India's Textile Machinery Exports Rose 31% In Q1FY'19

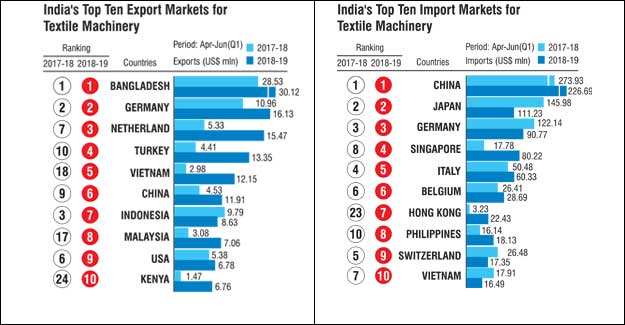

In the first quarter (Q1) of FY18-19, India's textile machinery trade balance improved by 2.95% to US$ 1144.85 million over the corresponding period of the last year (CPLY) where the trade balance totalled to US$ 1112.03 million. Textile machinery imports share the lion's share of 82% from the total textile machinery trade in India. Imports in Q1FY 18-19 totalled to US$ 940.25 million but perceived a negative growth of 1.67%. China is the leading sourcing destination for India's textile machinery. Exports have increased by 31.33% in Q1 FY18-19 to US$ 204.60 million over the CPLY. Bangladesh is the top most market for India's textile machinery exports. India's Textile Machinery Exports In Q1FY 18-19 In the first quarter for this fiscal year, spinning, twisting and yarn preparation machinery exports account for a major portion of 36% from the total textile machinery exports in Q1 FY 18-19 with an export value of US$ 72.71 million. Bangladesh is the top export market for India' textile machinery, the exports totalled to US$ 30.12 million. Commodity-wise exports from India Under the spinning, twisting and yarn preparation machine exports, cotton spinning ring frames were exported the most from India and its share was 56% under the spinning twisting and yarn preparation commodity. Exports of cotton spinning ring frame totalled to US$ 40.39 million with growth of 13.74% in Q1 FY 18-19 over the CPLY. Exports of cotton spinning roving frames has registered a massive growth of 612.50% to US$ 4.56 million over the CPLY where the exports totalled to US$ 0.64 million. Cotton combing machine exports have gone up by 31.43% to US$ 1.84 million in the Q1 FY 18-19 over the CPLY. Other textile fibres winding and reeling machines have perceived a strong growth of 203.61% totalling to US$ 2.52 million. Exports of printing machinery, including digital printing machines have witnessed a positive trend in Q1 FY 18-19 of 22.74% to US$ 28.82 million over the CPLY where exports totalled to US$ 23.48 million. Under this commodity, offset printing machinery reel feed is the top-most commodity with value of US$ 5.5 million and growth of 59.88% in Q1 FY 18-19. Auxiliary machinery used with other machines is the second highest commodity with respect to the export value in Q1 FY 18-19. The commodities export value totalled to US$ 42.45 million with a growth of 29.30% and it stakes 21% from the total textile machinery export in the first quarters of this fiscal year. Under this category, parts and accessories of machine used for manmade textile material is the top-most commodity exported from India in the first quarters of this fiscal. The commodity totalled to US$ 9.16 million with a growth of 68.69%. Weaving machine (loom) has witnessed a good growth of 29.42% with export value of US$ 9.15 million in the Q1 FY 18-19 and share 4% from the total exports of textile machinery Knitting machine exports have shown a negative trend in the first quarters. The exports totalled to US$ 0.59 million, a drop of 22.37%. Also machinery used for nonwoven sector has witnessed a decline in the exports by 33.33% totalling to US$ 0.06 million. Sewing machine and accessories have perceived a positive growth of 8.75% in the Q1 FY 18-19 totalling to US$ 14.04 million over the CPLY where exports were 12.91 million. The commodity shares 7% portion from the total export of textile machinery. Under this commodity, needles used for other sewing machines other than HH type were exported the most to the world from India. The exports for needles totalled to US$ 5.13 million with growth of 16.59%. Country-wise textile machinery exports from India Bangladesh is top export market for India's textile machinery. Exports to Bangladesh totalled to US$ 30.21 million in the Q1 FY 18-19, growth of 5.57% and share of 15% from the total textile machinery exports of India. Spinning, twisting and yarn preparation machines were the most exported commodity to Bangladesh in the quarter with an export value of US$ 14.88 million, but have witnessed a decline of 8.95%. Printing machinery including digital printing machinery exports were the second top-most export commodity to Bangladesh with an export value of US$ 4.86 million and growth of 60.99% and it shares 16% from the total exports of textile machinery to Bangladesh. Weaving machine exports which