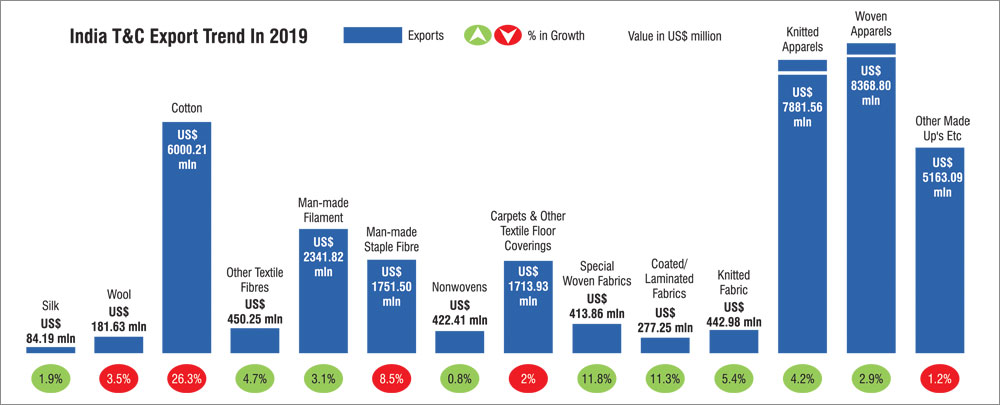

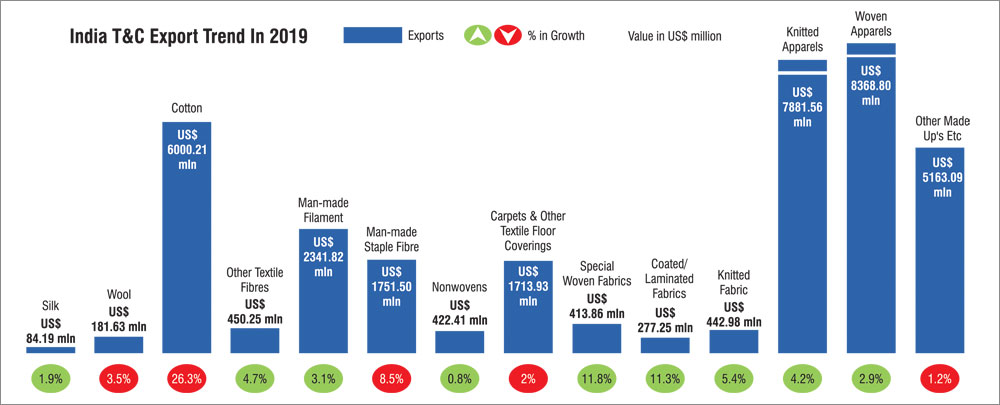

India's T&C Exports Declined By 4.5% In 2019

India's textile and clothing (T&C) exports have dropped in 2019 by 4.5% to US$ 35,493.48 million over 2018. India T&C exports have been affected by the global situation like the US-China trade war, Brexit, removal of GSP benefits from India by the US.

Cotton textile exports were down

Cotton and cotton textile exports witnessed a downward trend last year, falling by 26.3% to US$ 6,000.21 million over the previous year. This drop made a huge dent in the total T&C exports from India.

Cotton yarn exports, the mainstay of India's cotton textile exports, were down by 25.8% to US$ 2,852.58 million in 2019. Raw cotton, another important item of trade under this category, witnessed a fall in exports of as much as 52% to US$ 1,073.18 million in 2019.

Interestingly, cotton woven fabric exports went up by 23.9% in 2019, to US$ 236.19 million. This is an encouraging trend as the industry moves towards value-added exports.

Even as Bangladesh continued to be the top export market for Indian cotton textiles, exports to the neighbouring country were down by 24.1% to US$ 545.24 million compared to the previous year.

Exports to China too fell by 28.6% to US$ 1,044.05 million in 2019 and stands as the second largest export market for Indian cotton textiles. Iran emerged as an important market for Indian cotton textiles, with exports of US$ 52.64 million, recording a growth of 446.84% in 2019 over the previous year.

Woven apparel exports post 2.9% growth

Exports of woven apparel totalled to US$ 8,368.80 million with growth of 2.9% in 2019 and the commodity stakes 24% share in the total T&C exports of India.

Cotton men's shirts is the largest exported product under this category, exports totalled to US$ 830.42 million with a growth of 5.16% in 2019 over the previous year. Exports of dresses made of wool, synthetic fibres, artificial fibres and other textile materials witnessed a positive growth of 15.62%, 16.42%, 5.78% and 25.93% respectively in 2019 over the previous year.

