US Apparel Exports Perform Better Than Its Asian Counterparts

US textile and apparel exports are rising. US textile and apparel exports are around 21% of its imports, not a very small percentage, and an indication that `Made in America' is gaining traction. With the current deadlock in trade talks with China, there could be more incentive to manufacture more at home. Total US textile and apparel exports from January-March 2019 stood at US$ 5776.88 million, a growth of 0.9%. In March, US textile and apparel exports grew 14.23% over the previous month, to US$ 2073.92 million. US exports in 2018 at US$ 23467.36 million, were 3.15% higher than in 2017.

Apparel accounts for a little over 72% of total textile and apparel exports of the US. Apparel exports during January-March 2019 went up by 5.04%, compared to the same quarter of 2018. In 2018, apparel exports at US$ 6077.99 million were 6.38% higher than in 2017. This is a much higher export growth than what was witnessed by top apparel suppliers including India, China, Bangladesh and others.

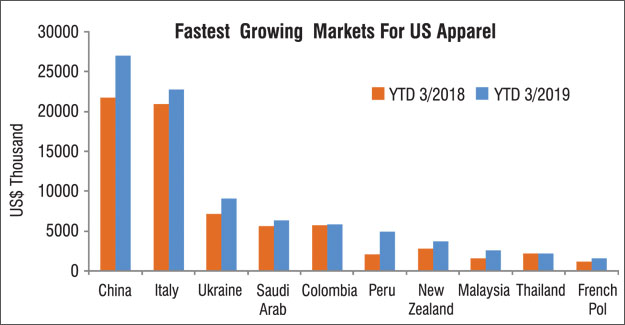

Within apparel, exports of functional apparel - performance wear, winter wear, nonwovens, etc -account for more than 26% of total apparel exports. Exports of these apparel at US$ 401.05 million grew 14.84% in the first quarter of 2019, compared to CPLY. Exports in 2018, at US$ 1530.54 million, grew 13.34% compared to exports in 2017. Other products which recorded a high rate of export growth include sports apparel, knitted apparel, sweaters, jackets and coats, for men and women. Clearly, these are high end performance apparel, or apparel with fine tailoring. While China is the largest supplier of apparel and textiles to the US, it is also the fastest growing market for US apparel, accounting for 2.32% of total US apparel exports.

In the first quarter of 2019, US apparel exports amounting to US$ 142.48 million, was 53.03% higher than in the CPLY. Other important markets for US apparel include Italy (with a growth of 29.73% during the period under review), Ukraine (79.18%), Saudi Arabia (26.07%), Colombia (34.76%). Peru (31.18%). Surprisingly on the list of fast growing markets are other apparel makers such as Thailand, Sri Lanka, and many African countries.

Apparel accounts for a little over 72% of total textile and apparel exports of the US. Apparel exports during January-March 2019 went up by 5.04%, compared to the same quarter of 2018. In 2018, apparel exports at US$ 6077.99 million were 6.38% higher than in 2017. This is a much higher export growth than what was witnessed by top apparel suppliers including India, China, Bangladesh and others.

Within apparel, exports of functional apparel - performance wear, winter wear, nonwovens, etc -account for more than 26% of total apparel exports. Exports of these apparel at US$ 401.05 million grew 14.84% in the first quarter of 2019, compared to CPLY. Exports in 2018, at US$ 1530.54 million, grew 13.34% compared to exports in 2017. Other products which recorded a high rate of export growth include sports apparel, knitted apparel, sweaters, jackets and coats, for men and women. Clearly, these are high end performance apparel, or apparel with fine tailoring. While China is the largest supplier of apparel and textiles to the US, it is also the fastest growing market for US apparel, accounting for 2.32% of total US apparel exports.

In the first quarter of 2019, US apparel exports amounting to US$ 142.48 million, was 53.03% higher than in the CPLY. Other important markets for US apparel include Italy (with a growth of 29.73% during the period under review), Ukraine (79.18%), Saudi Arabia (26.07%), Colombia (34.76%). Peru (31.18%). Surprisingly on the list of fast growing markets are other apparel makers such as Thailand, Sri Lanka, and many African countries.

