Industry Could Achieve Pre-Covid Business Levels By 2021: Textile Excellence Survey

The world is waiting to go back to the comfortable normal that it was used to. While that may take some time, lockdown restrictions the world over are easing. In India, a number of industrial units including textile and apparel factories have resumed operations. Of course, there are some issues - worker availability, strict adherence to hygiene and social distancing guidelines, financial stability, and more.

A recent survey by Textile Excellence is aimed at understanding how the industry plans to sail through the current crises, and how the situation could unfurl going forward.

Some key findings

Production

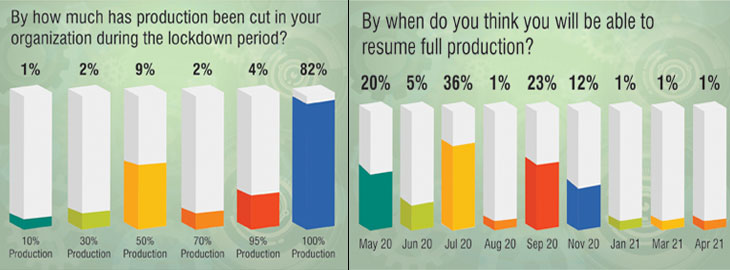

- 97% of the respondents said that production has been impacted anywhere between 50-100%. This was a given due to the lockdown imposed across the country. While partial production has begun in some textile and related mills, the industry believes it will have to wait for a few months to achieve full production.

- 36% of respondents feel they would achieve full production by July, 23% by September, 20% by next month, 12% by November. About 5% of the respondents feel they may get to full production by June.

- For the full financial year 2020-21, 43% of the respondents said that 30% of their production will be impacted, while 39% said that 50% of their total production will be impacted. Another 7% said that 10% of their production will be impacted. While 5% said that production will be hampered by 70%.

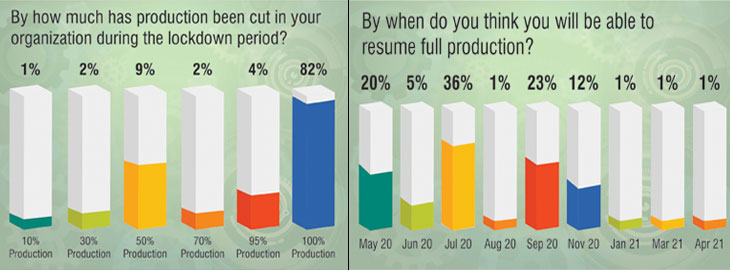

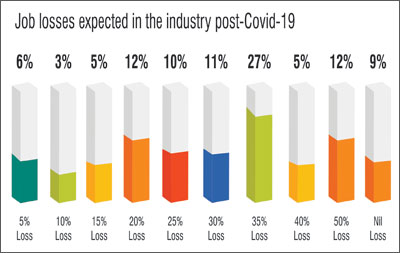

The economy could be looking at significant job losses in the textile industry in the near future.

The economy could be looking at significant job losses in the textile industry in the near future.

- 27% of the respondents expect 35% job losses in the textile industry.

- 12% respondents expect job losses of 20% and a similar number of respondents expect a 50% job loss.

- 9% of respondents have said there will be no job losses in their organisations, and the company will look at other ways to cut costs including a cut in salaries and wages.

Economic recovery

Economic recovery

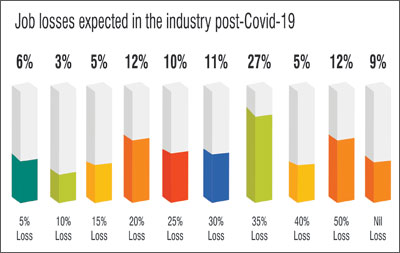

- 100% of the respondents expect severe recessionary impact of Covid-19 to be felt throughout 2020.

- 37% respondents expect the economy to recover within 6-12 months.

- 80% respondents expect economy to take 1 year to show signs of recovery.

- 07% respondents expect recovery to take 1-2 years.

- 93% respondents expect economic recovery to take 2 years.

- 65% respondents expect recovery to take 3 years.

