India Should Focus On Exports Of Jackets

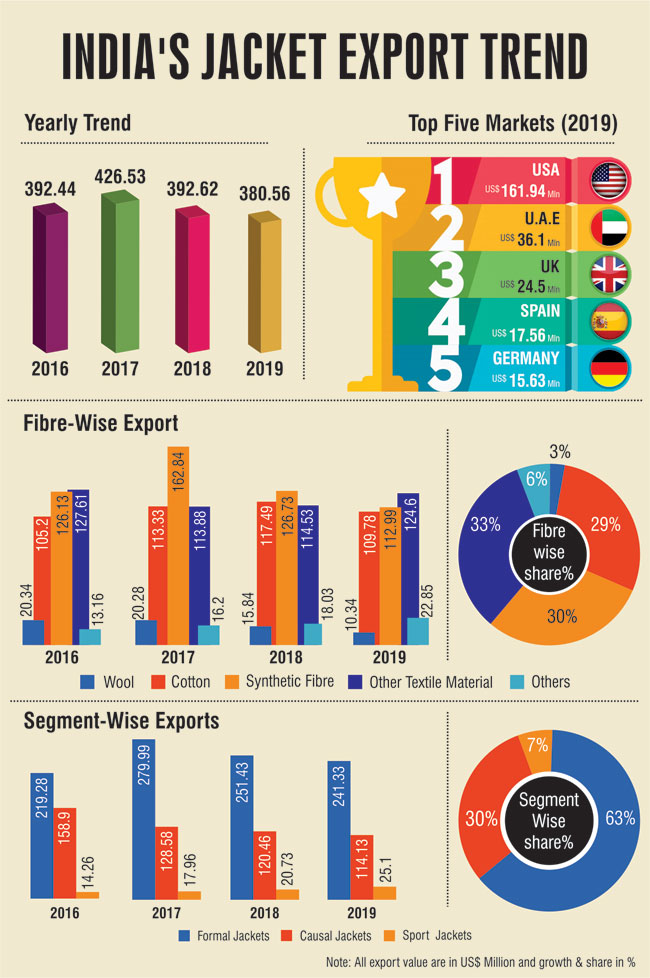

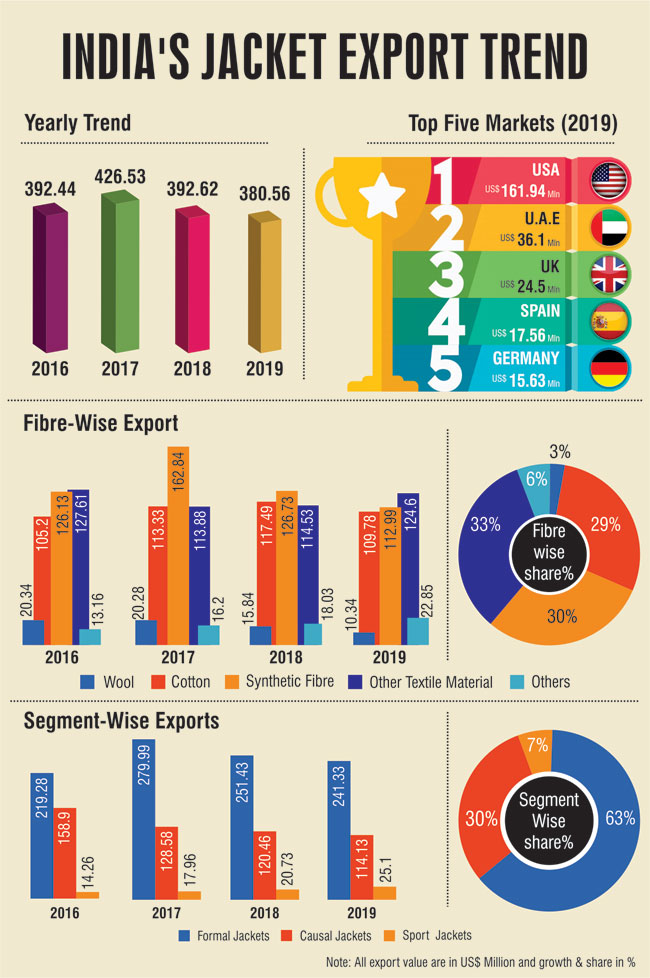

In the global export market for jackets, India stands on the 18th position and stakes only 1% share. India has exported jackets worth US$ 380.56 million in 2019, but perceived a negative growth of 3.07% over the previous year where the exports of jackets totalled to US$ 392.62 million. Jackets account for just 1% share in India's total T&C exports.

