India's Cotton Production Trend

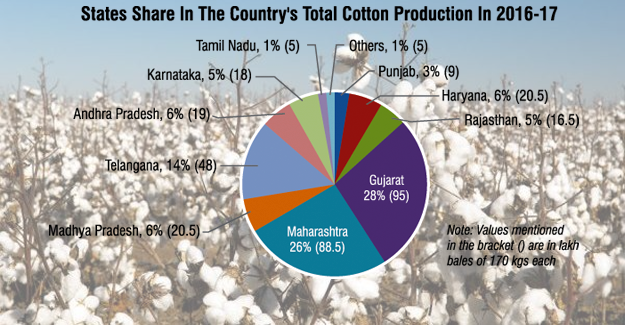

India's Cotton Production India's cotton production has grown from 119 lakh bales in 1991-92 to 345 lakh bales in the last season (2016-17) with growth of 190%. The cotton production was at its peak in 2013-14 when the country produced 398 lakh bales of cotton due to higher yield gone up in Gujarat to 124 lakh bales from 93 lakh bales in the previous cotton season. In the last season (2016-17) the country had produced 345 lakh bales of cotton with a growth of 3.92% over the previous season. Out of the three zones, the central zone has produced 59% (204 lakh bales) of the cotton. The northern and central zone picked a positive trend in the last season, the northern zone perceived a growth of 28.67% and central zone 10.87%, but the southern zone perceived a negative growth of -16.08%. From the ten topmost cotton producing states, Gujarat produces most of the cotton for the country, in the last season Gujarat produced 95 lakh bales of cotton. As per Cotton Advisory Board (CAB) in the current ongoing season (2017-18) of cotton, the estimated production is expected to touch 370 lakh bales with growth of 7.25%. The northern zone is expected to touch 56 lakh bales of cotton with growth of 21.74%, central zone to touch 209.5 lakh bales with 2.70% and southern zone to touch at 99 lakh bales of cotton with a growth of 10%. Gujarat would still be the topmost state in the production of cotton in the current season with growth of 9.47% to 104 lakh bales of cotton and would stake 28% share from the total production in the current cotton season and 50% share in the central zone. Cotton production in Maharashtra is expected to drop by -3.95% to 85 lakh bales and stake 23% from the total production. Rajasthan is estimated to show a good growth in the current season. Rest of the states show an average growth in the production of cotton. Northern zone Cotton production in the northern zone has always been on the average side. In 2016-17season, production in this zone was 46 lakh bales and witnessed a growth of 28.67% from the previous season. The zone witnessed its peak production in 2011-12 and 2012-13 with a cotton production of 64 lakh bales and the lowest in 2002-03 with 21.25 lakh bales. In this zone, Haryana produced 20.50 lakh bales of cotton in the last season (2016-17), making itself the topmost state in the northern zone. In 2016-17, Haryana perceived a growth of 41.38% and share of 45% in the northern zone and 6% in the total cotton production of India. Haryana has registered its peak cotton production in 2011-12 and 2012-13 seasons with a production of 26 lakh bales of cotton. In the last three seasons the production of cotton in Punjab has dropped compared to other seasons. The whitefly attack has resulted in huge losses to the farmers as the production of cotton in the state has dropped from 21 lakh bales in 2013-14 to 13 lakh bales in 2014-15. It further dropped to 6.25 lakh bales in 2015-16. In the last season (2016-17) the cotton production totaled to 9 lakh bales with a growth of 44% and it stakes 20% share in the zonal area and 3% in total production of India. In the last two seasons, the production of cotton has again picked up, but on an average border. In 2017-18, Punjab is expected to produce 11.5 lakh bales of cotton and witness a share of 21% in the zone's total cotton production. Rajasthan has recorded a growth of 10% in 2016-17 with a production of 16.5 lakh bales of cotton. The state stakes 36% share from the northern zone and 5% from the country's total cotton production. In the current season (2017-18) Rajasthan is expected to produce 22 lakh bales of cotton with growth of 33.33%. The state would witness a further 3% growth touching 39% in the zone and one percent more touching 6% in the total cotton production of India. Central Zone Central zone accounts for about 59% of the total cotton production in India. The main states in the central zone are Gujarat, Maharashtra and Madhya Pradesh where cotton is cultivated as full season crop. The central zone has witnessed its peak production in the 2013-14 with a production of 227 lakh bales of cotton. In the last season (16-17) the zone's production totaled to 204 lakh bales with growth of 10.87% over the previous season. As per CAB, central zone is expected to produce 209.5 lakh bales of cotton in the current season & stake 57% share in the total production of cotton. Gujarat is the topmost producing cotton state in the country and in the central zone. In the last season, Gujarat produced 95 lakh bales of cotton with a growth of 5.56%. The state shares 47% portion of the total production in the central zone and 28% from the total