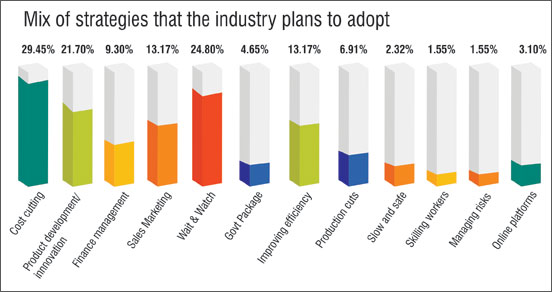

- Cost cutting was the most important strategy, with 29.45% of respondents choosing this, alongwith other measures such as product development and innovation (21.70%), improving efficiency (13.17%),

increased emphasis on marketing and sales both in domestic and export markets (13.17%), fund management (9.30%) and cutting production (6.97%).

increased emphasis on marketing and sales both in domestic and export markets (13.17%), fund management (9.30%) and cutting production (6.97%). - Around 24.80% of respondents prefer to wait and watch how the scenario emerges before deciding on a strategy.

- Surprisingly, skilling workforce is an option chosen by just 1.55% of the respondents.

- 10% of the respondents believe that e-commerce and other online platforms will be part of their strategy.

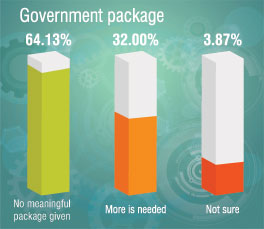

A meaningful stimulus package is sought for the medium to long term.

A meaningful stimulus package is sought for the medium to long term.

- 13% of the respondents said there was no government stimulus package announced for the textile industry, and the MSME sector.

- 32% of the respondents said that there was much more needed than what was announced.

- In keeping with the demands from the various textile industry associations, respondents too believed that there was urgent need for a stimulus package that would include among others:

- Restructuring of loan repayment

- Working capital loans at nominal rates of interest

- Interest subvention

- Package to boost textile & apparel exports

- Curb textile and apparel imports

- Specific package for MSMEs

- Current benefits should be extended for at least six months to a year, depending on how the economy moves forward

- More meaningful PF and ESIC relaxations

- Compensation for salaries and wages

- Restart economic activities as soon as possible in coordination with state governments

- Refund GST claims & TUFS subsidy without delay

- Compensation in utility bills

- Defer payments such as GST, etc.

Even if a stimulus package is in place, it will be some time before we see India's textile and clothing exports at pre-Covid-19 levels.

Even if a stimulus package is in place, it will be some time before we see India's textile and clothing exports at pre-Covid-19 levels.

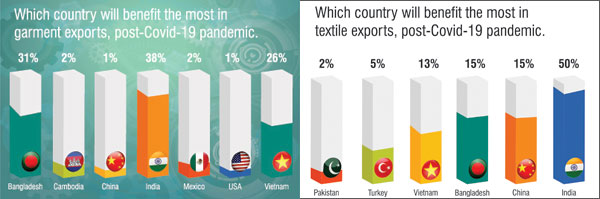

- The survey showed that 34% of the respondents believe exports will reach pre-Covid-19 levels by the end of 2020.

- However, 66% believe that will not happen in 2020.

- 8% respondents said the industry will localize its manufacturing, sourcing, selling

- 14% respondents said a shift away from China may not be possible

- 3% of the respondents believe that China will lose some importance as a textile and clothing supplier to the world, over the years.

- 7% of the respondents feel that China will remain an important player in the global textile and clothing market.

- 50% respondents said India will be the largest beneficiary for textile exports, as China loses its importance.

- 13% said Vietnam will become the next important textile sourcing hub

- 15% said China will continue to dominate

- In garment exports, 38% respondents said that India will gain a dominant position as supply chains shift away from China.

- 31% said Bangladesh will gain the most in garment exports.

- 26% said Vietnam will emerge a clear winner in apparel exports as buyers look for alternatives.

- 73% respondents said India is and will become a stronger investment hub for textiles and apparel.

- 95% respondents said without government will India cannot become the preferred investment destination for textiles & apparel.

‘The Industry Needs An Urgent Economic Stimulus’

Gurudas Aras

Director, A.T.E. Enterprises Pvt. Ltd.

India is better placed than many economies in the world. Many countries will fall into recession including the EU. Since no one knows how long and how deep impact the Covid-19 will have globally it is difficult to guess but certainly some part of the world is heading for long recession or even a depression. If the Indian government can handle the economic challenge well through large fiscal stimulus probably we can avoid going into recession, but the economy is likely to be under big stress for much longer period. Longer the lockdown period, much longer will be the economic recovery. Banks are flush with liquidity but are not ready to disburse to already ailing industrial sector, which is going to slow down the economic recovery further. According to me the financial year 2020-21 will be extremely bad in numbers with most companies declaring big losses while some will find it difficult to continue in the business.

