Cotton Traders Lower Volumes Over Anxiety On GST Regime

India’s local cotton prices witnessed a stable trend during second half of June as well. Prices of the fiber were mostly stable with few varieties witnessing some changes. As the country is going to adapt a new tax system from 1st of July this year, the trading volume of cotton remained lower. Goods and Services Tax (GST) structure which is being rolled out will levy GST on cotton fiber too. Therefore, most of the spinning mills who were in the market looking for fiber remained silent and buying volumes were just hand to mouth. The cotton exporters have also kept themselves away from the market as there was no clarity on whether exporters will get duty draw back on cotton purchased before June 30. Everyone wants to have clarity and waiting for the GST system to roll out. So, fiber demand has dwindled due to the changes in the tax system and procurement of fiber would start after first week of July when the system becomes comprehensible. On the other hand, monsoon has arrived in time and cotton sowing is in full swing across the cotton growing regions of the country. Report indicates that India is going have another bumper crop (estimated at 38 million bales) in the coming season as area under cotton is to increase by over 10%. In the price front, current domestic price for benchmark Shankar-6 variety is around Rs. 42,400 per candy (355.6kg, on 27th June 2017) which is lower by just Rs 300 per candy if compared to mid-June prices.

On the global front, cotton prices witnessed minor volatility and current benchmark prices fell during the fortnight. Cotton futures have, however, witnessed upward trend due to the reported damages of crop by dry weather and wind in USA. Over all, prices of cotton remain strong in spite of expected bumper harvest in the next season. USDA’s forecast for upcoming season indicates that world cotton production will be at 114.7 million bales up from current seasons’ estimates of 106 million bales (of 480 lb). Consumption estimates increased to 116.5 million bales from current seasons’ 113.6 million bales while ending stock declined to 87.7 million bales (from current seasons’ 89.3 million bales.

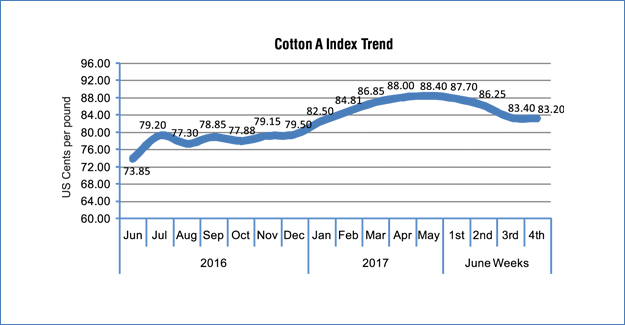

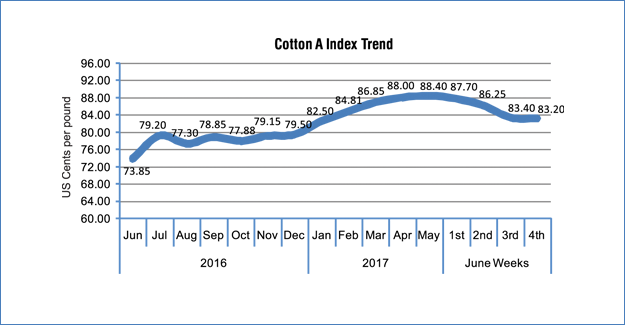

To look at the price trend, ‘A’ index witnessed some fluctuations and declined further down. At the time of writing the report, A index was at 83.20 US Cents per pound. The index touched this season’s high of 94.9 US cents per pound on 15th May and gradually declining since then with some fluctuations. Historically, ‘A’ Index was at 78.55 US Cents in December 2016 end and was at 69.55 US cents per pound in December 2015 end.

On the yarn front, cotton yarn prices seem to be declining as fiber prices have eased. Spinners have lower cost support to keep the yarn prices up. Demand for cotton yarn has been good both in domestic and export markets.

Cotlook ‘A’ Index: 83.20 (As on 27th June 2017)

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.