Polyester Prices Strong Despite Falling Crude

PTA

PTA spot prices were seen strengthening during first fortnight of February across Asian markets despite the decline in paraxylene and crude oil values. However, with inventory levels not so ample, PTA markets had strong capability to resist price drop. Asian PTA markers gained US$10 on the fortnight with CFR China at US$764-766 per metric ton while offer from Taiwan/Korea were at US$775-780 per metric ton. In India, prices were up US$15 at US$775 per metric ton CIF. In Europe, spot prices rolled over at US$692 per metric ton while US PTA contracts were at US cents 47.36 per pound (US$1,044 per metric ton).

MEG

MEG market activities were hampered by wider gap between offer price and buyer’s bids. Discussion for imported cargoes from China has become increasingly muted ahead of the Lunar New Year holiday. MEG spot prices gained US$20 on the fortnight with CFR China at US$1,020-1,025 per metric ton and CFR South East Asia to US$ 1,032-1,037 per metric ton. In India, CIF values were up by US$ 10 to reach US$1,020 per metric ton. In Europe, MEG bulk spot prices softened, pushed down by rather lackluster demand but truck prices were heard slightly firmer. While bulk prices were assessed at Euro 825-850 per metric ton CIF NWE, down Euro25 while truck prices were assessed up Euro10 at Euro870-890 per metric ton FCA NWE.

Polyester Chips

Fibre grade polyester chip markets in Asia were in weak fluctuation on the back of range-bound feedstock and moderate demand. Semi dull chip market sentiment was on a soft note as producers in China sporadically cut offers while transaction in super bright chip market was lusterless. Offers for semi dull chip fell to 7,950-8,000 Yuan per metric ton (US$1,260-1,265 per metric ton, down US$40) while super bright chip offers also fell to 7,950-8,000 Yuan per metric ton (US$1,260-1,265 per metric ton, down US$30). Asian benchmark, SD continuous spinning fibre grade chip offers of Taiwan/Korea origin remained unchanged at US$ 1,250-1,300 per metric ton FOB.

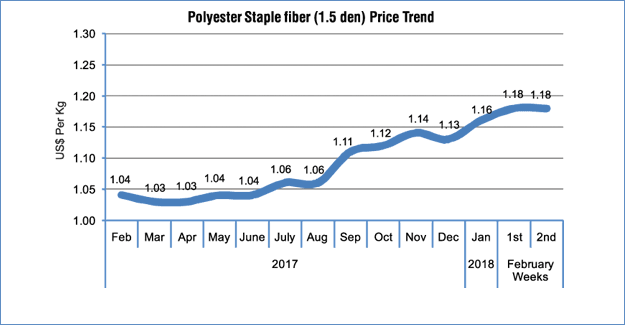

PSF

Polyester staple fibre prices were seen moderating in China while they inched up in India and Pakistan during the first two weeks of February. In China, as MEG and PET chips market retreated, polyester market fundamental was under correction. In Jiangsu and Zhejiang, offers for 1.4D direct-melt PSF edged down US cents 1-3 to US$1.42-1.45 per kg, while the same in Fujian and Shandong were at US$1.42-1.49 per kg. In India, PSF prices were hiked by INR 1 with 1.4D at INR93.25 per kg (or US$1.45 per kg) and 1.2D at INR96.50 per kg (US$1.50 a kg) by a major supplier in the beginning of the month. In Pakistan, 1.4D PSF prices gained PAkRs2 at PakRs.153-155 per kg (US$1.38-1.40 a kg), while import prices were at US$1.21 per kg, CNF Karachi. Polyester yarn prices moved up during the first two weeks of February but were stable in China during the week before long Lunar New Year vacation. 32s was offered at a rolled at US$2.20 per kg while 60s gained US cents 4 at US$2.48 per kg. In India and Pakistan, polyester yarn prices rose to reflect the hikes in PSF cost. 20s were at PakRs122 per pound or up US cents 12 at US$2.43 per kg in Karachi markets while 30s polyester knit yarn prices in Ludhiana were raised INR3 to INR131 per kg (US$$2.05 per kg, up US cents 2).

PFY

Polyester filament yarn prices retreated in the first week of February and did not move in the next in China and India, but stronger US$ pegged all quotes down by about US cents 1-2 depending on specs. In China, PFY prices rolled over in Jiangsu amid muted trading atmosphere, as downstream mills just purchased from hand to mouth and had certain raw material stocks in hand before the Lunar New Year holidays. In China, POY offers for 75/72 were at US$1.47-1.49 a kg in Shengze and 75/36 to US$1.46-1.47 a kg. In India, POY offers were around with 130/34 POY at INR102.25 per kg (or US$1.58 per kg) and 115/108 at INR106 per kg (or US$1.64 per kg).

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.