Indian manufacturers are mainly focusing on exporting formal and causal jackets with a share of 63% and 30% respectively from total exports of jackets from India. Sport jackets including windcheaters, wind jackets, ski jackets, life jackets and bullet proof jacket stakes the lowest share of 7%.

As per the latest data released by the government of India, formal jackets which are exported the most to the world perceived a negative growth of 4.02% in 2019 over the previous year. The export of the commodity totalled to US$ 241.33 million last year. Under this commodity, jackets and blazers made of other textile material is the major exported product.

The export value of this product totalled to US$ 97.30 million with a growth of 9.09% in 2019 over the previous year. Cotton jacket and blazer exports is second most exported item with a value of US$ 57.86 million, but the product perceived a negative growth of 3.28% in 2019 over the previous year.

Causal jacket which is the second exported product from India totalled to US$ 114.13 million and perceived a negative growth of 5.25% in 2019 over the previous year. Under this commodity, jackets made of cotton, is the most popular and exported product. The product's exports totalled to US$ 49.87 million with a growth of 9.80% in 2019 over previous year. Jackets made of synthetic fibre are second most exported product in this segment with an export total of US$ 35.95 million with a growth of -6.09%.

Sport jackets which stakes only 7% share in the total, has registered an export of US$ 25.1 million with a growth of 21.08% in 2019 over the previous year. Under this commodity, life jackets and lifebelts are exported the most, with a value of US$ 16.55 million and a growth of 12.36% in 2019 over the previous year.

Fibre-wise jackets export trend

Jackets made of other textile materials which includes silk and artificial fibres are the most exported jackets from India to the world.

The exports of these types of jackets totalled to US$ 124.60 million in 2019 with a growth of 8.79% over the previous year and stakes 33% share in the total exports of jackets from India. These jackets are mostly exported to USA with a stake of 37% in total exports of other textile material jackets. The exports to USA for this fibre jacket totalled US$ 46.46 million with a growth of 18.25% in 2019 over the previous year. Tanzania is a potential market for India's jackets made up of other textile material. Exports to UAE have dropped by 57.22% in 2019, totalling to US$ 5.24 million over the previous year.

Synthetic fibre jacket is the second highest exported fibre jacket from India. The exports totalled to US$ 112.99 million, but it has perceived a negative growth of 10.84% in 2019 over the previous year.

The product stakes a share of 30% in the total exports of jackets in India. These fibre jackets are mainly exported to UAE, but last year, the exports of the product dropped by 42.75% to US$ 17.33 million over the previous year. Currently the product stakes 15% share in the total of synthetic fibre jackets export of India. The second export market of India's synthetic fibre jackets is USA with exports of US$ 15.42 million with growth of 34.20% in 2019 over the previous year and the country stakes 14% share.

Cotton jacket is the third highest exported commodity under this segment. The exports of cotton jackets totalled US$ 109.78 million, but perceived a negative growth 6.56% in 2019 over the previous year.

The cotton fibre jackets currently stakes 29% in the total exports of jackets in India. USA is the largest export market for India's cotton jackets. Exports of cotton jackets to USA have dropped by 51.36% in 2019 with an export of US$ 7.11 million in 2019 over the previous year where the exports totalled to US$ 14.62 million. Spain, UK and Germany are high-class markets for Indian cotton jackets, but in 2019 the exports to these have witnessed a drastic fall. Looking at the export history of cotton jackets to USA, Spain, UK and Germany, Indian manufacturers really need to increase their manufacturing capacity as these markets are excellent trade markets for India.

Woollen jackets are very famous in the USA, UK, Italy and Spain. Woollen jacket do look very stylish and they serve the purpose too. India exports a very small quantity of the woollen jackets to the world.