cotton production in the country. The peak production of cotton in Gujarat was registered in 2013-14, which totaled to 124 lakh bales of cotton. For the current season, Gujarat is expected to produce 104 lakh bales of cotton with a growth of 9.47% and has projected to stake 50% share in zonal area and 28% in the total cotton production of India. Maharashtra is the second highest cotton producing state in the country. From 2009-10 to 2016-17, cotton production in Maharashtra has been fluctuating. In the last season the state took 43% share in the central zone and 26% from the country's total cotton production and has registered a production of 88.5 lakh bales with a growth of 16.45% in 2016-17 over the previous cotton season. The state had witnessed its peak production in the last season itself in the past 26 seasons of cotton production. In the current season Maharashtra is expected to witness a drop of -3.95% in the production of cotton and also it would witness a drop in its shares, it would stake 41% in its zone and 23% in total cotton production. Madhya Pradesh has been an average cotton growing state compared to the other top states. In the last season the state has produced 20.5 lakh bales with growth of 13.89% over the previous season. The state stakes 10% share in its zones total production and 6% in the country's total production. For the current season, CAB has estimated the production to remain the same as the last season. Madhya Pradesh has registered its peak production in 1997-98 with 22.5 lakh bales of cotton. Southern Zone Southern part of India is the second largest cotton producing zone in the country. But the zone has perceived a negative growth of -16.08% in the last season (2016-17) and stakes 26% share from the total cotton production of India. The zone has witnessed its peak production in 2014-15 which totaled to 117 lakh bales of cotton.It is projected that in the current season, the southern zone's cotton production will be 99 lakh bales and expected to witness a positive growth of 10% over the last season. Out of these four states, Telangana produces the most amount of cotton. The state stakes 53% share in the zone and 14% from the country's total production. In 2016-17, the state produced 48 lakh bales of cotton, a drop of 17.24% compared to the previous season. The peak production was recorded in 2015-16 with 58 lakh bales of cotton. As Telangana was separated from Andhra Pradesh in June 2014, and declared as a new state, hence the production of cotton in Andhra Pradesh too was divided. Therefore the data available for Telangana is from 2014-15 and before 2014-15 it was considered as a whole in Andhra Pradesh. For the current season, Telangana is expected to have an upward growth in the production of cotton and would produce an additional 9 lakh bales of cotton from the last season. Andhra Pradesh currently stakes 21% in the zone and 6% from the country's total production. The state perceived a negative growth of -20% to 19 lakh bales of cotton in 2016-17 season. In this ongoing season, Andhra Pradesh is expected to receive a positive growth of 7.89% to 20.5 lakh bales of cotton, but shares in the zone and country's total cotton production is expected to remain the same. Karnataka perceived a growth of -7.69% to 18 lakh bales of cotton in 2016-17 over the previous season and stakes 20% share in the zone area and 5% from the total production of the country. As per projections, it is expected that the state in the current season the state's cotton production would remain the same as in the last season. The least volume of cotton is produced Tamil Nadu, the average has been 5 to 7.5 lakh bales of cotton from 1991 to 2017. In the last season of cotton, the state produced 5 lakh bales of cotton, a fall of 16.08% compared to the previous season. The state stakes 6% share in the zone and 1% from the total production. In this current season of cotton, Tamil Nadu is expected to increase it cotton production to 5.5 lakh bales over the last season. India's Cotton Cultivation (Area) Trend In the last season, area under cotton cultivation fell to a 6 year low to 108.26 lakh hectares registering a fall of -11.93%. India witnessed its peak in 2014-15 with an area of 128.46 lakh hectares under cotton cultivation. Area-wise, 63% of the total area cultivated for cotton comes from the central zone, followed by the southern zone with 23%, northern zone by 12% and others with 2%. Out of the top ten states, seven states have shown a drop in area under cotton. In the current season (2017-18) the cultivation area for cotton is expected to rise by 14.95% to 124.44 lakh hectares . Northern zone In the northern zone, cotton cultivation area has dropped