Conflict In Ukraine Breeds Uncertainty For Global Cotton Consumption

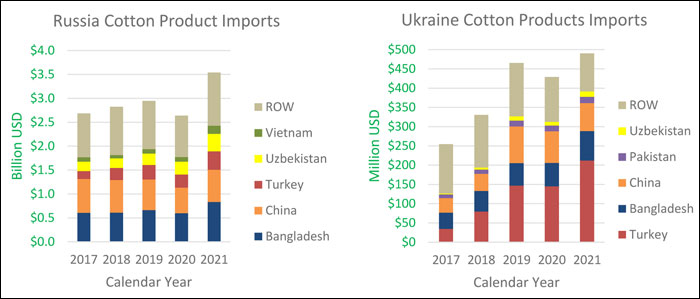

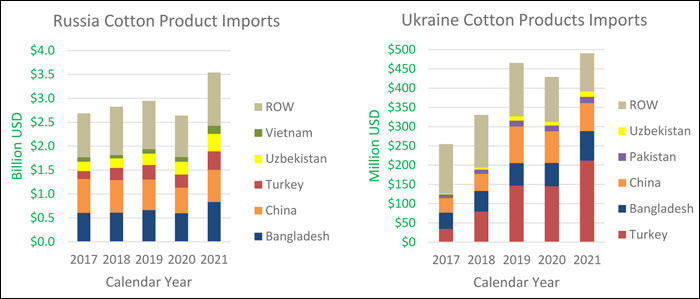

Neither Russia nor Ukraine are significant producers or consumers of cotton lint, but annual cotton product imports (apparel, towels, bed sheets, etc.) are valued at roughly US$ 3 billion and US$ 500 million, respectively.

Cotton is tied to both countries in the form of product imports, and — for different reasons — the current conflict is expected to slow consumer demand and further exacerbate mills’ problems across the globe, including rising costs for production (higher fuel prices), and for yarn manufacturing, electricity costs.

Russia and Ukraine cotton product imports are expected to fall, potentially lowering product exports and therefore consumption for major suppliers including Bangladesh, China, and Turkey. Still, China is the only country with lower projected cotton consumption relative to last month. Note that Russia and Ukraine imports pale in comparison to other major markets, including the United States and European Union.

In addition to lower expected product import demand from both countries, the conflict has driven already significant inflation even higher, with fuel and electricity prices witnessing volatile upward movements. Rising costs and logistical concerns in and around the Black Sea and Bosporus may complicate the flow of cotton products and textiles, which were already experiencing issues with container port congestion. This pertains to both ocean and rail freight in and around the conflict area, as well as the flow of cotton product exports to the world’s second-largest importing bloc, the European Union. 2021/22 global cotton consumption is lowered slightly from last month’s projected record but still forecast at its second-highest level.

2021/22 Outlook

Global production is raised over 342,000 bales from last month due to increases in Pakistan and Greece. Use is down 467,000 bales, and ending stocks are up over 800,000 bales. Global trade is down slightly with lower exports from Malaysia, Brazil, and India. Imports are lower for Pakistan and China.

US production is unchanged at 17.6 million bales. Exports and ending stocks are also unchanged at 14.8 and 3.5 million bales, respectively, and the projected US season-average farm price is up 1 cent to 91 cents per pound.

Global cotton prices surged since last month’s WASDE, with the A-Index rising over 20 cents per pound to 154 cents and nearly 70 cents above the same period last year. Despite the ongoing conflict in Ukraine, prices on the Intercontinental Exchange have witnessed an exuberant rally. Large quantities of unfixed sales on the May contract coupled with significantly low certificated stocks both supported the rise.

Contrary to price movements across the world, spot prices in China were unchanged. Large commercial stocks and slowing demand for cotton lint and yarn capped any significant climb. High lint prices and its large cotton yarn and fabric stocks are both helping to suppress cotton lint demand.

The A-Index is roughly 10 cents lower than domestic prices in China compared with roughly 30 cents last month, signaling that China’s price gap has narrowed dramatically. This is expected to slow China’s short-term foreign purchases despite the recent issuance of sliding scale quota.

In addition to lower expected product import demand from both countries, the conflict has driven already significant inflation even higher, with fuel and electricity prices witnessing volatile upward movements. Rising costs and logistical concerns in and around the Black Sea and Bosporus may complicate the flow of cotton products and textiles, which were already experiencing issues with container port congestion. This pertains to both ocean and rail freight in and around the conflict area, as well as the flow of cotton product exports to the world’s second-largest importing bloc, the European Union. 2021/22 global cotton consumption is lowered slightly from last month’s projected record but still forecast at its second-highest level.

2021/22 Outlook

Global production is raised over 342,000 bales from last month due to increases in Pakistan and Greece. Use is down 467,000 bales, and ending stocks are up over 800,000 bales. Global trade is down slightly with lower exports from Malaysia, Brazil, and India. Imports are lower for Pakistan and China.

US production is unchanged at 17.6 million bales. Exports and ending stocks are also unchanged at 14.8 and 3.5 million bales, respectively, and the projected US season-average farm price is up 1 cent to 91 cents per pound.

Global cotton prices surged since last month’s WASDE, with the A-Index rising over 20 cents per pound to 154 cents and nearly 70 cents above the same period last year. Despite the ongoing conflict in Ukraine, prices on the Intercontinental Exchange have witnessed an exuberant rally. Large quantities of unfixed sales on the May contract coupled with significantly low certificated stocks both supported the rise.

Contrary to price movements across the world, spot prices in China were unchanged. Large commercial stocks and slowing demand for cotton lint and yarn capped any significant climb. High lint prices and its large cotton yarn and fabric stocks are both helping to suppress cotton lint demand.

The A-Index is roughly 10 cents lower than domestic prices in China compared with roughly 30 cents last month, signaling that China’s price gap has narrowed dramatically. This is expected to slow China’s short-term foreign purchases despite the recent issuance of sliding scale quota.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.