share a portion of 5% from the total textile machinery exports have perceived a growth of 94.83% to US$ 1.62 in Q1 FY 18-19 over the CPLY where the exports summed to US$ 0.83 million. Sewing machine exports totalled to US$ 0.5 million taping a negative growth of 59.41%. Germany stands second in the export segment in the first quarters of this fiscal year. India's textile machinery exports to Germany witnessed a growth of 47.47% totalling to US$ 16.13 million and share of 8% from the total textile machinery exports. Parts of laundry type machine and machine for rolling, folding and cutting was exported the most to Germany with an export value of US$ 4.82 million, growth of 121.98% in Q1 FY 18-19. Auxiliary machines exports to Germany with value of US$ 3.80 million, growth of 3.35%. Spinning, twisting and yarn preparation machinery exports to Germany have shown vast progress. The exports to Germany totalled to US$ 2.74 million with a growth of 146.47% in Q1 FY 18-19 over the CPLY. The Netherlands has come up from the seventh to the third largest export market for Indian textile machinery in Q1 FY 18-19 over the CPLY and has shown huge improvement on the trends. India majorly exported spinning machines from India, worth US$ 10.17 million with a growth of 200.32%. Other than spinning machinery exports, Auxiliary machine exports have also shown vast improvement f 214.24% to US$ 3.97 million in the Q1 FY 18-19 over the CPLY where the exports totalled to US$ 1.26 million. Turkey which stood tenth in the Q1 FY 17-18, now stands on the fourth position. India's exports to Turkey have gone down by 202.72% to US$ 13.35 million and shares 7% from the total textile machinery exports. Spinning machine was exported the most to the country. Vietnam is the fifth largest export market for India's textile machinery in Q1 FY 18-19, whereas for the corresponding period of last fiscal year, the country stood on the 18th position. Exports totalled to US$ 12.15 million with a growth of 307.72%. Demand from China too has increased and stand on the sixth position currently. Exports to China in the Q1 of this fiscal year have gone up by 162.91% to US$ 11.91 million and shares 6% from the total textile machinery exports. Here auxiliary machines exports have been leading in the segment. Indonesia is the seventh largest market for India's textile machinery exports, where in last fiscal's Q1 the country was the third largest market. The country exports from India totalled to US$ 8.63 million perceiving a decline of 11.85% in Q1 FY 18-19 over the CPLY. The other top export markets for Indian textile machinery are Malaysia, USA and Kenya respective to their ranks. India's Textile Machinery Imports in Q1 FY 18-19 India majorly imports printing machinery including digital printing machine from the world. In the Q1 FY 18-19, the imports of printing machinery totalled to US$ 380.29 million with growth of 15.39% and share 40% from the total imports of textile machinery of India. China is the top sourcing market for India's textile machinery, imports from China totalled to US$ 226.69 million in the Q1 FY 18-19, a drop of 17.25%. Commodity-wise imports of textile machinery Under the printing machinery commodity, machines which perform two or more functions of printing have been imported the most to India. The imports totalled to US$ 80.75 million, growth of 15.22% in Q1 FY18-19 over the CPLY. Inkjet printing machinery has shown a growth of 13.61% to US$ 17.02 million in the first quarter of this fiscal. Spinning, twisting and yarn preparation machines imports have witnessed a decline by 37.83% in the Q1 FY 18-19 totalling to US$ 67.76 million over the CPLY. Cotton spinning machine has registered a massive growth of 137.6% in the Q1 FY 18-19 with an import of US$ 19.16 million over the CPLY where the imports totalled to US$ 8.07 million. Other textile fibres winding and reeling machine and cotton yarn winding machine imports have declined in the first quarter of this fiscal year. The commodities declined by 38.92% and 51.71% respectively. Cotton carding machine imports have registered a growth of 48.64% to US$ 1.35 million in the Q1 FY 18-19 over the CPLY. Unexpectedly cotton spinning draw frame and ring frame machine have perceived a negative growth in the quarter. Draw frames decline by 67.94% to US$ 0.5 million and ring frame by 78.59% to US$ 0.41 million. Nonwoven machines imports have registered a growth of 