Polyester Prices Face Minor Correction As Crude Falls

PTA

PTA prices witnessed very minor fluctuations during second half of June and prices slipped downward as crude oil values plummeted to US$ 45 a barrel during this fortnight. This has led to correction in prices of PX and other petrochemical based products which helped the PTA prices to come down. The second fortnight of June also witnessed maintenance shutdown of few large capacity plants in China. Therefore, the downward trend in PTA prices may not last long. Also, as crude oil is on the path of recovery, petrochemicals prices may get boost. In case of PTA, the supply concern could jack-up the commodity prices or at least provide enough cushions to the price. The downstream polyester sector is operating at a fair capacity and the demand for PTA is healthy. So, the commodity prices may witness upward trend is the oil prices does not dip further down. Current spot market offer prices for PTA are around US$ 600-605 per metric ton CFR CMP. Outlook for PTA prices indicates towards a stable price trend in the coming fortnight.

MEG

MEG prices witnessed turbulent trend during June second half. Prices went up and then fell as crude oil witnessed a plunge. Downstream demand for MEG has been healthy but at elevated prices, deals have dried up. However, as prices came down, markets were active again. Also, supply concern for MEG has eased. Thus, the commodity prices may not move up too high even though healthy downstream demand backing the prices. Current spot offer prices of MEG are around US$ 780-785 per MT CFR China and traded prices are around US$ 775-780 per metric ton. MEG prices are expected to exhibit a fluctuating trend in the coming weeks too.

PET Chips

PET chips prices witnessed marginal downward trend as the raw material prices declined during second half of June. The prices of PTA and MEG have softened during the fortnight while the supply situation has eased for MEG. Thus, PET chips prices witnessed marginal fall from the mid June level. However, hot summer may improve the demand for PET chips. Current Water Bottle Grade PET chips offer prices are around US$ 910-930 per MT FOB China while deals were done around US$ 905 - 915 per MT FOB China. Fiber grade chips quoted prices are around US$ 880-890 per MT FOB Korea. Chips prices are expected to move in line with raw material prices in the coming weeks.

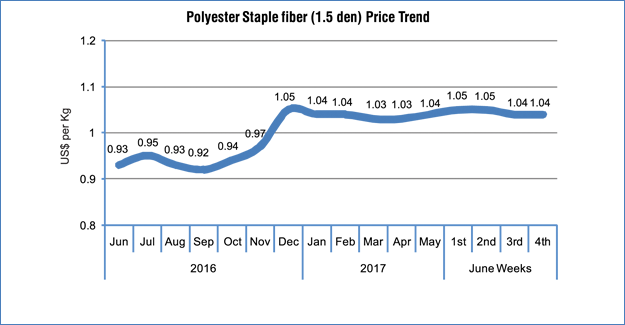

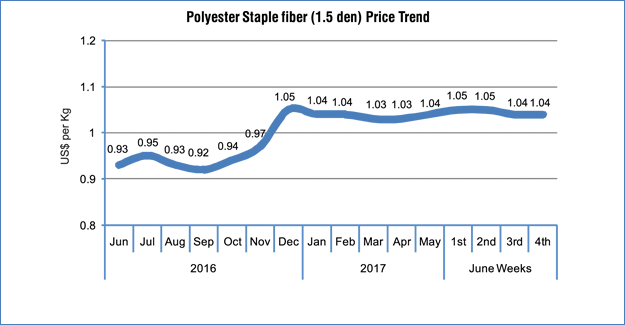

PSF

PSF offers witnessed marginal correction during June second half. The changes in the polyester raw material prices have eased the cost support to the fiber during the fortnight. This has resulted in minor price reduction. However, the demand for PSF has improved and inventory levels have come down and plant operating rates are moderately high. The margin for the fiber suppliers has been positive and this scenario may continue considering the current market dynamics. In Chinese local markets, trading activities for PSF has witnessed upward trend during the fortnight while fiber prices and inventory levels have declined. In Indian local markets, PSF prices have come down marginally and may witness slack demand in the coming month as GST (Goods and Services Tax) are going to be rolled out from 1st of July this year. The high rate of tax on PSF (GST rate on PSF @18%) would work as a negative factor as cost of PSF contained goods would increase. Current offered price for 1.4 denier raw white semi dull PSF is around US$ 1.02 – 1.05 FOB China/Taiwan. CNF India prices are around US$ 1.05 – 1.08 per kg. Prices of PSF are expected to witness minor corrections in the coming weeks.