by -5.42% in the last season to 13.26 lakh hectares of area. But as the production has increased in the same season the productivity of cotton has gone up by 71.28% to 589.74 kg/hectare over the previous season yield which was registered to 433.49 kg/hectare. The highest cultivated area in the northern zone was registered in 1996-97 with 20.45 lakh hectares of areas. For the current season the cultivated land in this zone is estimated to rise by 16.44% to 15.44 lakh hectares with a yield of 616.58 kg/hectare. Haryana has used 5.70 lakh hectares of area for the cultivation of cotton in the last season making itself the top state in the zone. But the state has perceived a negative growth of -7.32% and it shares 36% in its zone and 4% in the country's total area covered under the cultivation of cotton. Even with the drop in the area used for the cultivation of cotton, Haryana has produced more cotton in the last season. The cotton productivity growth in the state increased by 52.5% with a yield of 611.40 kg/hectare over the previous season's yield 400.81 kg/hectare. For the current season, the Cotton Advisory Board has projected the cultivation area would grow by 17.37% to 6.69 lakh hectares with a yield of 571.75 kg/hectare. Rajasthan is the only state in the zone that has registered a positive growth in the last season of cotton. The state perceived a growth of 5.13% with an area of 4.71 lakh hectares under cotton cultivation. In the ongoing season the state is expected to witness a rise of 23.99% to 5.84 lakh hectares of area and yield of 640.41 kg/hectare. Punjab has witnessed a major drop in the zone to 15.93% in the last season. Punjab cultivated cotton crop in 2.85 lakh hectares of area in 2016-17 and its shares 21% in the zone and 3% in the country total area under the cultivation of cotton crop. Even after witnessing a drop in the cultivation area, Punjab's cotton productivity at 536.84 kg/hectare grew 71.28% over the previous season's yield of 313.42 kg/hectare. In the current season the state may see a minimal rise by 2.11% to 2.91 lakh hectares of area with a yield of 671.82 kg/ hectare. Central Zone Area-wise this is the top zone that cultivates major amount of cotton crop on their land. But in the last season, the zone has witnessed a negative growth of -9.49% with an area of 67.81 lakh hectares of area over the previous cotton season and stakes 63% share from the total area used for the cultivation of cotton. Whereas the yield is concerned, the zone has perceived a growth of 22.49% with a yield of 511.43 kg/hectare over 417.51 kg/hectare yield in the previous season. For this continuing season the central zone is expected to witness an upward growth of 9.62% cultivating an area of 74.33 lakh hectares and yield of 479.15 kg/hectare. Here Maharashtra leads the scoreboard with 56% of the share in the zone and 35% in the total area used for the cultivation of cotton crop. In the last season of cotton, Maharashtra used 38 lakh hectares of areas for cotton, but witnessed a drop by -9.67% over the previous season with an area of 38 lakh hectares used for cotton. But Maharashtra produced a yield of 395.92 kg/hectare in the last season over the previous season yield of 307.11 kg/hectare. For this season Maharashtra is expected to grow its cultivation area by 10.71% to 42.07 lakh hectares and a cotton yield of 343.48 kg/hectare. Gujarat been the topmost state in cultivating cotton has also witnessed a drop by -12.49% in area cultivated for cotton in the last season with an area of 23.82 lakh hectares, but still it remains the topmost state with the area used for the cultivation of cotton. Yes it also tops the list in the productivity of the crop with a yield of 678 kg/ hectare with a growth of 20.62% over the previous season yield 562.09 kg/hectare. The state stakes 35% shares in the zone and 22% from the country's total area used under the cultivation of cotton. As per reports it's projected that Gujarat would see a rise of 10.71% in the current season with an area of 42.07 lakh hectares & yield of 674.04 kg/hectare. Area-wise Madhya Pradesh cultivates cotton with least area in the central zone. But compared to the other states in the zone, Madhya Pradesh has witnessed a rise of 6.39% with an area of 5.99 lakh hectares and is expected to rise to 6.03 lakh hectares in the current season with a yield of 577.94 kg/hectare of cotton. Southern Zone In the southern zone the cultivation area for cotton has witnessed a drop of -21.41% to 25.33 lakh hectares in the last season. The zone stakes 23% share from the country total area used for the cultivation cotton. All the states have witnessed a drop in the area except for Tamil Nadu which has remained the same over