Market Upbeat As Cotton Prices Surge

Cotton futures surged to hit an over six-year high, propelled by fund-buying and amid expectations of an increase in buying from China. Funds bought back some of the long positions they shed over the last month in anticipation of USDA’s WASDE report due next week. Prices also reacted to reports that China will probably import an extra 10 million bales next year. However, weekend saw futures edging lower as traders were cautious ahead of a monthly federal crop supply and demand report next week. The most active cotton contract on ICE, the December contract, settled at US cents 92.60 per pound up US cent 5.73 on the fortnight, and clocking four straight weekly gain. July futures closed at US cents 94.94 a pound, the highest level for a front-month contract since February 2012.

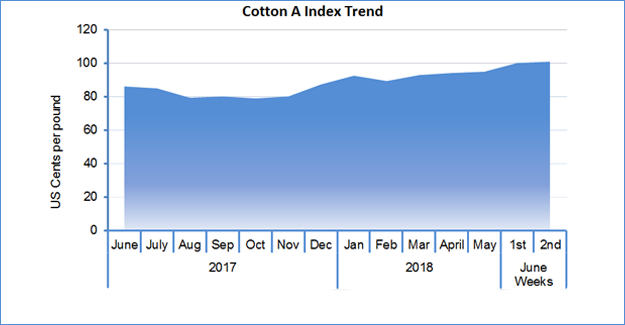

Global spot benchmark, the Cotlook A index also gained US cents 6.40 on the fortnight to US cents 101.35 per pound after gaining US cents 5.75 in early June.

China is re-emerging as a major consumer of US cotton after years of stockpiling, a shift that together with poor growing conditions in Texas has sent prices surging this week. According to USDA data, it has purchased futures contracts covering more than 361,000 bales of US cotton for 2019-20. China has never booked that much cotton in advance at this time of year, in data going back to 1998. In domestic market, spot was dominated by sidelined stance, with buyers focusing on state-reserved resold materials. Xinjiang-origin cotton from Shandong were quoted at 16.40-16.60 Yuan a kg (US cents 116-118 per pound). The China Cotton Index first gained 709 Yuan and later shed 294 Yuan to touch 16,458 a ton (US cents 117 a pound).

In India, cotton prices continued to rise in spot markets this week as almost all varieties gained INR2,800-2,900 per candy. Benchmark Shankar-6 was traded at INR45,900 per candy, up INR3,200 on the week. Mills feared that as the season comes to a close, prices may go up further and this may adversely affect the entire textile value chain.

Cotton yarn markets saw activity increasing in China as prices went up with surge in global cotton prices. However, downstream buying interest weakened slightly after price went up. This led to an increase in inventories at some producers. Deals were mainly heard for 32s and 40s yarns. 32s cotton yarn prices were at 24.30 Yuan per kg (US$3.80 /kg, up US cents 7) while 40s were lifted to 25.40 Yuan per kg (US$3.97/kg, up US cents 10) in Shengze. In India, cotton yarn markets reflected the increase in cotton prices for both domestic and international markets. Mills raised prices for cotton yarn to recoup margins, but this may hurt demand in coming period as cotton prices will continue to rise. 30s combed cotton yarn for knitting were raised INR15 to INR210 per kg (US$3.11, up US cents 25) in Ludhiana. Both Cotton and cotton yarn prices are expected to remain strong in the coming fortnight of the month.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.