US apparel production will increase in the future

A recent report on apparel industry sourcing shows that by 2025, nearshoring will be a reality. Much more of clothes will be made in the US, and closer to home. "Today, the industry is at a crossroads, where speed beats marginal cost advantage and basic compliance is upgraded to an integrated sustainability strategy," according to a McKinsey report.

Besides, the Asian clothing market is growing, and eventually producers in China, Vietnam and Bangladesh will need to concentrate on delivering quickly to markets in their immediate neighborhood, creating a capacity shortage for Western buyers.

So far, higher production costs near the big Western markets are still an obstacle. McKinsey calculated that cheaper freight and lower duties already make it less expensive to produce a pair of basic jeans in Mexico than in China for the US market and in Turkey for the German market. But Bangladesh still significantly undercuts Turkey for the European market and matches Mexico's costs for the US. And moving production home - to the US and Germany - is still a non-starter; it increases cost by 17% in the US and by 144% in Germany.

But as lead times gain importance, shortening them compensates for some of the labour cost disadvantage by increasing the share of clothes sold at the full price. Raising it by 6.1% for a garment that takes 60 minutes to produce would justify the transfer of production from China to the US, McKinsey calculated.

US apparel production will increase in the future

A recent report on apparel industry sourcing shows that by 2025, nearshoring will be a reality. Much more of clothes will be made in the US, and closer to home. "Today, the industry is at a crossroads, where speed beats marginal cost advantage and basic compliance is upgraded to an integrated sustainability strategy," according to a McKinsey report.

Besides, the Asian clothing market is growing, and eventually producers in China, Vietnam and Bangladesh will need to concentrate on delivering quickly to markets in their immediate neighborhood, creating a capacity shortage for Western buyers.

So far, higher production costs near the big Western markets are still an obstacle. McKinsey calculated that cheaper freight and lower duties already make it less expensive to produce a pair of basic jeans in Mexico than in China for the US market and in Turkey for the German market. But Bangladesh still significantly undercuts Turkey for the European market and matches Mexico's costs for the US. And moving production home - to the US and Germany - is still a non-starter; it increases cost by 17% in the US and by 144% in Germany.

But as lead times gain importance, shortening them compensates for some of the labour cost disadvantage by increasing the share of clothes sold at the full price. Raising it by 6.1% for a garment that takes 60 minutes to produce would justify the transfer of production from China to the US, McKinsey calculated.

Besides, automation can drive down the cost in Western countries. Now, sewing a pair of jeans takes an average of 19 minutes, more than half of the total production time. McKinsey and RWTH Aachen figure robotics can cut that time by 40-90%. At another important step, distressing the jeans, technology exists to cut the time necessary from about 20 minutes to 90 seconds: Levi's does it with lasers.

Eighty-two percent of the sourcing managers surveyed by McKinsey say the production of simple garments will be fully automated by 2025. If they're right, production is coming back - but the jobs aren't. And China isn't likely to fritter away its current advantage even as it becomes more expensive: Chinese garment companies are building factories in cheap labour countries closer to Europe such as Ethiopia. With these caveats, it's likely that the buyers of mass market clothes, not just expensive designer threads, will be dressing in garments from geographically closer countries soon.

Will the 25% tariffs really impact US buying

After the US imposed tariffs on China, from July 2018, US apparel retailers and buying houses began exploring newer markets to source from, and near sourcing surely seemed the order of the day. Besides, the US also sourced a lot of high end apparel from Europe. And Ethiopia's exports to US are witnessing a robust increase.

