Rising Crude Causes Polyester Prices To Surge

POLYESTER

PTA

PTA markets moved up further in Asia during first half of January, as crude oil price continued to rush up under the influence geo-political situation in Iran while paraxylene markets also followed up strongly on the back of growing demand. In China, suppliers raised offers for bonded goods and for nearby-month cargoes, with the spread between suppliers and buyers slightly widened. Asian PTA markers gained US$29 with CFR China at US$730-732 per metric ton while in India, prices surged US$10 to US$750 per metric ton CIF. In China, offers for bonded goods closed at US$745-760 per metric ton, and for nearby-month cargoes at US$740-745 per metric ton.

MEG

Mono ethylene glycol prices surged to touch the US$ 1,000 per metric ton CFR CMP mark in Asia with discussions for imported cargoes in China surging in the first week of January as bullish sentiment gained traction due to strong crude oil prices. Sellers were holding on to cargoes as higher bids began to surface. Meanwhile, MEG inventories increased 0.4% to 460 kilo ton in China and by 2% from levels in the early December. Asian MEG market jumped US$ 20 with CFR China at US$ 983-988 per metric ton and CFR South East Asia to US$ 988-993 per metric ton. In China, the week closed with offers for nearby-month cargoes at US$ 1,000 per metric ton, with counter offers at US$ 990-995 per metric ton, and deals believed to conclude at USS 990 per metric ton. MEG prices are expected to remain strong in short term.

PET Chips

Polyester fibre grade chip prices moved up rapidly on support of rising cost of PTA and MEG in the first fortnight of January. Semi dull chip market firmed up as some makers hiked offers in Jiangsu amid extremely tight supply. However, transaction was modest due to lackluster buying interest. SD chip offers were lifted US$40 to US$1,225-1,230 per metric ton. Water bottle grade PET chip offer prices are around US$1140 -1150 per metric ton FOB China while discussions were at US$1130 per metric ton FOB China.

PSF

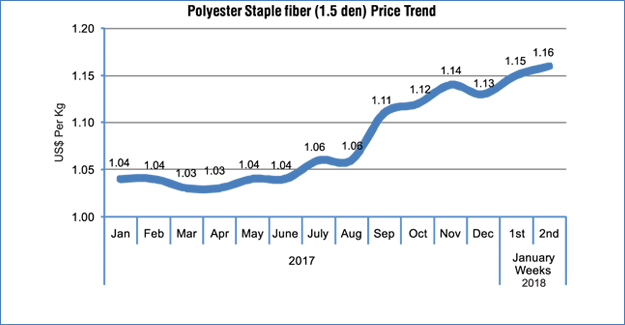

Polyester staple fibre prices inched up in China as crude oil and PTA-MEG cost marched higher after the New Year Day holiday. Downstream mills and traders made larger procurement, leading to brisk transaction. In Jiangsu, 1.4D melt directly spun PSF offers were raised and deals were concluded at high-end numbers. In Jiangsu and Zhejiang, offers for 1.4D direct-melt PSF were raised to US$1.38-1.39 per kg, while the same in Fujian and Shandong were at US$1.36-1.42 per kg if converted to US$, all up US cents 3-5 on the fortnight. The hike in fibre price is also backed by strong local currency. In India, producers’ price remained unchanged for the moment as raw material cost saw fresh rise this week. 1.4D prices were at INR 90.25 per kg (or US$1.42/kg) and 1.2D at INR 93.50 per kg (US$1.47 a kg). In terms of export offers, 1.4 D RWSD polyester fibre is quoted US$ 1.15-1.16 per kg on FOB basis.

PFY

Polyester filament yarn prices were lifted in China following upward fluctuations in crude oil and PTA futures. Overall trading atmosphere was calm somewhat, as downstream mills were less active following the previous procurement. Trading atmosphere weakened, as downstream mills had covered their short positions. POY offers were lifted US cents 2 with 75/72 at US$ 1.46-1.48 per kg in Shengze and 75/36 to US$1.45-1.46 per kg. 75/72 DTY intermingled were up US cent 3 at US$ 1.99-2.00 per kg in Shengze and 75/36 at US$1.93-1.94 per kg. In India, POY prices were stable amid soft trading atmosphere as mills purchased from hand to mouth volume. POY 130/34 were at INR 98.75 per kg (or US$1.56/kg) and 115/108 at INR 106.75 per kg (or US$1.68/kg), both up US cent 1 due to stronger INR.

