Pressure Eases On US Cotton Prices

Cotton

US cotton futures eased in the first half of January 2018 falling below the psychological US cents 80 level, with March contract settling at US cents 78.01 per pound after touching US cents 79.25 a pound on the ICE Futures in the first week of 2018, the highest close for the most active contract since mid-May. Despite the decent, US cotton remained the most competitively-priced on the market, and export demand remained strong. However, growers expect for a jump to US cents 85, so a selloff is in order. Nevertheless, the market exhibited some panic buying, as mills chased prices higher and increased their price fixations. This sparked some panic trade selling. The new crop December futures contract was at 74 US cents per pound and planting intentions for 2018 in US have climbed to 12.9-13.2 million acres – a million more than 2017.

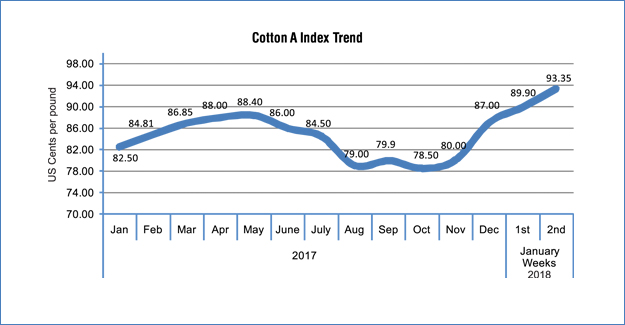

Global spot benchmark, the Cotlook A index rose to notch a 34-week high and closing the week at US cents 93.35 per pound on 12th January.

In China, spot cotton markets were insipid in the first two weeks of January, with sellers aggressively pushing volumes. State-reserved Xinjiang-origin grade-1328 cotton in Shandong were priced at 15.20 Yuan a kg (US cents 106 per pound). The China Cotton Index moved down 34 Yuan on the fortnight to 15,665 Yuan per metric ton (US cents 109 per pound).

In India, cotton prices moved in different directions, with some retreating INR200-300 per candy and some gaining INR300-1,000 a candy. Benchmark Shankar-6 was traded at 40,900 per candy or US cents 82.33 per pound.

In Pakistan, cotton prices topped seven years high after they had reached at the highest-ever level in 2010-11 season as the market was running significantly short of consumption demand this year. Prices were also pushed by the weakening PakRe which made the imports costlier and difficult to purchase in the international market. The KCA spot rate jumped to PakRs7,945 per maund or US cents 87 per pound. However, trading activity weakened following the government’s decision to withdraw duty and taxes on lint imports.

Cotton Yarn

Cotton yarn markets in China were stable to slightly weak amid thin transaction after the market opened following the end of New Year holidays. Some mills lowered their high offers slightly to boost demand. 21s rolled over at 19.00 Yuan per kg (US$ 2.93/kg) and 32s at 23.10 Yuan per kg (US$3.56/kg) in Shengze, both up US cents 2 due to strong Yuan. In India, cotton yarn prices were raised further in Ludhiana market in line with recent surge in cotton prices. It is apparent that spinners’ margins have improved due to some fall in cotton prices. On the export market, cotton yarn prices have slightly declined. 30s combed cotton yarn for knitting were quoted INR 5 per kg higher to INR 197 per kg (US$3.11/kg, up US cents 11, also due to strong INR) in Ludhiana while export offers remained unchanged at US$3.00 per kg in spite of weakening US Dollar.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.