With a special economic package the MSME sector, which has a share of 45% of the total industrial production, has a chance to survive. Otherwise many small sized companies will be forced to close down.

The industry on its part will do what it has to for survival - cost cutting, keeping staff engaged and motivated, labour rationalisation, new product development, etc. but will mainly require cash to run the show, and hence injecting liquidity will be very crucial on the part of the government and the banking sector.

It is extremely important for the Indian government to act fast with fiscal stimulus. The industry was already under financial stress before Covid-19 itself. This long lockdown is certainly taking a heavy toll on the industry. I'm afraid many small scale companies, and new start-ups may be forced to close down. The government must act fast as many other countries have done. The fiscal stimulus should be at least 3- 5% of the GDP. Moreover, the government should immediately clear all pending claims of industry w.r.t. GST, RoSTL, MEIS, etc. As far as textile sector is concerned it will have a new opportunity in terms of shifting of business partly from China due to the changed global sentiment towards China. However India does not seem to be ready to accept this opportunity due to many factors like inconsistent policies, old land and labour laws, bureaucracy in decision making, fragmented supply chain and fragmented garmenting capacities, etc. It's necessary that the government create conducive infrastructure and ecosystem for foreign investors to come and invest as well as make India their preferred buying destination. Indian companies need to improve considerably in quality, costing and delivery commitment and for that they need to invest in technology/automation and respect delivery commitments. China had been the preferred business partner as it scores high on all these parameters, a strategy now followed by Vietnam and Bangladesh as well.

On government part there is a dire need of land and labour reforms if we want to be competitive globally. The competition will be from countries like Vietnam, Bangladesh and Indonesia who are also equally eager to attract business shifting from China and their governments have already taken necessary steps in that direction.

India is still lagging in taking firm steps to grab this global opportunity. It is time to wake up for both the Indian government and the textile industry or else this opportunity will also pass by like earlier.

‘The Industry Needs An Urgent Economic Stimulus’

Gurudas Aras

Director, A.T.E. Enterprises Pvt. Ltd.

India is better placed than many economies in the world. Many countries will fall into recession including the EU. Since no one knows how long and how deep impact the Covid-19 will have globally it is difficult to guess but certainly some part of the world is heading for long recession or even a depression. If the Indian government can handle the economic challenge well through large fiscal stimulus probably we can avoid going into recession, but the economy is likely to be under big stress for much longer period. Longer the lockdown period, much longer will be the economic recovery. Banks are flush with liquidity but are not ready to disburse to already ailing industrial sector, which is going to slow down the economic recovery further. According to me the financial year 2020-21 will be extremely bad in numbers with most companies declaring big losses while some will find it difficult to continue in the business.

With a special economic package the MSME sector, which has a share of 45% of the total industrial production, has a chance to survive. Otherwise many small sized companies will be forced to close down.

The industry on its part will do what it has to for survival - cost cutting, keeping staff engaged and motivated, labour rationalisation, new product development, etc. but will mainly require cash to run the show, and hence injecting liquidity will be very crucial on the part of the government and the banking sector.

It is extremely important for the Indian government to act fast with fiscal stimulus. The industry was already under financial stress before Covid-19 itself. This long lockdown is certainly taking a heavy toll on the industry. I'm afraid many small scale companies, and new start-ups may be forced to close down. The government must act fast as many other countries have done. The fiscal stimulus should be at least 3- 5% of the GDP. Moreover, the government should immediately clear all pending claims of industry w.r.t. GST, RoSTL, MEIS, etc. As far as textile sector is concerned it will have a new opportunity in terms of shifting of business partly from China due to the changed global sentiment towards China. However India does not seem to be ready to accept this opportunity due to many factors like inconsistent policies, old land and labour laws, bureaucracy in decision making, fragmented supply chain and fragmented garmenting capacities, etc. It's necessary that the government create conducive infrastructure and ecosystem for foreign investors to come and invest as well as make India their preferred buying destination. Indian companies need to improve considerably in quality, costing and delivery commitment and for that they need to invest in technology/automation and respect delivery commitments. China had been the preferred business partner as it scores high on all these parameters, a strategy now followed by Vietnam and Bangladesh as well.

On government part there is a dire need of land and labour reforms if we want to be competitive globally. The competition will be from countries like Vietnam, Bangladesh and Indonesia who are also equally eager to attract business shifting from China and their governments have already taken necessary steps in that direction.

India is still lagging in taking firm steps to grab this global opportunity. It is time to wake up for both the Indian government and the textile industry or else this opportunity will also pass by like earlier.