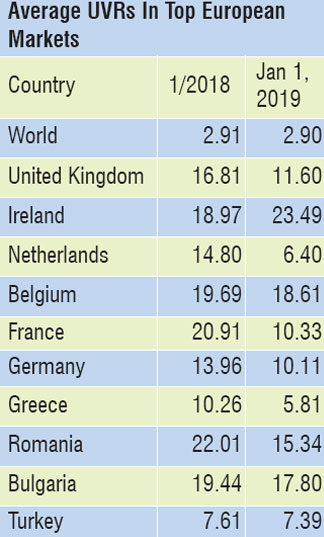

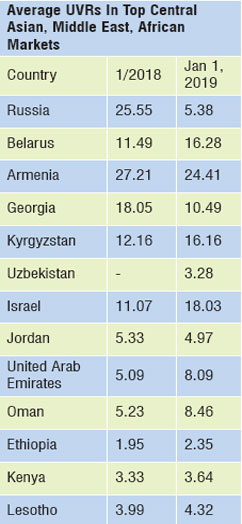

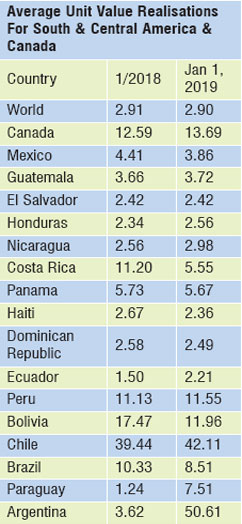

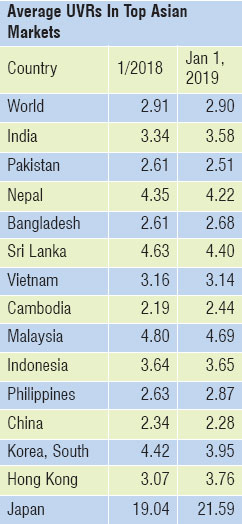

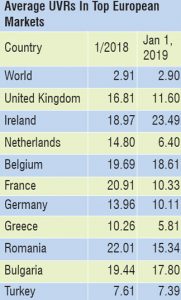

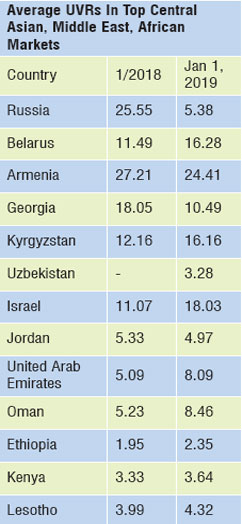

And while doing so, US retailers and buying houses have paid higher apparel prices, as is evident in the table. And China's average UVR will still be much lower than in many other supplying countries. Moreover, it is a known fact that China's industries thrive on government subsidies and incentives even today. So, Chinese factories could still bear the 25% tariff hike. Moreover, China has emerged a major textile technology player today, and is heavily automating its manufacturing and supply chains to cut costs, and delivery times. Technology costs for China would be lower than for other competing countries in the region. And China is moving up the value chain, thus being able to command a better price for its apparel.

Besides, automation can drive down the cost in Western countries. Now, sewing a pair of jeans takes an average of 19 minutes, more than half of the total production time. McKinsey and RWTH Aachen figure robotics can cut that time by 40-90%. At another important step, distressing the jeans, technology exists to cut the time necessary from about 20 minutes to 90 seconds: Levi's does it with lasers.

Eighty-two percent of the sourcing managers surveyed by McKinsey say the production of simple garments will be fully automated by 2025. If they're right, production is coming back - but the jobs aren't. And China isn't likely to fritter away its current advantage even as it becomes more expensive: Chinese garment companies are building factories in cheap labour countries closer to Europe such as Ethiopia. With these caveats, it's likely that the buyers of mass market clothes, not just expensive designer threads, will be dressing in garments from geographically closer countries soon.

Will the 25% tariffs really impact US buying

After the US imposed tariffs on China, from July 2018, US apparel retailers and buying houses began exploring newer markets to source from, and near sourcing surely seemed the order of the day. Besides, the US also sourced a lot of high end apparel from Europe. And Ethiopia's exports to US are witnessing a robust increase.

And while doing so, US retailers and buying houses have paid higher apparel prices, as is evident in the table. And China's average UVR will still be much lower than in many other supplying countries. Moreover, it is a known fact that China's industries thrive on government subsidies and incentives even today. So, Chinese factories could still bear the 25% tariff hike. Moreover, China has emerged a major textile technology player today, and is heavily automating its manufacturing and supply chains to cut costs, and delivery times. Technology costs for China would be lower than for other competing countries in the region. And China is moving up the value chain, thus being able to command a better price for its apparel.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.