Mill Procurements Slacken In US Cotton Market

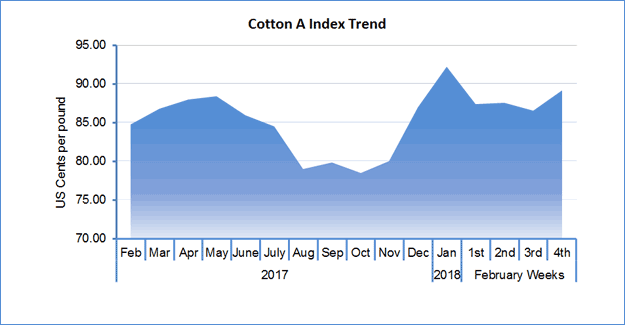

The most-active US cotton May contract gained US cents 5% in the last fortnight of February at US cents 81.34 per pound while maturing March jumped 6% to settle at US cents 81.45 per pound, its highest close since end January. Mill procurements, slackened fund long liquidation and few rounds of speculative short covering propelled the cotton futures to gain. Meanwhile, the USDA unveiled its first full estimates for world cotton supply and demand in 2018-19, predicting that Cotlook A index will decline 12%. The forecast came despite world cotton stocks likely to fall by 5.9 million bales to a seven-year low by this season. Cotton Outlook, at the same time also predicted world cotton production shortfall of 2.68 million bales in next season – well below the 5.9 million-bale deficit expected by the USDA. World demand forecast for next season stood at 122.7 million bales, in line with USDA estimate. Global spot benchmark, the Cotlook A index gained 2% on the fortnight at US cents 89.20 per pound.

In China, spot cotton market was stable and prices for mechanically-harvested grade-3128/29 cotton in Xinjiang were at premiums over futures. Some textile producers were still relying on older stocks. The China Cotton Index fell 7 Yuan to 15,691 metric ton (US cents 112 per pound) In Pakistan, dull trading was witnessed on the Karachi Cotton Exchange while spot rates declined PakRs100 on the fortnight to PakRs7,045 per maund ex-Karachi. The decline in trading activity implied that the traders remained on the sidelines because besides cotton prices, yarn prices were also depressed. Spinners are not entering in buying at higher rates. In India, cotton prices moved either sides depending on specs availability. Arrivals remained around 140,000 – 150,000 bales per day. Meanwhile, reports stated that cotton imports this season may surpass the official estimate of 1.7 million bales, as textile mills increasingly prefer US cotton as it is available at discounted price. Shankar 6 was traded at INR 39,700 a candy (355.6 kgs), down INR600 from previous fortnight.

Cotton yarn markets in China were gradually recovering after long holidays and prices were kept steady amid modest transaction. Conventional and low-count yarn reported slightly better sales, and 32s and 21s sold well. 32s were at 22.90 Yuan per kg (US$3.61 a kg) and 40s at 23.90 Yuan per kg (US$3.76 per kg) in Shengze. In India, cotton yarn prices inched up, despite fibre prices were slightly down. 30s combed cotton yarn for knitting was at around INR200 per kg (US$3.09 per kg) in Ludhiana while export offers were at US$3.35 per kg.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.