How Are US Cotton Exports Panning Out

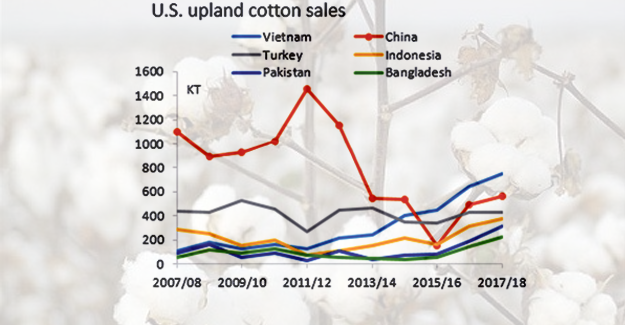

By the week ending Aug 2, 2017/18 crop season has ended for US, and total sales of 2017/18 US cotton reached 3.86 million tons, including 3.71 million tons of upland cotton and 0.15 million tons of Pima. Sales of 2018/19 cotton approach 1.91 million tons and that of 2019/20 cotton are 0.31 million tons. Sales of 2017/18 cotton are the largest to Vietnam, followed by China. For 2018/19 cotton, China books the most, with Vietnam at the second place. Bangladesh cotton imports from US saw the largest increment of 486%.

US cotton is mainly exported to developing countries in Asia, and the major cotton consumed is length above 1-1/16. Cotton with length below 1 inch is mainly exported to Japan, and cotton with length between 1-1-1/16 inch is mainly exported to Mexico. US principally exports cotton with length above 1-1/16, and China and Turkey rank the second and third places. For Pima, the consumption in US is only about 10kt and the rest is for export, with China being the largest consumer.

Among the export destinations, except Turkey, whose import volumes are stable, import volumes of other countries have witnessed significant increase in recent two years.

For Pima, China is the largest consumer, and import demand from India also rose quickly after 2014/15 season. In 2016/17 season, export to China decreased due to high cotton output in China, leading to lower prices, so consumption turned to domestic Xinjiang long staple cotton.

The trade relationship between US and Turkey/China has deteriorated, leading to sharp depreciation of emerging markets. In the meantime, higher tariffs on cotton lead to sharp fall of US cotton sales. Nevertheless, even as US is likely to lose China and Turkey, international market looks positive for US cotton prices. On one hand, import demand from China is bound to rise with decreasing reserved cotton stocks. Despite of high tariffs and exchange rate issue, consumption cannot disappear, & Chinese buyers will seek for alternative sources. On the other hand, for ICE cotton futures market, large quantity of hedging (but spot goods are not registered as warehouse receipts) and unfixed on-call contracts may lead to market squeeze. Therefore, market players look positive towards the ICE cotton futures market. Pima market is different from upland cotton market, as it is not related with futures market. The supply and demand is the key factor for the price fluctuation, and its market is relatively fixed. China has the capability to plant more long staple cotton crops, so once it loses Chinese market, the Pima market may be damaged. And US cotton consuming countries are adjusting the cotton structure, in face of the possible higher US cotton prices. Import dependency of Vietnam, Indonesia and Turkey is the highest, and their adjustment of cotton structure is difficult. For China, the import dependency is actually low. If China cannot import US cotton, the influence on high-end market is large, but is low for the whole industry.

Through the analysis on US cotton exports, trade dispute between US and Turkey may have an influence more on Turkey’s cotton textile market, with its high import dependency on US cotton.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.