The export of woollen jacket totalled to US$ 10.34 million in 2019 over the previous year. This fibre only shares 3% in the total exports of jackets from India. Here too USA is the largest market, with an export value of US$ 4.3 million in 2019, whereas in the previous year, the exports totalled to US$ 8.26 million. India has witnessed a drop of 47.94% in the export of woollen jackets in 2019 over the previous and USA stakes 42% share in India's total woollen jackets exports. UK is potential market of these jackets.

Markets For Indian jackets

USA is the single largest export market for Indian jackets and stakes 43% share in the total exports of jackets from India. Exports to USA totalled to US$ 161.94 million with a growth of 8.34% in 2019 over the previous. From all the jackets, woven jackets and blazers made up of other textile material are exported the most to USA, in 2019 the export of the same product totalled to US$ 46.46 million and growth of 18.26% over the previous year.

There has been a significant drop in knitted cotton jackets and blazers exports by 51.35% to US$ 7.11 million. Woven jackets made of cotton has witnessed the maximum growth of 62.70% in 2019 with an export value of US$ 19.82 million.

Though UAE remains the second largest market for Indian jackets, the country has witnessed a sharp drop of 40.70% to US$ 36.10 million in 2019 over the previous year where the exports totalled to US$ 60.88 million. The exports fell after UAE imposed taxes on imports of all merchandise products, including apparels.

Therefore all the Indian exporters who were using UAE as a gateway for repacking and reshipping their apparel products to Africa, Europe and Middle Eastern countries, have started ship the consignment directly to destination now. The second major reason is the increasing jackets exports to USA and many European countries.

China is the single largest jacket manufacturer

Fibre-wise jackets export trend

Jackets made of other textile materials which includes silk and artificial fibres are the most exported jackets from India to the world.

The exports of these types of jackets totalled to US$ 124.60 million in 2019 with a growth of 8.79% over the previous year and stakes 33% share in the total exports of jackets from India. These jackets are mostly exported to USA with a stake of 37% in total exports of other textile material jackets. The exports to USA for this fibre jacket totalled US$ 46.46 million with a growth of 18.25% in 2019 over the previous year. Tanzania is a potential market for India's jackets made up of other textile material. Exports to UAE have dropped by 57.22% in 2019, totalling to US$ 5.24 million over the previous year.

Synthetic fibre jacket is the second highest exported fibre jacket from India. The exports totalled to US$ 112.99 million, but it has perceived a negative growth of 10.84% in 2019 over the previous year.

The product stakes a share of 30% in the total exports of jackets in India. These fibre jackets are mainly exported to UAE, but last year, the exports of the product dropped by 42.75% to US$ 17.33 million over the previous year. Currently the product stakes 15% share in the total of synthetic fibre jackets export of India. The second export market of India's synthetic fibre jackets is USA with exports of US$ 15.42 million with growth of 34.20% in 2019 over the previous year and the country stakes 14% share.

Cotton jacket is the third highest exported commodity under this segment. The exports of cotton jackets totalled US$ 109.78 million, but perceived a negative growth 6.56% in 2019 over the previous year.

The cotton fibre jackets currently stakes 29% in the total exports of jackets in India. USA is the largest export market for India's cotton jackets. Exports of cotton jackets to USA have dropped by 51.36% in 2019 with an export of US$ 7.11 million in 2019 over the previous year where the exports totalled to US$ 14.62 million. Spain, UK and Germany are high-class markets for Indian cotton jackets, but in 2019 the exports to these have witnessed a drastic fall. Looking at the export history of cotton jackets to USA, Spain, UK and Germany, Indian manufacturers really need to increase their manufacturing capacity as these markets are excellent trade markets for India.

Woollen jackets are very famous in the USA, UK, Italy and Spain. Woollen jacket do look very stylish and they serve the purpose too. India exports a very small quantity of the woollen jackets to the world.

The export of woollen jacket totalled to US$ 10.34 million in 2019 over the previous year. This fibre only shares 3% in the total exports of jackets from India. Here too USA is the largest market, with an export value of US$ 4.3 million in 2019, whereas in the previous year, the exports totalled to US$ 8.26 million. India has witnessed a drop of 47.94% in the export of woollen jackets in 2019 over the previous and USA stakes 42% share in India's total woollen jackets exports. UK is potential market of these jackets.

