1.03 – 1.05 FOB China/Taiwan. CNF India prices are around US$ 1.07 – 1.09 per kg. Prices of PSF are expected to witness some positive correction in the coming weeks.

POY, PTY & Flat Yarn

Polyester Filament Yarn prices remained flat during first half of April. Firmness in crude oil price has helped petrochemicals prices to move up which may impact the polyester sector too. Also, the demand for polyester filament yarn has improved marginally and expected to recover further in the coming weeks. This has helped reducing the inventory levels to some extent.

The polyester filament sector operating at a healthy rate and inventory levels are still high. In the last fortnight, prices of POY remained almost stable in the finer deniers while coarser deniers witnessed some corrections.

On the other hand, FDY prices witnessed weakness and declined while DTY prices remained stable. Prices in Chinese local markets have come down while Indian market witnessed a stable price regime. Current quoted price for 115D/36F POY is US$ 1.04-1.05/kg FOB China/Taiwan, 150D/48F POY price is US$ 0.94-0.96/kg FOB, whereas 75D/36F DTY price is US$ 1.44-1.46/kg and 75D/72F FDY price is US$ 1.04 – 1.06/kg FOB China/Taiwan. PFY market forecast indicates that yarn prices would be governed by raw material price movements and may witness some firmness in the coming fortnight.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.