USA is the largest export market of Indian woven apparel, exports of this commodity totalled to US$ 2297.24 million with a growth of 6.53% in 2019, over the previous year.Exports to the following countries from the top ten list i.e. UK, UAE, Spain, Germany, France and Netherlands- registered a negative growth of 0.05%, 8.72%, 7.48%, 6.01%, 3.64% and 1.44% respectively in 2019. Exports to Saudi Arab rose by 29.71% to US$ 225.05 million in 2019.

Nigeria, Sudan are emerging markets for Indian knitted apparels

Knit apparels is now the second largest commodity (in overall T&C category) exported from India.

India's knitted apparel exports grew 4.2% to US$ 7881.56 million in 2019 over the previous year. Currently knitted apparels stake 22% share in the total T&C exports of India. Cotton tees remain the largest exported product in this commodity for 2019 too. Exports totalled to US$ 1957.87 million with a growth of 9.56%. The share of cotton t-shirts in apparel exports has come down over the last many years, but still remains significant. Cotton t-shirts accounted for 24% of total knitwear exports in 2018, and 25% in 2019. In overall apparel exports, cotton t-shirts accounted for a 11% share in 2018, and 12% in 2019.

Exports of other garments made of other textile materials witnessed a drastic fall of 42.28% to US$ 135.82 million in 2019 over the previous year. USA is India's largest market for knit apparel. Exports to USA totalled to US$ 2046.04 million with a growth of 10.69% in 2019 over the previous year.

Exportsto Nigeria grew as much as 105.46% to US$ 212.3 million. UAE which is the second largest export market for knitted apparels, and Saudi Arab, have witnessed a positive growth of 2.79% and 53.14% respectively. Exports to Sudan too have increased by 521.68% to US$ 32.83 million last year.

MMF textile exports to Afghanistan grew 326%

India's exports of man-made filament products witnessed a growth of 3.1% to US$ 2341.82 million in 2019 over the previous year. Currently MMF stakes a share of 7% in the total T&C exports of India. Here high tenacity yarn of nylon was exported the most in 2019 with a value of US$ 1133 million, but the product perceived an negative growth of 10.7% over the previous year. Woven fabrics made of synthetic filament yarn gained a growth of 24.2% to US$ 1110.16 million in 2019.

Turkey is the leading market for India's MMF textiles, exports totalled to US$ 306.71 million, a slight fall of 1.58% in 2019 over previous year. MMF textile exports to Afghanistan surprisingly picked up to US$ 166.64 million, a growth of 326.81% in 2019. Brazil is India's second largest export market for MMF textiles, but recorded a fall of 24.81% to US$ 211.38 million in 2019.

MMSF exports fell 8.5%

India's man-made staple fibre (MMSF) exports fell 8.5% in 2019, to US$ 1751.50 million. MMSF accounted for 5% share in the total T&C export of India in 2019.

Exports to top market Turkey totalled to US$ 161.55 million, a fall of 19.01%. Exports to second largest market Bangladesh fell by 4.22% to US$ 155.62 million. Exports to Iran increased by 39.68% to US$ 113.37 million in 2019 over the previous year. Under MMSF commodity, synthetic staple fibre yarn was exported the most - US$ 488.46 million. However exports were down by 18.1% in 2019 over the previous year. Exports of artificial fibre yarns grew 6% to US$ 109.73 million and MMSF yarn exports were up by 12.5% to US$ 16.43 million in 2019 over the previous year.

Carpets, floor coverings exports fell 2%

India's exports of carpets and other textile floor coverings registered a negative growth of 2.0% with a value of US$ 1713.93 million in 2019 over the previous year. The commodity stakes 5% share in the total T&C of India.

Woven carpets and other textile floor coverings were the major exported product under this commodity, with exports of US$ 557.77 million in 2019. Exports remained at the same level as in 2018.

Exports to USA, India's largest market for this category too, totalled to US$ 914.64 million with a marginal decline of of 0.41%. USA accounted for 53% of India's total textile floor coverings exports in 2019.

Exports to UAE were down by 29.96% to US$ 52.81 million, Germany by 7.97% to US$ 105.82 million, Italy by 13.25% to US$ 35.27 million in 2019 over the previous year. Exports to many more major markets witnessed a drop in this cateogory.

