China's Cotton Reserves Sales Trend In April

Till April 25, 2017, China has sold 804,451.72 tons of its reserve cotton. In 2011-12, reserved cotton traded was 887,439 tons, in the price range of 13760-14520 yuan/mt.

In 2012-13, 9528.04 tons of reserved cotton was sold in the price range of 14000-15840 yuan/mt. In 2013-14, 7153.583 tons of reserved cotton was traded, in the price range of 13830-15850 yuan/mt.

On April 25, CNCRC planned to auction 29,828.4644 tons of cotton while the actual trading volume was 17,569.062 tons. Target was 58.90% fulfilled. Textile enterprises accounted for 52.83% of the buying and non textile enterprises took up the remaining 47.62% of the cotton. On April 26, 29,975.319 tons of reserved cotton are planned to be sold, including 14,881 tons of Xinjiang cotton and 15,094 tons of upcountry cotton.

Selling price of China's reserved cotton during Apr 24-28, 2017

According to relative regulation, the base selling price of the week (from April 24-28) scores at 15,592 yuan/mt (standard type price), up 217 yuan/mt compared to the prior week. Based on the selling price of standard type, the actual reserved cotton prices will be calculated according to the price difference of different quality.

China lowers VAT for cotton

The Chinese government has removed the 13% value-added tax from the four levels of VAT, which now only includes 17%, 11% & 9%. Effective July 1, 2017, cotton VAT will be reduced from 13% to 11%. This will bring further tax cuts for China's cotton processors, additional reduction to cotton cost for spinning mills and a lower import cost. This could also lead to a potential rise in cotton imports in the near future.

What will happen if less Xinjiang reserve is offered

By April 14, cumulative reserve sales reached 656400 tons, including 435600 tons of Xinjiang reserve and 220800 tons of inland reserve. Xinjiang reserves account for 66.4% and inland takes up the remaining 33.6%, or just about half of Xinjiang's share. The situation is however slowly changing. According to CN Cotton, daily tender of Xinjiang reserves experienced a high level between two lows. Volume during April 1-7 was below 15000 tons, but picked up during April 10-13, reaching as high as 19000 tons. Starting April 14, Xinjiang supplies again decreased to less than 15000 tons, while inland supplies gradually increased and finally exceeds the volume of Xinjiang reserves.

How will a smaller Xinjiang supply affect reserve sales? First, we see a declining sales ratio. For the past month, Xinjiang offtake was much higher than inland sales and sales ratio tend to be high when Xinjiang reserves were offered in bigger volume. And the same is true vice versa. Quality is the main reason for the preference for Xinjiang reserves. And if the volume of Xinjiang reserves decreases in the months to come, daily clearance rate will be definitely lower.

Meanwhile, reduced supply of Xinjiang reserve will also result in a smaller Xinjiang supply in cash market, and therefore keep Xinjiang cotton price firm. By the end of March, commercial cotton stock is estimated at more than 2 million tons. Without a steady reserve tender, these stocks will not meet the demand of spinning mills. Xinjiang cotton price is already showing strength with a smaller availability. With ZCE stock now dominated by Xinjiang cotton, falling Xinjiang tender may trigger a price rebound on ZCE cotton futures.

Cotton planting intention survey in China's major producing regions

In China, cotton sowing work is going on gradually, and growers' planting enthusiasm has reportedly improved much this year compared to last year. The sowing work has been complete in some divisions of Xinjiang Production and Construction Corps (XPCC) and in other regions, the sowing may get momentum in mid or late April according to local weather and sowing habits and is predicted to end basically in May.

So, what about the cotton planting areas in 2017?

According to China Cotton Association, China cotton planting areas are projected at 46.038 million mu in 2017, up 5% year on year, including 30.529 million mu in Xinjiang, up 5.1% year on year and the yearly growth rate in Yellow River and Yangtze River areas scores at 4% and 3.5% respectively. Therefore, China cotton areas are expected to increase in 2017 after continual decrease.

In Chinese mainland, growers tend to plant more cotton this year, with a yearly growth rate of 5-15%. In Xinjiang, the cotton areas in XPCC may decrease somewhat, while in non-XPCC areas, the areas may increase slightly and in some regions, the areas of machine-picked cotton may expand. Besides, areas for long staple cotton in Xinjiang are projected to decrease by 45.5% to 1.10-1.20 million mu in 2017, but yield is expected to improve, so output may reach 0.13 million tons in 2017, which can basically meet mills' demand. The higher cotton areas in 2017 is benefited from the upswing of cotton prices in 2016 and the policy support from the government.

Government policy

To deepen the cotton target price system, China sets the target price at 18,600 yuan/mt in 2017-2019 in Xinjiang and the quantity of cotton that enjoys the subsidy will be limited to the 85% of the cotton output from 2012 to 2014 nationwide, according to announcement released by the National Development & Reform Commission and Ministry of Finance on March 16, 2017.

On April 10, State Council released the guidance on constructing food production functional area and important agricultural product protection area, pointing out clearly to set cotton production protection area of 35 million mu.

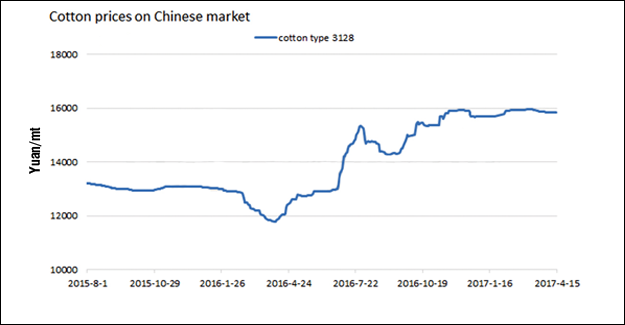

Market price

In 2016-17 season, Chinese cotton prices increased, and profits for growers are generally higher than last season, which improves the growers' enthusiasm.

Besides, profits of competitive crops were also unfavourable in 2016. In Hebei, gross profit of corn reached 695yuan per mu and that of wheat was 850 yuan per mu, so the total gross profits for two harvests were 1,545 yuan per mu. And if growers planted cotton, the gross profits were about 2,030 yuan per mu, which was higher.

Domestic supply and demand

In terms of macro aspect, China's cotton supply and demand is a key influence on cotton prices and industry. Chinese cotton output has been constantly decreasing and in 2016-17 season, it increased slightly, but remains at a low level. However, consumption has moved up steadily over the past three seasons. Output is much lower than consumption, supplemented by state reserved cotton and imported cotton.

After China restricts cotton quotas, the reserved cotton accounts for the most. If 2.50 million tons of reserved cotton are sold in 2016-17, the ending stocks may reduce to 7.624 million tons. If the policy stays and 2.50 million tons of reserved cotton are consumed per season, the reserved cotton will be sold out after two seasons. If cotton areas do not increase, low output and high consumption may lead to severe tight supply due to which cotton prices may maintain in the next few years and growers can increase cotton areas.

In general, cotton areas are predicted to increase slightly in China in 2017, on the back of policy support, higher cotton prices and supply and demand situation and the increment in Chinese mainland is larger than that in Xinjiang.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.