Record Imports Drive Down Domestic Cotton Prices

Cotton

India’s local cotton prices witnessed a declining trend in the first half of May. Prices have eased as demand for the fiber slowed down at elevated prices. Also, Indian mills have imported record quantity of raw cotton from the international markets during the current season which has eased the demand for local cotton. Data indicates that till February 2017, India has imported nearly 3 million bales (of 170 kg equivalent) which itself is a record (previous high was 2.5 million bales in 2001-2 season). Hoarding of cotton by farmers and traders, slow arrival due to demonetisation were among the reasons for extreme high local cotton prices during the ongoing season. And thus, spinners have sourced competitively priced cotton from international markets. Interestingly, Australia replaced USA as top source of cotton for Indian mills. Also, nearly one third of the imports were made from African countries (Egypt, Male, Cote D’ Ivoire, Benin, Cameroon – top five exporters to India). Also, strong INR against the greenback assisted cotton imports while export of the fiber slackened. This has made the availability of the fiber resulting price drop in local markets. On the arrival front, it is estimated that over 80% of the harvested cotton have arrived the mandiesand total cotton arrival in the country till date is estimated to be around 31 million bales. Cotton arrival is at its fag end and current arrival is estimated to be between 45,000- 55,000 bales per day across India. Current domestic price of benchmark Shankar-6 variety was recorded at around Rs. 41800 per candy (355.6kg, on 13th May 2017) which is lower by Rs 1100 per candy if compared to end April price.

On the global front, cotton prices gained and then declined but fiber prices are still strong. Current prices are strong as there are speculation that exportable quality cotton is short supply and till fresh fiber arrives (from next season) the prices are expected to remain strong. Also, softer US Dollar boosted the fiber price. This month USDA has made the forecast available for the 2017-18 Season and there are indication of substantial increase in production and consumption of the fiber. USDA’s latest forecast for season 2017-18 indicates that world cotton production to be 113.2 million bales up from current seasons’ estimates of 105.9 million bales (of 480 lb). Consumption estimates increased to 115.8 million bales from current seasons’ 113.2 million bales while ending stock to decline to 87.1 million bales (from current seasons’89.5 million bales.

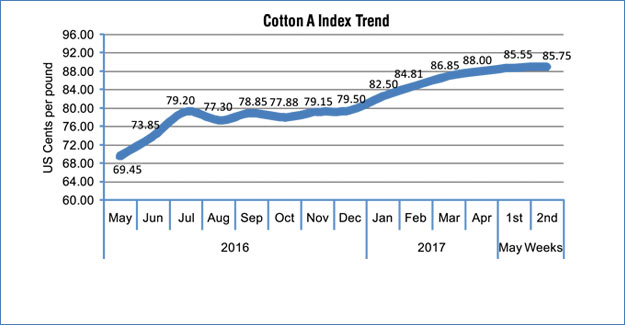

To look at the price trend, ‘A’ index witnessed an upswing beginning of the month and touched this seasons’ high of 89.1 cents per pound on 3rd May. While it came down a bit and recorded at 88.90 US Cents on 12th May. ‘A’ Index was at 78.55 US Cents in December 2016 end and was at 69.55 US cents per pound in December 2015 end.

On the yarn front, cotton yarn prices remained strong backed by strong cotton prices. However, buyers are reluctant to procure at elevated prices. Therefore, traded volumes have been low and mostly need based. The demand for cotton yarn may remain slack owing to higher prices.

Cotlook ‘A’ Index: 88.90 (As on 12th May 2017)

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.