Other textile made-ups exports were lower too

Exports of other textile made-ups commodities witnessed a drop of 1.2%to US$ 5163.09 million in 2019 over the previous year. Made-ups account for 15% share in total T&C exports of India. Toilet and kitchen linen made of terry fabric of cotton is the major product exported to the world under this category. The product's export value totalled to US$ 1081.53 million with a growth of 2.49% in 2019 over the previous year.

USA is the largest market for India's textile made-ups articles. In 2019, exports of the commodity totalled to US$ 2474.71 million with growth of 0.48% over the previous year. Spain and Netherland being the fifth and sixth largest export market for this product had perceived a good growth of 5.22% and 5.27%. While countries like UK, Germany, UAE, France and Australia have perceived a negative export trend in 2019.

India's Top T&C Exports Markets

Country-wise, USA remains the largest export market for India's T&C goods. In 2019, the T&C exports to USA totalled to US$ 8440.08 million with a growth of 4.4%. USA accounts for 24% share in the total T&C exports.India's other textile made-ups exports to USA is ruling the basket, with a share of 29% in the total T&C exports to USA in 2019.

Apparel exports to USA totalled to US$ 4343.28 million in 2019 with a growth of 8.45% over the previous year. Individually knitted apparels exports have improved the most by 10.69% to US$ 2046.04 million in 2019 over the previous year, while the woven apparels have increased by 6.53%. Cotton, man-made staple fire and knitted fabrics exports to USA have witnessed a negative trend in 2019 by 2.24%, 25.89% and 14.38% respectively.

T&C exports to UAE from India declined by 1.1% in 2019 over the previous year with an export value of US$ 2442.67 million. The country moved up one position to reclaim its ranking as India's second largest export market for India's T&C goods, accounting for 7% share. Knitted apparel goods has a very strong market in UAE compared to the other commodities of T&C. The export of knitted apparel totalled US$ 1126.24 million with growth of 2.79% in 2019 over the previous year. Demand for special woven fabric has witnessed a rise by 87.5% in the UAE market to US$ 49.84 million. Carpets and other textile floor covering exports have perceived the maximum drop of 29.96% growth in 2019 over the previous year.

Exports to UK, the third largest export market for India's T&C goods,recorded a negative growth of 2.1% to US$ 2153.35 million in 2019.

Woven apparel is the largest exported item to UK by India; the exports totalled US$ 834.98 million, a drop of 3.33% in 2019. Exports of man-made staple fibre fell by 23.92% to US$ 21.61 million and cotton textile exports were down by 10.33% to US$ 21.45 million in 2019 over the last year.

Bangladesh, which is an important market for India's T&C goods, has witnessed a negative growth of 18.1% to US$ 2055.89 million in 2019. The country has come down two positions, now being the fourth largest market for India T&C goods. Currently Bangladesh stakes 6% share in the total T&C exports of India. Indian cotton textiles, and especially cotton, is the most traded commodity with Bangladesh. Exports totalled to US$ 1545.24 million, but growth declined by 24.12% in 2019 over the previous year. Indian MMF exports to Bangladesh were up 9.71% while MMSF exports dropped by 4.22% in 2019.

Germany is another important market for India's T&C goods. Out of the 14 commodities of T&C, 11 of them have witnessed a drop in Germany's market. The T&C exports to Germany totalled to US$ 1515.06 million with a negative growth of 11.4% in 2019 over the previous year. Currently the country is the fifth largest export market of India's T&C goods and stakes a share of 4% in the total T&C exports of India. Knitted apparel is the major commodity exported to Germany from India with an export value of US$ 560.06 million, but perceived a negative growth of 16.57% in 2019 over the previous year. Followed by knitted apparels are woven apparel with an export value of US$ 453.35 million and negative growth of 6.01% in 2019.

Demands from China for India's T&C goods have come down drastically by 23.7% to US$ 1401.49 million in 2019 over the previous year. The US-China trade war resulted in a drop in exports to China. Currently China stakes 4% share in the total T&C exports of India. Cotton, the main export item to China, fell by 28.67% to US$ 1044.05 million in 2019 over the previous year. Man-made staple fibre recorded a growth in China market in the last calendar year. The export of MMSF totalled to US$ 63.73 million with growth of 17.35%.

Vietnam is an emerging market for India's T&C goods, but witnessed a sharp decline in 2019. In the 2018, Vietnam was the 12th largest export market for India's T& C goods, but in 2019 the country had slipped down to 22nd position.

In 2019, exports of T&C to Vietnam totalled to US$ 340.05 million, down 46.7%. The drop in cotton demand from Vietnam has brought the country to 22nd position. Cotton exports to Vietnam fell as much as 54.77% to US$ 230.95 million in 2019 over the previous year.

