Upward Swing In Crude Rectifies, Stabilizes Polyester Prices

PTA

PTA prices witnessed upward movement during second half of July and as crude oil prices have moved upward and benchmark Brent crossed the US$ 50 a barrel mark during the fortnight. This has led to correction in prices of petrochemical based products. Also, there were supply concerns for PTA which helped the prices to go up. However, the last fortnight witnessed start-up of few plants which were down for maintenance. Therefore, supply situation would improve and PTA prices movement would be governed by feedstock prices. Here to note that the downstream polyester sector is operating at a fair capacity and the demand for PTA has been healthy and improved supply would help stabilize the prices unless oil prices does not move up significantly. Current spot market offer prices for PTA are around US$ 650-655 per metric ton CFR CMP. Outlook for PTA prices indicates towards a stable to strong price trend in the coming fortnight.

MEG

MEG prices witnessed a volatile trend during second half of July. Prices went up and then fell moderately based on availability of goods. The demand for MEG has been healthy as polyester sector is operating at a high rate. While few of the MEG plants have been started after maintenance shut-downs, still the availability is an issue. Meanwhile, Reliance Industries have postponed its start-up of 750 kilo ton plant to August which was supposed to start in July. Therefore, prices of the commodity witnessed fluctuation but as supply is expected to improve by next month MEG prices should see some stabilization, provided oil prices move around US$ 50 barrel mark. Current spot offer prices of MEG are around US$ 855-860 per MT CFR China and traded prices are around US$ 845-850 per metric ton. MEG prices are expected to exhibit a fluctuating trend in the coming weeks too.

PET Chips

PET chips prices witnessed upward trend as the raw material prices increased during second half of July. The prices of PTA and MEG have improved during the fortnight which provided impetus to the PET chips prices. Also, hot summer has improved the demand for PET chips from beverages factories. Current Water Bottle Grade PET chips offer prices are around US$ 975-985 per MT FOB China while deals were done around US$ 970 - 975 per MT FOB China. Fiber grade chips quoted prices are around US$ 930-940 per MT FOB Korea. Chips prices are expected to move in line with raw material prices in the coming weeks.

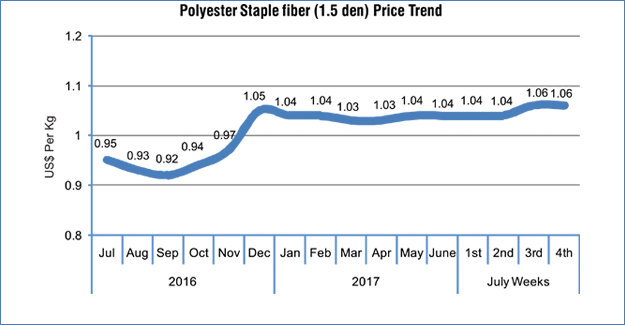

PSF

PSF prices witnessed upward trend during July second half backed by strong raw material prices. The upward movement in the polyester raw material prices provided required cost support to the fiber producers to increase prices during the fortnight. On the other hand, the demand for PSF has improved and inventory levels are low while the plant operating rates are high. So, the prices of fiber expected to remain healthy and the margin for the fiber suppliers would be in positive. In Chinese local markets, trading activities for PSF has witnessed healthy during the fortnight while the inventory levels have declined. In Indian local markets, PSF prices remained stable but demand remain subdued under the new tax regime (GST - Goods and Services Tax) as many downstream fabric producers have gone on strike against it. The high rate of tax on PSF (GST rate on PSF @18%) would work as a negative factor as cost of PSF contained goods would increase. Current offered price for 1.4 denier raw white semi dull PSF is around US$ 1.05 – 1.09 FOB China/Taiwan. CNF India prices are around US$ 1.10 – 1.13 per kg.

Prices of PSF are expected to witness minor corrections in the coming weeks.

PFY

Polyester Filament Yarn prices witnessed upward trend as the raw material prices have moved north during July second half. Both the raw materials - PTA and MEG have witnessed upward movement in prices providing cost support for the polyester yarn makers during the fortnight. The demand for filament yarn of all verities has been healthy while the inventory levels are low in spite of high plant operating rates. Thus, there have been enough cushions for the yarn prices. While all types of polyester filament yarns have showed upward trend, the rate of price hike in FDY has been steep. It is expected that polyester filament yarn prices might remain strong as raw material prices to hold on to current price levels considering the current demand supply scenario. Prices of PFY in Chinese local markets have increased marginally during the last fortnight. On the other hand, Indian market witnessed a weaker demand scenario arising out of new tax regime (GST) as textile manufacturers and traders have picketed against it. Current quoted price for 115D/36F POY is US$ 1.11-1.12/kg FOB China/Taiwan, 150D/48F POY price is US$ 1.0 - 1.01/kg FOB, whereas 75D/36F DTY price increased to US$ 1.46-1.47/kg and 75D/72F FDY price increased to US$ 1.28 – 1.30/kg FOB China/Taiwan. PFY market forecast indicates that yarn prices would witness stronger trend if raw material price does not change in the coming weeks.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.