India-EU FTA Bonus: Can Indian Textiles & Apparels Enter Turkish Market Duty Free?

The recently announced “mother of all deals” between India and 27-nation EU Free Trade Agreement is likely to deliver one more market for Indian Textiles & Apparels. Indian goods may reroute through EU to enter its customs union partner Turkey.

The

India-EU FTA will provide duty-free access to Indian textiles & apparels in

the 27-member group once it comes into force. This good news comes with a bonus

- EU has a bilateral customs union with Turkey, which binds it to align with the

EU’s common external tariff. This means that when the EU reduces duties for an

FTA partner such as India, Turkey must extend the same tariff benefit to Indian

goods.

EU-Turkey

customs union agreement is in place since 31st December 1995, which allows

industrial products (with few exceptions) to move freely between their

respective customs areas without tariffs or quotas. This also requires Turkey to

apply the EU’s common external tariff on imports from third countries. Under

the India-EU FTA when it comes into force, Indian Textiles & Apparels would

be able to enter the EU zone duty-free which then can move to Turkey too.

However,

Turkish goods cannot follow the same path under the India-EU FTA to enter India

duty-free even if the goods are shipped through any EU port. The reason being

the origin of the goods remain Turkish and therefore do not qualify the rules

of origin under India-EU FTA.

Of

late, India’s relation with Turkey deteriorated due to political reasons and for

supporting India’s adversaries. According to the Turkish media reports, the India-EU

FTA deal could affect Turkey’s foreign trade and its industrial production due

to the elimination of duties on Indian goods, especially in textiles, steel, and

automotive sectors.

India-Turkey

bilateral trade data show that India’s exports to Turkey declined by 14% to US$

5.7 billion in 2024-25 from US$ 6.7 billion in 2023-24, while imports from Turkey

fell 20.8% to around US$ 3 billion in 2024-25 from US$ 3.8 billion in 2023-24.

Turkey accounts for about 1.3% share of India’s total exports.

Turkey

being a major textile and apparel manufacturing hub, offers a sizable market

for textile raw materials as well as finished apparels. In 2024, Turkey

imported US$ 7.9 billion worth of textiles, and apparel imports touched US$

3.96 billion after a surge of 23% over previous year.

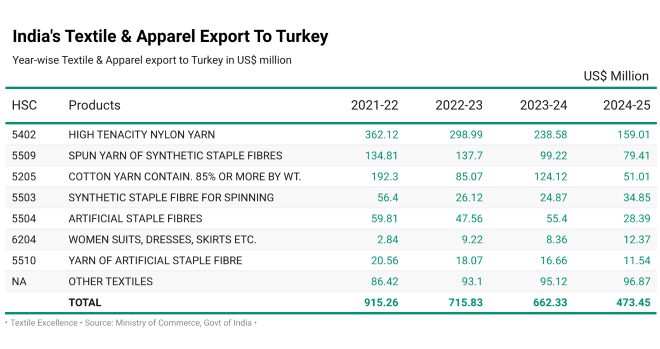

India’s

textile & apparel exports to Turkey are following a declining trend due to

various protective measures introduced in recent years. The country mostly

imported Indian textile raw materials like nylon yarn, cotton spun yarn and synthetic

spun yarns to add further value. In 2024-25, India’s textile and apparel export

to Turkey declined by 28.5% to US$ 473.45 million from US$ 662.33 million in

the previous financial year. On the import front, India imported about US$ 77

million worth of textile goods from Turkey during 2024-25.

With

the India-EU FTA, Indian goods can avail duty-free access to the Turkish market if they enter via EU ports. However, time would tell how Indian exporters explore this

possibility and whether it is logistically viable!

EU has bilateral customs union with Turkey which binds it to align with the EU’s common external tariff. This means that when the EU reduces duties for an FTA partner such as India, Turkey must extend the same tariff benefit to Indian goods. However, Turkish goods cannot follow the same path under the India-EU FTA to enter India duty-free even if the goods are shipped through any EU port.

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.