Emerging markets for India's T&C

Saudi Arabia, Nigeria and Afghanistan are emerging markets of India's T&C goods.

Saudi Arabia which was the 15th largest export market, is now the 11th largest one. Export of T&C from India to the country have summed to US$ 687.3 million with a growth of 45.1% in 2019, driven mainly by apparel exports. Knitted apparel exports totalled to US$ 284.76 million, up 53.14%; and woven apparel exports at US$ 225.05 million registered a growth of 29.71% in 2019 over the previous year.

Nigeria has moved seven positions up, now standing as the 14th largest export market for India's T&C goods. Exports totalled to US$ 486.31 million with a growth of 58.4% in 2019, driven mainly by knit apparel exports.Exports of knitted apparels totalled to US$ 212.3 million with a growth of 105.46% in 2019 over the previous year. Cotton exports to Nigeria also went up significantly by 58.18% in 2019, to US$ 33.9 million.

Afghanistan witnessed a growth of 66.3% in 2019 with an export value of U$ 401.05 million over the previous year. The country has moved five positions up, now being the 18th largest export market of India's T&C goods. India's man-made filament has high demand in Afghanistan. India exported MMF goods worth US$ 1166.64 million in 2019 with a growth of 326.81% over the previous year.

MMSF exports fell 8.5%

India's man-made staple fibre (MMSF) exports fell 8.5% in 2019, to US$ 1751.50 million. MMSF accounted for 5% share in the total T&C export of India in 2019.

Exports to top market Turkey totalled to US$ 161.55 million, a fall of 19.01%. Exports to second largest market Bangladesh fell by 4.22% to US$ 155.62 million. Exports to Iran increased by 39.68% to US$ 113.37 million in 2019 over the previous year. Under MMSF commodity, synthetic staple fibre yarn was exported the most - US$ 488.46 million. However exports were down by 18.1% in 2019 over the previous year. Exports of artificial fibre yarns grew 6% to US$ 109.73 million and MMSF yarn exports were up by 12.5% to US$ 16.43 million in 2019 over the previous year.

Carpets, floor coverings exports fell 2%

India's exports of carpets and other textile floor coverings registered a negative growth of 2.0% with a value of US$ 1713.93 million in 2019 over the previous year. The commodity stakes 5% share in the total T&C of India.

Woven carpets and other textile floor coverings were the major exported product under this commodity, with exports of US$ 557.77 million in 2019. Exports remained at the same level as in 2018.

Exports to USA, India's largest market for this category too, totalled to US$ 914.64 million with a marginal decline of of 0.41%. USA accounted for 53% of India's total textile floor coverings exports in 2019.

Exports to UAE were down by 29.96% to US$ 52.81 million, Germany by 7.97% to US$ 105.82 million, Italy by 13.25% to US$ 35.27 million in 2019 over the previous year. Exports to many more major markets witnessed a drop in this cateogory.

Other textile made-ups exports were lower too

Exports of other textile made-ups commodities witnessed a drop of 1.2%to US$ 5163.09 million in 2019 over the previous year. Made-ups account for 15% share in total T&C exports of India. Toilet and kitchen linen made of terry fabric of cotton is the major product exported to the world under this category. The product's export value totalled to US$ 1081.53 million with a growth of 2.49% in 2019 over the previous year.

USA is the largest market for India's textile made-ups articles. In 2019, exports of the commodity totalled to US$ 2474.71 million with growth of 0.48% over the previous year. Spain and Netherland being the fifth and sixth largest export market for this product had perceived a good growth of 5.22% and 5.27%. While countries like UK, Germany, UAE, France and Australia have perceived a negative export trend in 2019.

India's Top T&C Exports Markets

Country-wise, USA remains the largest export market for India's T&C goods. In 2019, the T&C exports to USA totalled to US$ 8440.08 million with a growth of 4.4%. USA accounts for 24% share in the total T&C exports.India's other textile made-ups exports to USA is ruling the basket, with a share of 29% in the total T&C exports to USA in 2019.

Apparel exports to USA totalled to US$ 4343.28 million in 2019 with a growth of 8.45% over the previous year. Individually knitted apparels exports have improved the most by 10.69% to US$ 2046.04 million in 2019 over the previous year, while the woven apparels have increased by 6.53%. Cotton, man-made staple fire and knitted fabrics exports to USA have witnessed a negative trend in 2019 by 2.24%, 25.89% and 14.38% respectively.