84.96% to US$ 7.01 million in the first quarter of this fiscal year. Sewing machine imports also have seen a growth of 6.58% to US$ 64.61 million in the quarter and shares 7% from the total imports of India's textile machinery. Weaving machines (looms) have shown an slight increase of 0.55% to US$ 119.44 million in Q1 FY 18-19 over the CPLY, where the imports were US$ 118.79 million. Machines other than cotton weaving machines were imported the most to India, the imports totalled to US$ 82.37 million, with minor decline of 0.35% in Q1 FY 18-19. Knitting machine and auxiliary machines used with other machines, both the commodities have dropped in the first quarters. Knitting machines imports dropped by 45.85% to US$ 66.06 million, while auxiliary machines dropped by 6.73% to US$ 91.58 million. Imports of machine used for extruding, drawing and texturing have perceived vast growth of 123.53% to US$ 39.99 million in Q1 FY 18-19 over the CPLY. Country-wise textile machinery imports to India China is top sourcing market for India's textile machinery. India imported textile machinery worth of US$ 226.69 million from China, but perceived a negative growth of 17.25% in the Q1 FY 18-19 over the CPLY. China shares a portion of 24% from the total imports of India's textile machinery. Though the imports of weaving machines have perceived a decline in the growth, the commodity is the top most commodity exports from China to India. The imports of weaving machines totalled to US$ 46.81 million with negative growth of 8.54%. Knitting machines which is the second largest commodity exported from China to India in the first quarter of this fiscal year, has witnessed a drop by half of the value registered in Q1 FY17-18. Knitting machine import value totalled to 41.29 with a negative growth of 51.74%. Sewing machines, spinning machines and machines used extruding, drawing and texturing have also witnessed a drop in the imports to India from China in the Q1 FY 18-19. Auxiliary machines have picked up by 19.53% while machinery used for nonwoven increased by 57.8%. Japan has maintained its position as the second largest sourcing market for India's textile machinery. Japan exports to India totalled to US$ 111.23 million and share of 12% from the total imports of India textile machinery. Japan too witnessed a decline by 23.80% in the Q1 FY 18-19 over the CPLY. Printing machinery including digital printing is the most exported commodity from Japan to India. The exports from Japan totalled to US$ 38.60 million, but perceived a growth of 42.10% in the Q1 FY 18-19 over the CPLY. Weaving machines looms export from Japan has picked up 6.32% to US$ 34.56 million. Spinning machines exports dropped by 31.88%. Germany's textile machinery exports to India have also dropped by 25.68% and shares 10% from the total imports of India's textile machinery. Germany exports totalled to US$ 90.77 million in Q1 FY 18-19 over the CPLY, where the exports were registered at US$ 122.14 million. Auxiliary machines were exported the most from Germany to India. The exports totalled to US$ 25.77 million, but perceived a decline of 2.11% in the first quarters of this fiscal year. Machines used for extruding, drawing and texturing have shown an spectacular growth of 910.61% to US$ 13.61 million in the Q1 FY 18-19. Singapore's textile machinery exports to India increased by 351% to US$ 80.22 million and shares 10% from the total imports of India's textile machinery in Q1 FY 18-19. Printing machines including digital printing was exported the most from Singapore with value of US$ 61.54 million with a growth of 458.94% in Q1 FY 18-19 over the CPLY. Sewing machine exports from Singapore has also shown an impressive growth of 157.05% to US$ 13.24 million. The other top sourcing countries for India's textile machinery are Italy with 6% share and imports of US$ 60.33 million, Belgium with 3% share and imports of US$ 28.69 million, Hong Kong with 2% share and imports of US$ 22.43 million and Philippines with 2% and imports of US$ 18.13 million. From the top ten countries, Switzerland which stands on the ninth position, has perceived a negative growth of 34.48% with a share of 2% and imports totalled to US$ 16.49 million and Vietnam which is tenth largest sourcing market for India has also perceived a declining growth of 7.39% to US$ 16.49 million in the first quarter of FY 18-19.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.