‘Make In India’

Ashok Juneja

National President, Textile Association Of India

Make in India is even more relevant today than ever. The pandemic has made us and the world realise that local content is important, for the industry, for job creation and protection, and for the economy. The industry worldwide is waiting to restart, even as it stares at a bleak 2020.

The Indian textile industry will need to seriously consider import substitution where possible, and set up an integrated textile value chain. We have the advantage of a huge domestic market, and must capitalise on this. I believe the Indian textile industry will eventually become an important textile and clothing supplier to the world, as China's importance wanes.

‘Make In India’

Ashok Juneja

National President, Textile Association Of India

Make in India is even more relevant today than ever. The pandemic has made us and the world realise that local content is important, for the industry, for job creation and protection, and for the economy. The industry worldwide is waiting to restart, even as it stares at a bleak 2020.

The Indian textile industry will need to seriously consider import substitution where possible, and set up an integrated textile value chain. We have the advantage of a huge domestic market, and must capitalise on this. I believe the Indian textile industry will eventually become an important textile and clothing supplier to the world, as China's importance wanes.

‘The Textile Value Chain Players Must Come Together’

Vikas Sharan

Director - India Operations, Saurer Textile Solutions Pvt. Ltd.

Organisations will need to be lean and agile, cut travel costs, depend more on online communication, become more self reliant with localisation of parts, reduce lead time and inventory, multi-skill workers, adopt innovative work practices.

On its part, the Indian government should look at compensating industries for salaries, interests on loans and working capital. They should quickly and effectively restart non-essential goods movement in coordination with state governments. Utilities may need to be provided at concessional rates for some time.

Players in the textile value chain have to now help each other with minimum dependence on imports and cater to the domestic market. Globally, the situation could be worse for the exporting countries if consuming markets like USA and Europe collapse due to the Covid-19 situation.

I believe India is poised to go to great heights in the coming ten years, if we can grab the various opportunities coming our way. The central and state government should work very closely and increase the FDIs into India as much as they can. This will also have a direct positive effect on the employment levels in the country.

‘The Textile Value Chain Players Must Come Together’

Vikas Sharan

Director - India Operations, Saurer Textile Solutions Pvt. Ltd.

Organisations will need to be lean and agile, cut travel costs, depend more on online communication, become more self reliant with localisation of parts, reduce lead time and inventory, multi-skill workers, adopt innovative work practices.

On its part, the Indian government should look at compensating industries for salaries, interests on loans and working capital. They should quickly and effectively restart non-essential goods movement in coordination with state governments. Utilities may need to be provided at concessional rates for some time.

Players in the textile value chain have to now help each other with minimum dependence on imports and cater to the domestic market. Globally, the situation could be worse for the exporting countries if consuming markets like USA and Europe collapse due to the Covid-19 situation.

I believe India is poised to go to great heights in the coming ten years, if we can grab the various opportunities coming our way. The central and state government should work very closely and increase the FDIs into India as much as they can. This will also have a direct positive effect on the employment levels in the country.

‘The Industry Must Device Sustainable Methods Of Operation’

Murugan. S

Founder, TexDoc Online Solution Pvt. Ltd.

India has a strong domestic market, and we presume, India will be able to recover from the recessionary impact of Covid-19 from the second half of 2021. The world, overall, will start its economic recovery from 2022. Normally, I don't expect economic stimulus from the government. But, working capital which has eroded due to lock down, needs some short term support to make up for some more months, say for six months. In such case, the government may lend interest-free loans for six months. (The amount may be 30% of the total working capital required for six months which is calculated from the past five years' balance sheet.) The industry needs to devise mid-term and long-term strategies, in which the possibility of adapting and producing sustainable methods and products respectively should be considered. The clothing which was used by our ancestors with a prime aim of having a function of protecting against nature has slowly changed to luxury and fashion. Now is the time for us, the textile people, to think of adding more functions to clothing and at the same time implementing new ways involving the use of sustainable methods.

India is a preferred investment destination today. I hope, here after, as a whole, the world will not take the risk of having too much of a supply chain concentrated in one place.

‘The Industry Must Device Sustainable Methods Of Operation’

Murugan. S

Founder, TexDoc Online Solution Pvt. Ltd.

