Indian Spinning Mills Facing Heat Of Rising Cotton Prices And Steady Yarn Prices

Indian spinning mills had a golden run in the year 2021. The kind of profits mills enjoyed were never seen before. This improved their finances as was visible in their balance sheets and share prices.

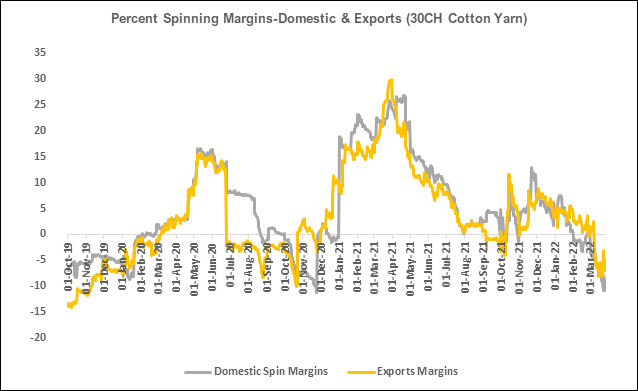

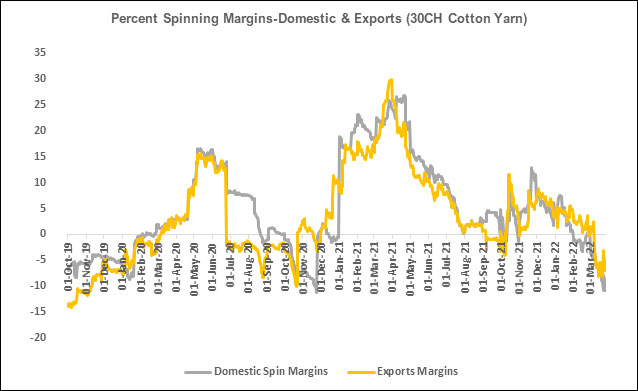

The graph here indicates spot spinning margins for 30 combed knit yarns for Indian spinning mills using Gujarat S-6 cotton in physical market. As can be seen from the graph, at current cotton and yarn prices, spinning mills are losing money and losses will increase further as raw cotton prices continue to rise but cotton yarn is still steady.

Spinning margins were at peaks last year during same time and mills were earning record profits. This was the time when cotton, yarn and textile markets were recovering fast after the pandemic, export demand was strong, and domestic demand was improving too. India did record strong textile exports last year and this was major reason that yarn prices and profits for mills kept going high.

This even pushed some mills to increase spindleage capacities as they expected demand to remain high after the pandemic related lockdowns were lifted across the world. Raw cotton prices were rising throughout last year and mills also kept raising cotton yarn prices to keep their profits high. Yarn buyers at that time were forced to pay these prices as there was strong demand for their textiles products as well and they were also earning although not as high as spinners. But situation has changed this year and new incidences are impacting.

Yarn demand weakens at current high prices; Ukraine-Russia war hitting the sentiments of textile buyers

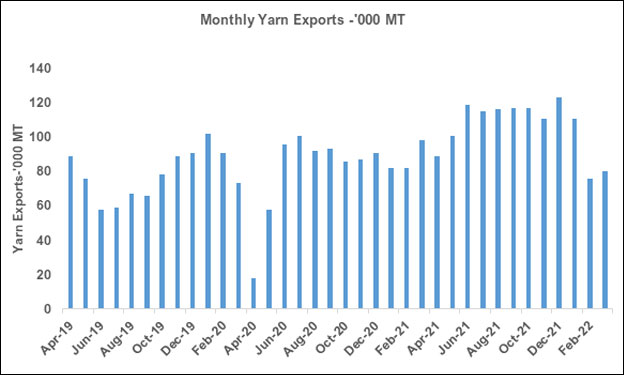

Demand for yarn in domestic and international market has weakened and export volumes have come down in last couple of months as per Ministry of Commerce data. The volatile international situation developing especially due to the Ukraine-Russia war, has started hitting sentiments in the international market. This war has been impacting global trade in yarn and textile sectors. Market has started resisting high cotton yarn prices and sales are very limited at current prices. Textile exports which saw record sales last year have also been little down recently.

Spinning margins were at peaks last year during same time and mills were earning record profits. This was the time when cotton, yarn and textile markets were recovering fast after the pandemic, export demand was strong, and domestic demand was improving too. India did record strong textile exports last year and this was major reason that yarn prices and profits for mills kept going high.