the previous season. In the current season (2017-18) the area for cotton is to witness a rise of 29.17% in the zone with an area of 32.72 lakh hectares and yield of 514.36 kg/hectare of cotton. Telangana leads in the zone with a share of 56% from the total areas cultivated with cotton crop in the zone. In the last season the state cultivated cotton with an area of 14.09 lakh hectares, but registered a negative growth of -20.53%. Here the area and production both have dropped but still the yield has increased by 4.41% to 579.13 kg/hectare over the previous season. For the ongoing season, Telangana is expected to witness a major rise 34.63% with an area of 18.97 lakh hectares with a yield of 492.88 kg/hectare. Andhra Pradesh also had registered a fall of 29.13% in the cultivation area totaling to 4.72 lakh hectares in the last season. In this state too, the area and production has witnessed a downward trend, but the yield has witnessed a growth of 12.88% to 684.32 kg/hectare over the previous season. For this season (2017-18) the area is expected to go upto 36.44 lakh hectares and increase it share in the zone by one percent achieving 20% from the total areas covered for cotton crop in the southern zone and with a yield of 541.15 kg/hectare. Karnataka has cultivated cotton crop with slight more area than Andhra Pradesh. The state cultivated cotton on 5.10 lakh hectare of area in the last season with a growth of -20.56%. Witnessing a drop in the area and production, the state has still managed a growth of 16.20% with a yield of 600 kg/hectares of cotton over the previous season yield 516.36 kg/hectare of cotton. In the current season, the state is expected to have very little growth of 7.06% with an area of 5.46 lakh hectares and yield of 560.44 kg/hectare. Area-wise Tamil Nadu cultivates cotton on least size area from the top ten cotton growing states. In the last season Tamil Nadu cultivated cotton with an area 1.42 lakh hectare with no growth from the previous season. This is the only state which has witnessed a fall in the yield of cotton with -16.67% to 598.59 kg/hectare over the previous season. But in the ongoing season it is likely to go up by 30.28% to 1.85 lakh hectares with a yield of 505.41 kg/hectare India's Cotton Export-Import Trend Cotton Exports After India witnessed a drop in the cotton export market for three fiscal years in a row, the segment has shined in 2017-18 export with a growth of 6.4% totaling US$ 7036.17 million over the previous fiscal year. The commodity has gained 19% share from the total T&C exports. Bangladesh remains the largest importer of India's cotton as the demands from China continue to drop over the last fiscal year. Cotton exports to Bangladesh in 2017-18 valued to US$ 1816.21 million with growth of 13.8% over the previous fiscal year. The country takes 26% share from the total cotton exports. While the exports to China have dropped by 25.2% totaling to US$ 1003.2% with share of 14% in 2017-18.Pakistan has retained its position as the third largest market for India's cotton exports, although the cotton exports have increased by 14% totaling US$ 544.40 million. Pakistan takes eight percent share from the India's total cotton exports.In terms of exports growth, Sri Lanka had gained 4.2 % in 2016-17, but in 2017-18 the cotton exports dropped significantly by -7.3% totaling US$ 222.66 million. Vietnam is another important market for India's cotton exports. In 2017-18 the exports totalled to US$ 435.64 million with a growth of 54.9% over the previous fiscal year. The country has imported increasingly higher volumes of cotton in the recent years. This surge in volumes mainly serves to feed the growing needs of its textile and garment production and export endeavour. Cotton Imports India's cotton imports from the world perceived a positive growth of 4.31% totaling to US$ 1180.97 million in 2017-18 over the previous fiscal which totaled to US$ 1132.21 million. In 2017-18 India majorly imports cotton from USA, Australia, China, Egypt, Mali, Burkina Faso, Cameroon, Benin, Cote D'Ivoire and Bangladesh. USA remains the top country in India's cotton import segment. India imported around US$ 461.93 million of cotton from USA. Australia also remains as the second top country in India's cotton import segment with total import of US$ 141.82 million, but the perceived a negative growth of 49.86% over the previous fiscal year where it totaled to US$ 282.86 million. While Bangladesh was not in top ten import list in 2016-17 where it exported cotton worth US$ 12.43 million to India, in the last fiscal year Bangladesh exported cotton to India with an export value of US$ 18.62 million.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.