Floods Damage Crops And Offset Fall In Demand For Fiber Under New GST Regime

Cotton

India’s local cotton prices remained almost stable during second half of July. Prices across all categories of fiber were stable with marginal fluctuations in few local markets. However, buying of the fiber has been need based after the country has adopted a new tax system from 1st of July this year. There were sporadic protest by textile traders and manufacturers from un-organised sectors in textile hubs across the country which brought down the demand for the fiber. Also, the cotton value chain has come under mandatory tax structure in the Goods and Services Tax (GST) regime. Therefore, fiber procurement by spinning mills was just hand to mouth. The cotton exporters were also away from the market as there was ambiguity over duty draw back rate on cotton exports. On the other hand, rains have played havoc in cotton producing regions (in western India) and flood has destroyed some crops. While the crop loss is yet to be estimated, there are reports that India’s production estimates may fall well short of earlier forecast. Further, the crop arrival is expected to be delayed by a month for the upcoming season. Considering all factors, it is expected that local cotton prices to remain strong in spite of reduced demand till new arrivals reach the markets. In the price front, current domestic price for benchmark Shankar-6 variety is around Rs. 42500 per candy (355.6kg, on 28th July 2017) which is higher by just Rs 200 per candy if compared to end June prices.

On the global front, cotton prices witnessed some volatility and gained upward movement during the last fortnight. Cotton futures have, however, witnessed downward trend due to the estimated higher production of fiber in the upcoming season. Over all, prices of cotton remain strong in spite of expected bumper harvest in the next season. USDA’s forecast for upcoming season indicates that world cotton production to be at 115.4 million bales up from earlier estimates of 114.7 million bales (of 480 lb). Consumption estimates increased to 117 million bales from earlier estimate of 116.5 million bales while ending stock to increase to 88.7 million bales (from last estimated figure of 87.7 million bales).

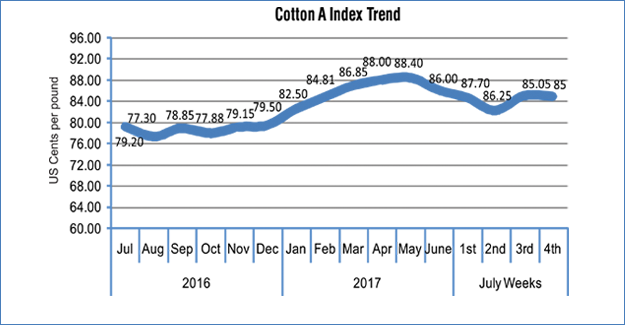

To look at the price trend, ‘A’ index witnessed some fluctuations and moved up. At the time of writing the report, A index was at 85.0 US Cents per pound. The index touched this season’s high of 94.9 US cents per pound on 15th May and gradually declined since then and now hovering around 85 cents level. Historically, ‘A’ Index was at 78.55 US Cents in December 2016 end and was at 69.55 US cents per pound in December 2015 end.

On the yarn front, cotton yarn prices stabilised but some players are trying to hike prices. Demand for cotton yarn from overseas markets has improved but increased yarn price has dampened buying. On the other hand yarn spinners have wafer thin margins and thus, will try to hike prices in the coming weeks.

Cotlook ‘A’ Index: 85.0 (As on 28th July 2017)

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.