Markets For Indian jackets

USA is the single largest export market for Indian jackets and stakes 43% share in the total exports of jackets from India. Exports to USA totalled to US$ 161.94 million with a growth of 8.34% in 2019 over the previous. From all the jackets, woven jackets and blazers made up of other textile material are exported the most to USA, in 2019 the export of the same product totalled to US$ 46.46 million and growth of 18.26% over the previous year.

There has been a significant drop in knitted cotton jackets and blazers exports by 51.35% to US$ 7.11 million. Woven jackets made of cotton has witnessed the maximum growth of 62.70% in 2019 with an export value of US$ 19.82 million.

Though UAE remains the second largest market for Indian jackets, the country has witnessed a sharp drop of 40.70% to US$ 36.10 million in 2019 over the previous year where the exports totalled to US$ 60.88 million. The exports fell after UAE imposed taxes on imports of all merchandise products, including apparels.

Therefore all the Indian exporters who were using UAE as a gateway for repacking and reshipping their apparel products to Africa, Europe and Middle Eastern countries, have started ship the consignment directly to destination now. The second major reason is the increasing jackets exports to USA and many European countries.

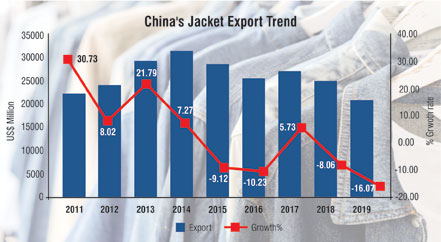

China is the single largest jacket manufacturer

China single-handedly exports around 65% of jackets from the world's total manufactured jackets. China's jacket exports to the world totaled to US$ 20900.68 million in 2019 over the previous year, but the country perceived a negative growth of 16.07%. USA is the largest export market for Chinese manufactured jackets, the exports totaled to US$ 2986.99 million in 2019, but the growth declined by 13.76% over the previous year. USA stakes 14% share in China's jacket exports. Nigeria which was the eighth largest export market for China in 2018, is currently the third largest market in 2019, the export to the country rose by 81.46% totaling to US$ 1096.25 million 2019 over the previous year where the exports totaled to US$ 604.11 million. Product-wise, China exports mostly women's woven windcheaters or wind jackets made of man-made fibre. This product's exports totaled to US$ 4053.37 million in 2019, while it marked a negative growth of 15.84% over the previous year. Currently the product stakes 19% share in the total export of jackets from China. Woven jackets for men made of other textile material have witnessed a growth of 210.50% in 2019 with an export value of US$ 1310.13 million over the previous year where the exports were registered at US$ 421.94 million.

USA jacket imports

USA imports all types of jackets from most of the apparel manufacturing countries. USA imports of jackets totaled to US$ 4325.93 million 2019 with a growth of 11.51% over the previous year. For USA, China is the largest sourcing destination for jackets. Emerging suppliers like Vietnam, Indonesia & Bangladesh have increased their jacket exports to USA by 23.49%, 23.11% and 31.06% respectively.

China single-handedly exports around 65% of jackets from the world's total manufactured jackets. China's jacket exports to the world totaled to US$ 20900.68 million in 2019 over the previous year, but the country perceived a negative growth of 16.07%. USA is the largest export market for Chinese manufactured jackets, the exports totaled to US$ 2986.99 million in 2019, but the growth declined by 13.76% over the previous year. USA stakes 14% share in China's jacket exports. Nigeria which was the eighth largest export market for China in 2018, is currently the third largest market in 2019, the export to the country rose by 81.46% totaling to US$ 1096.25 million 2019 over the previous year where the exports totaled to US$ 604.11 million. Product-wise, China exports mostly women's woven windcheaters or wind jackets made of man-made fibre. This product's exports totaled to US$ 4053.37 million in 2019, while it marked a negative growth of 15.84% over the previous year. Currently the product stakes 19% share in the total export of jackets from China. Woven jackets for men made of other textile material have witnessed a growth of 210.50% in 2019 with an export value of US$ 1310.13 million over the previous year where the exports were registered at US$ 421.94 million.

