US Cotton Future Falls To 8-Week Low

Cotton

US Cotton future fell to eight-week low in the second week of February on continued liquidation selling which maintained pressure on futures. Spot March fell US cents 3.80 or 4.7% since late January to close at US cents 76.68 per pound. The market earlier rallied to triple-digit old-crop gains on strong US weekly export sales-shipments data but slipped significantly after USDA cut its 2017-18 export forecast and upped world ending stocks modestly. May contract fell US cents 3.59 in same comparison to finish at US cents 77.63 a pound while December closed at US cents 75.52 a pound. The USDA cut its 2017-18 export forecast by 300,000 bales in its monthly supply-demand report, based on lagging shipments, and raised ending stocks by corresponding number to 6 million bales.

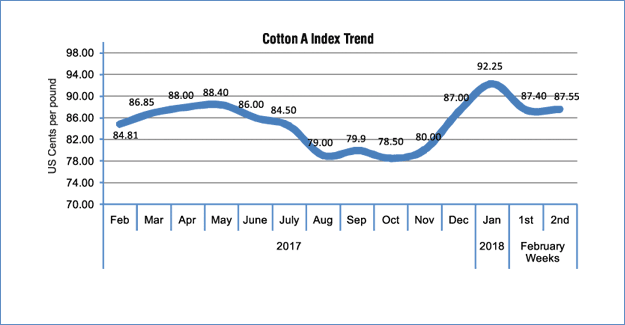

Global spot benchmark, the Cotlook A index also moderated US cents 5, to a seven-week low, at US cents 87.55 per pound. This was more a reflection of the International Cotton Advisory Committee’s nudging its cotton prices forecast higher for 2017-18 while it cut forecast for world stocks. The committee pegged cotton prices at US cents 77 a pound, measured by Cotlook A index of physical values, for the season. This implies that the committee expected prices to fall over the rest of the season, as values until end-January had already averaged US cents 82.4 a pound.

In China, spot cotton markets were in stalemate as trade volume decreased this week. Offers for mechanically-picked Xinjiang-origin fibre were at US cents 113-114 per pound while the China Cotton Index edged down to US cents 113 per pound.

In Pakistan, trading activity on the cotton market failed to pick up as buyers remained away from due to falling global cotton prices and poor domestic trading of yarn. Slow trading activity caused liquidity crunch and buyers / sellers were unable to fulfil their commitments. During the first half of February, KCA spot rates were cut PakRs500 to PakRs7,145 per maund while spot rate on ready counter were down PakRs1,000 per maund.

In India, cotton price movements were mixed across specs this week, although arrivals were touching their seasonal peaks of 2.50 lakh bales per day. Coarser varieties were dearer while finer were cheaper. Benchmark Shankar-6 was traded at INR40,300 per candy (as of 12 February), down INR1,500 from January end prices. Other varieties saw prices fall INR200-1,500 per candy during the same period.

Cotton yarn markets were stable to slightly weak in China amid thin transaction. Conventional varieties like 32s saw slightly better sales but spinners expected tight supply going ahead, thus held back sales. With the long Lunar New Year holiday, market participants had started winding up for vacation by mid of second week of February. 21/2 cotton yarn was traded at US$3.34 per kg and 40s at US$3.78 per kg in Shengze. In India, cotton yarn prices edged down slightly, in line with cotton prices but export prices first retreated than rebounded on better demand. Local market price of 30s combed cotton yarn for knitting were at INR 200 per kg (US$3.09 per kg, down US cents 3, also due to weak INR) in Ludhiana while export offers were at US$3.35 per kg.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.