This even pushed some mills to increase spindleage capacities as they expected demand to remain high after the pandemic related lockdowns were lifted across the world. Raw cotton prices were rising throughout last year and mills also kept raising cotton yarn prices to keep their profits high. Yarn buyers at that time were forced to pay these prices as there was strong demand for their textiles products as well and they were also earning although not as high as spinners. But situation has changed this year and new incidences are impacting.

Yarn demand weakens at current high prices; Ukraine-Russia war hitting the sentiments of textile buyers

Demand for yarn in domestic and international market has weakened and export volumes have come down in last couple of months as per Ministry of Commerce data. The volatile international situation developing especially due to the Ukraine-Russia war, has started hitting sentiments in the international market. This war has been impacting global trade in yarn and textile sectors. Market has started resisting high cotton yarn prices and sales are very limited at current prices. Textile exports which saw record sales last year have also been little down recently.

There is no visible end to the war yet, and the market thus continues to remain cautious, with apprehensions of worsening economic conditions if the war prolongs. If this was not enough, news of another Covid-19 surge in China also took headlines and millions of people were again put in strict lockdown situation. All these events are holding back economic recovery around the world.

How long can spinning mills sustain the losses?

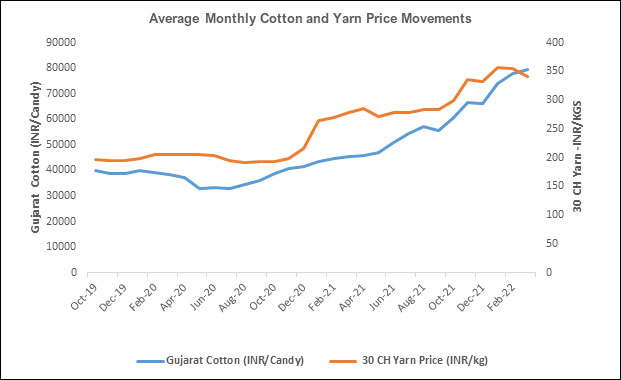

As per the graphical comparison of cotton and yarn prices, we can see cotton prices are still in uptrend and cotton yarn is steady or weakening. If this trend continues, mills will find themselves in a difficult situation.

How long Indian spinning mills can sustain losses will be a big question as spinning profits are expected to dip down further in coming days if cotton yarn does not pick up.

There is no visible end to the war yet, and the market thus continues to remain cautious, with apprehensions of worsening economic conditions if the war prolongs. If this was not enough, news of another Covid-19 surge in China also took headlines and millions of people were again put in strict lockdown situation. All these events are holding back economic recovery around the world.

How long can spinning mills sustain the losses?

As per the graphical comparison of cotton and yarn prices, we can see cotton prices are still in uptrend and cotton yarn is steady or weakening. If this trend continues, mills will find themselves in a difficult situation.

How long Indian spinning mills can sustain losses will be a big question as spinning profits are expected to dip down further in coming days if cotton yarn does not pick up.

Luckily, last year’s profits have given mills some financial strength, to handle the current losses for some time. To cut losses and operating costs, mills tend to shift to synthetics, specialized yarns like twisted, double yarn etc which have better margins or divert towards longer counts to lower their cotton consumptions and earn better margins. Historically spinning mills have faced even lower margins and they understand that the situation can turn suddenly, so no need to press the panic button. Spinning mills are however pinning their hopes on new summer season and are expecting demand yarns and textiles will return soon. Recent rally in cotton may also give some boost to cotton yarn prices as well.

Spinning mills are also pushing textile ministry to remove import duty and feel that this may help to cool down the market.

International cotton demand up again, ICE is on strong rally

In the international markets, raw cotton is back in bullish zone and demand has witnessed strong recovery. This can be seen in US cotton weekly sales reports. Importing countries are looking to fill their pipelines and build their stocks for future before world’s situation actually goes out of control hitting the trade completely.

Luckily, last year’s profits have given mills some financial strength, to handle the current losses for some time. To cut losses and operating costs, mills tend to shift to synthetics, specialized yarns like twisted, double yarn etc which have better margins or divert towards longer counts to lower their cotton consumptions and earn better margins. Historically spinning mills have faced even lower margins and they understand that the situation can turn suddenly, so no need to press the panic button. Spinning mills are however pinning their hopes on new summer season and are expecting demand yarns and textiles will return soon. Recent rally in cotton may also give some boost to cotton yarn prices as well.

Spinning mills are also pushing textile ministry to remove import duty and feel that this may help to cool down the market.

International cotton demand up again, ICE is on strong rally

In the international markets, raw cotton is back in bullish zone and demand has witnessed strong recovery. This can be seen in US cotton weekly sales reports. Importing countries are looking to fill their pipelines and build their stocks for future before world’s situation actually goes out of control hitting the trade completely.