USA jacket imports

USA imports all types of jackets from most of the apparel manufacturing countries. USA imports of jackets totaled to US$ 4325.93 million 2019 with a growth of 11.51% over the previous year. For USA, China is the largest sourcing destination for jackets. Emerging suppliers like Vietnam, Indonesia & Bangladesh have increased their jacket exports to USA by 23.49%, 23.11% and 31.06% respectively.

Out of these three countries, Vietnam is the only economy to have a stake of two digits share i.e. 23% in the total imports of jackets to USA. India ranks as the seventh largest jacket sourcing market to USA.

The jacket imports from India totaled to US$ 90.53 million and witnessed a rise of 3.05% in 2019 over the previous year. India stakes a share of 2% in the total imports of jackets of USA.

USA imports windcheaters and wind jackets the most from the globe, the import of these products under jackets totaled to US$ 1550.61 million with a growth of 18.67% in 2019 over the previous year. Men's garments made of textile fabric is the second largest imported product to the country and men's jackets and blazer made of wool is the third largest one. Men's garment made of textile fabric imports to USA totalled to US$ 738.30 million with a growth of 14.84% and men's jackets and blazer made of wool totalled to US$ 415.84 million and growth of 3.27% in 2019 over the previous year.

Around the globe

Out of these three countries, Vietnam is the only economy to have a stake of two digits share i.e. 23% in the total imports of jackets to USA. India ranks as the seventh largest jacket sourcing market to USA.

The jacket imports from India totaled to US$ 90.53 million and witnessed a rise of 3.05% in 2019 over the previous year. India stakes a share of 2% in the total imports of jackets of USA.

USA imports windcheaters and wind jackets the most from the globe, the import of these products under jackets totaled to US$ 1550.61 million with a growth of 18.67% in 2019 over the previous year. Men's garments made of textile fabric is the second largest imported product to the country and men's jackets and blazer made of wool is the third largest one. Men's garment made of textile fabric imports to USA totalled to US$ 738.30 million with a growth of 14.84% and men's jackets and blazer made of wool totalled to US$ 415.84 million and growth of 3.27% in 2019 over the previous year.

Around the globe

From the total T&C exports of the world, jackets commodity stakes around 5% share registering a total export of US$ 42759.07 million, perceiving a growth of 8.89% in 2019 over the previous year. In the world, the most exported item overall is women's woven wind cheaters, wind jackets made of man-made fibre. The exports of these jackets from the world totaled to US$ 10624.77 million.

The entire textile and apparel industry has witnessed deteriorating trend in 2019. This is in line with the slowdown in global textile & textile machinery exports.

And now with the current ongoing global crisis due to Covid-19, the industry has come to a standstill. With most of the countries put under lockdown for months, the exports and imports of all commodities including jackets have been hit severely.

In the overall trade of textile and apparel there would be a sharp decline by the end of this half year and by next year it would be very interesting to see how trade picks up, and in what direction the supply chains move. Would China remain the largest manufacturer and exporter for jackets and would USA continue to source its jackets from China?

Source: DGCI&S, Kolkata and ITC calculations based on UN COMTRADE and ITC statistics.

From the total T&C exports of the world, jackets commodity stakes around 5% share registering a total export of US$ 42759.07 million, perceiving a growth of 8.89% in 2019 over the previous year. In the world, the most exported item overall is women's woven wind cheaters, wind jackets made of man-made fibre. The exports of these jackets from the world totaled to US$ 10624.77 million.

The entire textile and apparel industry has witnessed deteriorating trend in 2019. This is in line with the slowdown in global textile & textile machinery exports.

And now with the current ongoing global crisis due to Covid-19, the industry has come to a standstill. With most of the countries put under lockdown for months, the exports and imports of all commodities including jackets have been hit severely.

In the overall trade of textile and apparel there would be a sharp decline by the end of this half year and by next year it would be very interesting to see how trade picks up, and in what direction the supply chains move. Would China remain the largest manufacturer and exporter for jackets and would USA continue to source its jackets from China?

Source: DGCI&S, Kolkata and ITC calculations based on UN COMTRADE and ITC statistics.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.