T&C exports to UAE from India declined by 1.1% in 2019 over the previous year with an export value of US$ 2442.67 million. The country moved up one position to reclaim its ranking as India's second largest export market for India's T&C goods, accounting for 7% share. Knitted apparel goods has a very strong market in UAE compared to the other commodities of T&C. The export of knitted apparel totalled US$ 1126.24 million with growth of 2.79% in 2019 over the previous year. Demand for special woven fabric has witnessed a rise by 87.5% in the UAE market to US$ 49.84 million. Carpets and other textile floor covering exports have perceived the maximum drop of 29.96% growth in 2019 over the previous year.

Exports to UK, the third largest export market for India's T&C goods,recorded a negative growth of 2.1% to US$ 2153.35 million in 2019.

Woven apparel is the largest exported item to UK by India; the exports totalled US$ 834.98 million, a drop of 3.33% in 2019. Exports of man-made staple fibre fell by 23.92% to US$ 21.61 million and cotton textile exports were down by 10.33% to US$ 21.45 million in 2019 over the last year.

Bangladesh, which is an important market for India's T&C goods, has witnessed a negative growth of 18.1% to US$ 2055.89 million in 2019. The country has come down two positions, now being the fourth largest market for India T&C goods. Currently Bangladesh stakes 6% share in the total T&C exports of India. Indian cotton textiles, and especially cotton, is the most traded commodity with Bangladesh. Exports totalled to US$ 1545.24 million, but growth declined by 24.12% in 2019 over the previous year. Indian MMF exports to Bangladesh were up 9.71% while MMSF exports dropped by 4.22% in 2019.

Germany is another important market for India's T&C goods. Out of the 14 commodities of T&C, 11 of them have witnessed a drop in Germany's market. The T&C exports to Germany totalled to US$ 1515.06 million with a negative growth of 11.4% in 2019 over the previous year. Currently the country is the fifth largest export market of India's T&C goods and stakes a share of 4% in the total T&C exports of India. Knitted apparel is the major commodity exported to Germany from India with an export value of US$ 560.06 million, but perceived a negative growth of 16.57% in 2019 over the previous year. Followed by knitted apparels are woven apparel with an export value of US$ 453.35 million and negative growth of 6.01% in 2019.

Demands from China for India's T&C goods have come down drastically by 23.7% to US$ 1401.49 million in 2019 over the previous year. The US-China trade war resulted in a drop in exports to China. Currently China stakes 4% share in the total T&C exports of India. Cotton, the main export item to China, fell by 28.67% to US$ 1044.05 million in 2019 over the previous year. Man-made staple fibre recorded a growth in China market in the last calendar year. The export of MMSF totalled to US$ 63.73 million with growth of 17.35%.

Vietnam is an emerging market for India's T&C goods, but witnessed a sharp decline in 2019. In the 2018, Vietnam was the 12th largest export market for India's T& C goods, but in 2019 the country had slipped down to 22nd position.

In 2019, exports of T&C to Vietnam totalled to US$ 340.05 million, down 46.7%. The drop in cotton demand from Vietnam has brought the country to 22nd position. Cotton exports to Vietnam fell as much as 54.77% to US$ 230.95 million in 2019 over the previous year.

Emerging markets for India's T&C

Saudi Arabia, Nigeria and Afghanistan are emerging markets of India's T&C goods.

Saudi Arabia which was the 15th largest export market, is now the 11th largest one. Export of T&C from India to the country have summed to US$ 687.3 million with a growth of 45.1% in 2019, driven mainly by apparel exports. Knitted apparel exports totalled to US$ 284.76 million, up 53.14%; and woven apparel exports at US$ 225.05 million registered a growth of 29.71% in 2019 over the previous year.

Nigeria has moved seven positions up, now standing as the 14th largest export market for India's T&C goods. Exports totalled to US$ 486.31 million with a growth of 58.4% in 2019, driven mainly by knit apparel exports.Exports of knitted apparels totalled to US$ 212.3 million with a growth of 105.46% in 2019 over the previous year. Cotton exports to Nigeria also went up significantly by 58.18% in 2019, to US$ 33.9 million.

Afghanistan witnessed a growth of 66.3% in 2019 with an export value of U$ 401.05 million over the previous year. The country has moved five positions up, now being the 18th largest export market of India's T&C goods. India's man-made filament has high demand in Afghanistan. India exported MMF goods worth US$ 1166.64 million in 2019 with a growth of 326.81% over the previous year.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.