India has a strong domestic market, and we presume, India will be able to recover from the recessionary impact of Covid-19 from the second half of 2021. The world, overall, will start its economic recovery from 2022. Normally, I don't expect economic stimulus from the government. But, working capital which has eroded due to lock down, needs some short term support to make up for some more months, say for six months. In such case, the government may lend interest-free loans for six months. (The amount may be 30% of the total working capital required for six months which is calculated from the past five years' balance sheet.) The industry needs to devise mid-term and long-term strategies, in which the possibility of adapting and producing sustainable methods and products respectively should be considered. The clothing which was used by our ancestors with a prime aim of having a function of protecting against nature has slowly changed to luxury and fashion. Now is the time for us, the textile people, to think of adding more functions to clothing and at the same time implementing new ways involving the use of sustainable methods.

India is a preferred investment destination today. I hope, here after, as a whole, the world will not take the risk of having too much of a supply chain concentrated in one place.

‘Localisation Will Be The New Normal’

Saurav Jalan

Director, Sri Shyam Fashion India Pvt. Ltd.

I feel this is just the tip of the iceberg. We are heading into uncertain times, it might take a few years for a complete recovery, and to go back to the higher levels of business activity.

In the short term, to tide over the crises, the industry will have to go for some serious cost-cutting, and more importantly be selective about customers, reduce risk exposure by working with top customers who have sound financials.

In the meantime, the government will have to come up with a meaningful stimulus package. The economic package that was announced does little to help the industry.

The industry urgently needs the interest burden to be reduced, EMIs to be meaningfully waived. We absolutely need support for payment of wages and salaries, at a time when there is no stream of revenue.

I feel going down the lane, localisation and dependency on home economy will be the new way to do business. All countries will try to develop their markets and capacities.

‘Localisation Will Be The New Normal’

Saurav Jalan

Director, Sri Shyam Fashion India Pvt. Ltd.

I feel this is just the tip of the iceberg. We are heading into uncertain times, it might take a few years for a complete recovery, and to go back to the higher levels of business activity.

In the short term, to tide over the crises, the industry will have to go for some serious cost-cutting, and more importantly be selective about customers, reduce risk exposure by working with top customers who have sound financials.

In the meantime, the government will have to come up with a meaningful stimulus package. The economic package that was announced does little to help the industry.

The industry urgently needs the interest burden to be reduced, EMIs to be meaningfully waived. We absolutely need support for payment of wages and salaries, at a time when there is no stream of revenue.

I feel going down the lane, localisation and dependency on home economy will be the new way to do business. All countries will try to develop their markets and capacities.

‘Slow And Safe Is The Priority Now’

Vimal Verma

Trader - Cotton, Reinhart India Pvt. Ltd.

In normal conditions, I would expect recovery to be faster than expected. But we have to wait and see how the scenario unfurls. There are expectations of medium to high level recession in India and across the world. But this will also depend on the post-coronavirus situation worldwide.

We have to consider things like would there be any tension or deal between the US and China, or among other bigger economies? Such developments could impact the pace of recovery.

On its part the Indian textile industry should try to see future orders are not cancelled, work in close coordination with their buying and selling counterparts, and ensure best possible execution of committed orders. This will help all stakeholders to minimise losses, improve confidence. Slow, safe and survival business should be the priority now.

To help the situation further, at this time when the industry is genuinely suffering, it should ask the government for an economic package for survival, rather than short term compensations.

In the long run, the government and the industry need to work towards attracting investments into India. Already, India is an important market and investment destination for USA. Japan and other countries too can shift textile manufacturing from China to India.

But again, it's too early to say how the world will behave with China after Covid-19.

‘Slow And Safe Is The Priority Now’

Vimal Verma

Trader - Cotton, Reinhart India Pvt. Ltd.

In normal conditions, I would expect recovery to be faster than expected. But we have to wait and see how the scenario unfurls. There are expectations of medium to high level recession in India and across the world. But this will also depend on the post-coronavirus situation worldwide.

We have to consider things like would there be any tension or deal between the US and China, or among other bigger economies? Such developments could impact the pace of recovery.

On its part the Indian textile industry should try to see future orders are not cancelled, work in close coordination with their buying and selling counterparts, and ensure best possible execution of committed orders. This will help all stakeholders to minimise losses, improve confidence. Slow, safe and survival business should be the priority now.

To help the situation further, at this time when the industry is genuinely suffering, it should ask the government for an economic package for survival, rather than short term compensations.

In the long run, the government and the industry need to work towards attracting investments into India. Already, India is an important market and investment destination for USA. Japan and other countries too can shift textile manufacturing from China to India.

But again, it's too early to say how the world will behave with China after Covid-19.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.