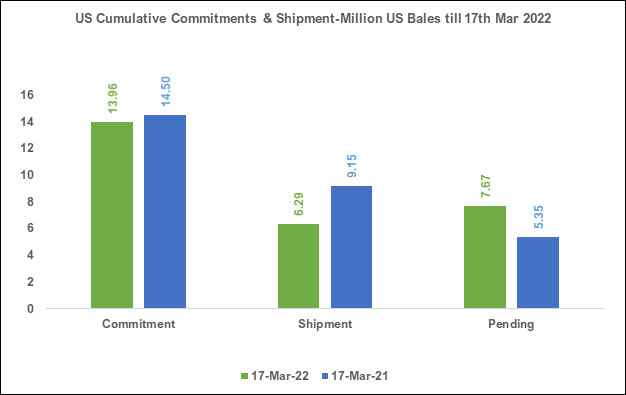

Cumulative cotton commitments for US cotton have reached 13.95 million US bales as against 14.50 million US bales last year by same period but main concern is the speed of shipments. The logistic constraints have largely impacted the US shipments and more than 50% of sold bales are yet to be shipped. Strong demand has pushed prices very high and ICE May has touched record 135 cents. It has shown a jump of 15% in last 10 days. This has also given momentum to Indian cotton prices as well.

Farmers could increase cotton planting in coming season

Recent rally in ICE has given further momentum to cotton prices in India which were already at historical peaks. Recently prices for Gujarat S-6 good quality are close to Rs 87,000 per candy with expectation of further increase in coming days.

Strong buying by spinning mills and tight supplies in India has resulted in the soaring prices, as mills are worried about future availability of cotton in India.

Cumulative cotton commitments for US cotton have reached 13.95 million US bales as against 14.50 million US bales last year by same period but main concern is the speed of shipments. The logistic constraints have largely impacted the US shipments and more than 50% of sold bales are yet to be shipped. Strong demand has pushed prices very high and ICE May has touched record 135 cents. It has shown a jump of 15% in last 10 days. This has also given momentum to Indian cotton prices as well.

Farmers could increase cotton planting in coming season

Recent rally in ICE has given further momentum to cotton prices in India which were already at historical peaks. Recently prices for Gujarat S-6 good quality are close to Rs 87,000 per candy with expectation of further increase in coming days.

Strong buying by spinning mills and tight supplies in India has resulted in the soaring prices, as mills are worried about future availability of cotton in India.

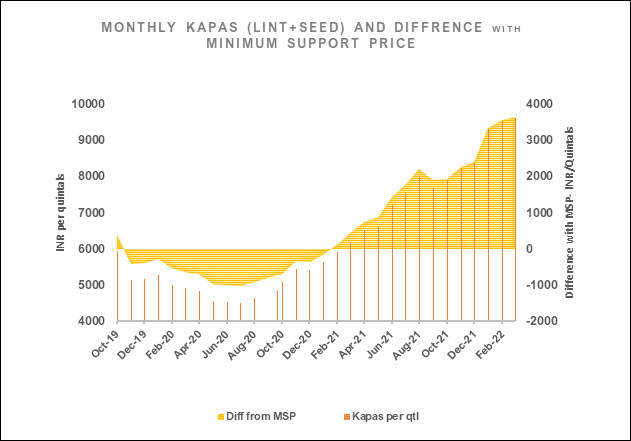

Quality of cotton has fallen considerably and cotton is facing colour grade, Mic and staple issues. Indian arrivals have fallen fast since last month which indicates not much cotton is in the hands of farmers now. Lower yields this year are however compensated with record kapas (lint+seed) prices for farmers. Prices have gone past Rs 10,000 per 100 kgs and are close to Rs 10500-10700.

As per telephonic surveys done by Greenleaf Corporations (Research based company in New Delhi), farmers are looking to increase the planting of cotton in coming season.

Vikas Narula is Research Head, Greenleaf Corporations.

Email: vikas.narula@greenleafcorporations.com

Phone: 8980022010

Quality of cotton has fallen considerably and cotton is facing colour grade, Mic and staple issues. Indian arrivals have fallen fast since last month which indicates not much cotton is in the hands of farmers now. Lower yields this year are however compensated with record kapas (lint+seed) prices for farmers. Prices have gone past Rs 10,000 per 100 kgs and are close to Rs 10500-10700.

As per telephonic surveys done by Greenleaf Corporations (Research based company in New Delhi), farmers are looking to increase the planting of cotton in coming season.

Vikas Narula is Research Head, Greenleaf Corporations.

Email: vikas.narula@greenleafcorporations.com

Phone: 8980022010

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.