PFY

Polyester Filament Yarn prices witnessed marginal price hike though the raw material prices have eased during June second half. The raw materials PTA and MEG has witnessed marginal decline in prices easing the cost support for the polyester yarn makers during the fortnight. The demand for filament yarn has improved and inventory levels are well within the normal limit. However, if raw material prices do not show much change then there might be some price corrections as demand for filament yarn is not that strong to hold on to the current price levels. Prices of PFY in Chinese local markets have increased marginally as well during the fortnight. Indian market witnessed a weaker price regime as GST rate on polyester yarn has been kept on the higher side (18%). Current quoted price for 115D/36F POY is US$ 1.04-1.05/kg FOB China/Taiwan, 150D/48F POY price is US$ 0.92 - 0.93/kg FOB, whereas 75D/36F DTY price remain unchanged at US$ 1.44-1.46/kg and 75D/72F FDY price increased to US$ 1.14 – 1.15/kg FOB China/Taiwan. PFY market forecast indicates that yarn prices would witness marginal corrections if raw material price changes in the coming weeks.

ACN

Acrylonitrile prices witnessed nearly stable trend during second fortnight of June. Upward trend in propylene prices during the fortnight helped ACN prices to remain stable. The demand for the commodity has been lustreless. Current spot prices for ACN to Far East Asian market is around US$ 1498 – 1500 per MT CFR Far East Asia and around US$ 1467 per MT CFR South East Asia and around US$ 1440 per MT CFR South Asia. ACN prices are expected to remain steady in the coming weeks.

ASF

Acrylic fiber prices remained steady during June second half. There were downward pressure on ASF but stable raw material prices helped the fiber prices to remain stable. Demand for ASF has been weak and plant operating rates have come down drastically. Current offered price for regular 3 den fiber are around US$ 1.95 – 2.0 per kg FOB Taiwan. Offers for 3 den bright ASF tow and anti-pilling 1.5 den tow were at US$ 1.98 - 2.04/kg and US$ 2.05-2.18/kg respectively. ASF prices are expected to witness some corrections in the coming weeks.

CPL

Caprolactam prices witnessed a stable trend during June. The commodity prices seem to have touched the bottom but weak benzene prices may pull down the prices considering the prevailing weak crude prices. Also, demand for the commodity has been average while inventory levels were low. But supply demand scenario is balanced. Current spot offer price for CPL originating from Eastern Europe are around US$ 1550-1600 per MT while high grade material are quoted around US$ 1600 per MT mark. CPL price may witness a stable trend.

NFY

Nylon filament yarn prices witnessed price hike again in June second half. But the current raw material and demand scenario do not support further hike in nylon yarn prices. Current offer prices of 70D/24F Nylon DTY is in the range of US$ 2.86 – 2.87 per kg FOB China whereas Nylon FDY of 70D/24F quoted US$ 2.72 – 2.74 per kg FOB Far East Asia. Nylon filament yarn prices are expected to witness stable trend in the coming weeks.

Pulp

RGWP prices remained stable in June second half after gradual decline since mid-April. Offered price for high quality RGWP was around US$ 920 - 930 per MT and regular grade imported hard wood RGWP prices were about US$ 830 - 840 per MT. However, traded prices have been below the offered prices. Pulp prices are expected to witness stability in the coming fortnight.

VSF

Viscose fiber price witnessed a stable trend during June second half as well. Demand for the fiber seems to have improved as traded volumes increased during June second half. Fiber prices in Chinese local markets have witnessed marginal upward trend as many producers have cut plant operating rate and inventory level dwindled. Current offered price for 1.4 denier fiber is around US$ 1.78 – 1.84 per kg FOB originating from China and offers originating from Indonesia are around US$ 1.84 -1.90 per kg. VSF prices are expected to witness stable trend in the coming fortnight.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.