Polyester Prices Witness Moderate Fluctuation

PTA

PTA markets were under fluctuation in Asia in the first two weeks of June and offers are seen moving either ways, but ended the period slightly up from previous fortnight. Spot prices were supported by supply shortage which is expected to ease with an aromatics complex restarting in July. Asian markers inched up US$11 in the first fortnight with CFR China at US$842 per metric ton while offer from Taiwan/Korea were at US$852 per metric ton. In China, offers for bonded goods were maintained at US$853 per metric ton, and discussions for nearby-month cargoes were at US$845 per metric ton.

MEG

Asian MEG spot prices declined further as market activity remained mute in the first half of June, while buying appetite was dampened by high inventory levels. Although, inventories in east China decreased to 866 kilo ton, sales performance of downstream polyester sector began to slow down, weighing down buying interest. Spot prices declined US$6 from previous fortnight with CFR China at US$900.50 per metric ton and CFR South East Asia to US$894 per metric ton. Spot discussions dropped from US$932 per metric ton to US$905 per metric ton by weekend.

Polyester Chips

Fibre grade polyester chip markets were on a soft note in the first half of June seeing upstream PTA prices almost flat and MEG declining, easing some cost pressure. Semi dull chip makers in China cut offers as transaction was weak in Jiangsu and Zhejiang, amid thick wait-and-watch stance. Super bright chip prices eased a bit but mirrored the trend in semi dull chip markets. CDP chip markets were in narrow fluctuation, with discussions and offer decline on the fortnight. Semi dull chip offers were down to 7,700-7,750 Yuan per metric ton (US$1,200-1,210 per metric ton, down US$25) while super bright chip offers fell to 7,965-8,050 Yuan per metric ton (US$1,245- 1,265 per metric ton, down US$30).

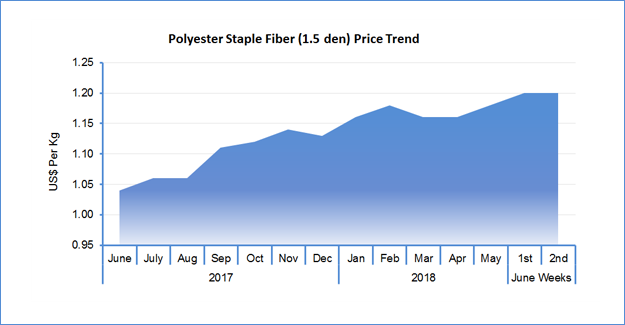

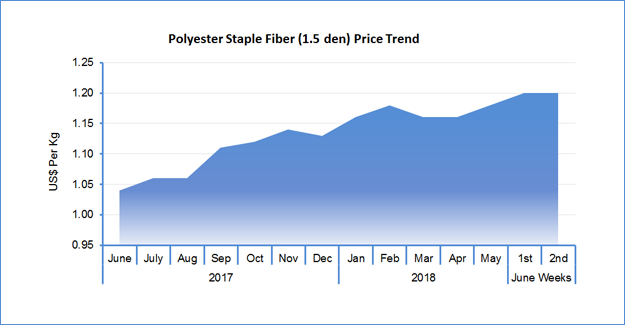

PSF

PSF markets in China were stable to soft amid moderate trading sentiment. Although, crude oil and PTA markets firmed up, PSF makers cut offers to push volumes given the inactive buying sentiment and poor confidence. In Jiangsu and Zhejiang, offers for 1.4D direct-melt PSF declined US cents 3 to US$1.37 a kg, while the same in Fujian and Shandong were down US cents 1-4 to around US$1.37 a kg. In India, PSF offer prices remain strong while some producers have offered discounts on volume and inventory level. Traded price of 1.4D were around INR95.75 per kg (or US$1.40/ kg) and 1.2D at INR97 per kg (US$1.42/ kg). Polyester spun yarn prices moved in China this fortnight in line with movement in PSF markets in the last two week. In India, polyester spun yarn prices were revised upward. Finer count yarn prices in China were seen rising in the last week. It is apparent that demand is hard to improve given the slowdown in yarn offtake by converters and offers are not lowered to maintain margins. 32s polyester yarn offers were unchanged at 14.30 Yuan per kg (US$2.23/kg) while 60s were hiked to 16.40 Yuan per kg (or US$2.56/kg), up US cents 6 on the fortnight. In India, 30s polyester (recycled PSF) knit yarn prices remained flat at INR132 per kg (or US$$1.95/kg) in Ludhiana market. 30s polyester (virgin PSF) knitting yarn price from south Indian mills stood around INR188 per kg (or UD$2.77)

PFY

PFY yarn prices moderated in China and did not move in India and Pakistan during the first fortnight of June. Downstream buying interest remained low, but low inventory and high converters run rates provided certain liquidity. Offer for 75/72 DTY were down US cents 2 at US$1.97-1.98 per kg in Shengze and 75/76 FDY were US cents 3 cheaper at US$1.56-1.58 per kg. POY prices in India were generally stable while trading atmosphere was low. POY 115/108 were at INR110 per kg (or US$1.63/kg) and 130/34 POY at INR102 per kg (or US$1.51/kg).

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.