ACRYLIC

Acrylonitrile (ACN)

Acrylonitrile markets warmed up a bit in Asia seeing supply a little tighter amid good demand from downstream. Sellers were bullish, marked by a slight uptick in domestic prices in China. Overall, many market participants were looking up. Downstream demand was good and stable with acrylamide suppliers sticking to their offers while acrylic fiber makers ramping up capacity seeing active replenishment in downstream. Asian markers were flat on the fortnight with CFR Far East at US$1,839-1,841 per metric ton and CFR SE Asia at US$1,779-1,781 per metric ton. In India, ACN prices remained unchanged at US$1,800-1,850 per metric ton CFR.

ASF

Acrylic staple fibre markets saw prices being adjusted down at the upper end in China while benchmark offers of Taiwan origin ASF were lowered after 6 weeks of stability. In China, ASF producers sustained stable supply in fear of feedstock changes, as the ACN market warmed up this week. Demand remained healthy, as yarn makers stepped up buying at lower price levels. Medium-length fibre and cotton-type staple at US$2.23-2.45 per kg, down US cents 3 at the upper end while benchmark Taiwan origin 3D bright ASF tow offers were lowered by US cents 10 to US$2.10-2.15 per kg. In India, ASF prices did not move this week as ACN cost was still high and firm. In India, offers fell to INR 151.50-153.00 per kg (US$2.39-2.43/ kg, down by 16 US cents).

NYLON

Caprolactam (CPL)

Caprolactam prices were seen falling although feedstock benzene was range bound. In China, prices for liquid CPL were down 1.7% while Sinopec and Fibrant reduced their January contract nominations. Asian caprolactam markers fell US$70 with SE and FE Asia at US$1,950-1,980 per metric ton while European goods were also at US$1,950?1,980 per metric ton CIF China. Demand seem to remain stagnant with polymerization units and yarn makers operating at 78%. Sinopec pegged its January contract price for liquid goods at 16,500 Yuan per metric ton (US$2,540 per metric ton) while Fibrant’s nomination were at 16,600 Yuan per metric ton (US$2,560 per metric ton). In Europe, December contract price was assessed at Euro2,309-2451 per metric ton FD NWE.

Nylon Filament Yarn (NFY)

Nylon filament yarn prices fell at the upper end of the price range indicating high cost goods pegged lower as market remained bearish. Also, upstream caprolactam markets were on a weak note while nylon-6 chip market took downward trend. Nylon yarn makers operated at low rates amid seasonal lull. Demand for FDY, DTY and POY was still need-to basis ahead of the lunar year-end in China when markets turn bearish. Nylon FDY 70D/24F SD prices retreated at the upper end to 21.50-22.20 Yuan per kg (US$ 3.31-3.42 a kg), while DTY 70D fell to 22.80-24.20 Yuan per kg (US$ 3.51-3.73/kg). Monofilament 30D prices declined to 23.50-24.50 Yuan per kg (US$ 3.62-3.77/kg, down US cents 2). Nylon staple fiber 1.5D prices dropped to 19.00-20.00 Yuan per kg (US$2.93-3.08/kg, down by 4 US cents).

VISCOSE

RGWP

Rayon grade dissolving pulp market sentiment was stable in Asia, with trading prices for hardwood pulp at US$ 915-920 per metric ton and softwood pulp at US$ 980-1,100 per metric ton. Filament-grade dissolving pulp prices moved sideways as suppliers tended to maintain prices stable during the fortnight. In China, domestic dissolving pulp offers were firm, with that for hardwood pulp at 7,450-7,500 Yuan per metric ton (US$1,150-1,155 per metric ton). Offers for softwood pulp slightly rose to 7,700-7,800 Yuan per metric ton (US$1,185-1,200 per metric ton, up US$15).

VSF

Viscose staple fibre market sentiments were firm in Asia. In China, while producers raised offers, deals were mostly done at previous levels, amid healthy atmosphere and overall brisk activities. Mainstream discussions for medium-end and high end VSF moved up a bit and stronger Yuan pegged numbers even more higher. Offers for medium-end VSF were hiked to 14.30-14.40 Yuan per kg (US$2.20-2.22/kg) while high-end were lifted to 14.60-14.80 Yuan per metric ton (US$2.25- 2.28/kg), both up US cents 2-3 also due to strong Yuan. In India, VSF prices remained unchanged despite active trading atmosphere while supply was stable, citing unchanged industrial run rate. In India, VSF prices were stable at INR 144-151 per kg (US$2.27-2.38/kg).

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.