From Tariffs To Trade Blocs: Why BRICS Now Matters More Than Ever

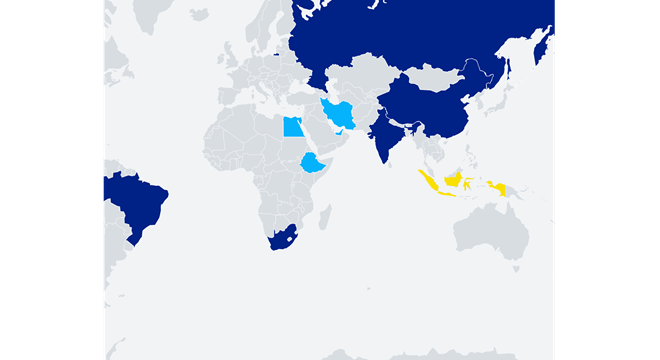

BRICS

- now a 10-nation bloc comprising Brazil, Russia, India, China, South Africa,

Egypt, Ethiopia, Indonesia, Iran, and the UAE - is emerging as a consequential

trade axis for India’s textile and apparel industry. This is no longer

peripheral exposure. Today, BRICS markets account for nearly 12.5% of India’s

total textile and apparel exports, a share that is strategically significant.

India’s

textile and apparel exports to BRICS surged 21.4% to ₹36,535 crore in FY24,

before moderating by around 5% to ₹34,647 crore in FY25. The pullback reflects

demand volatility, not a structural retreat. Within the bloc, the UAE, China,

Brazil, and Egypt have become India’s most important destination markets for

textiles and clothing.

At

the same time, India’s textile and apparel imports from BRICS rose 6.9% to

₹36,854 crore in FY25, reinforcing the bloc’s dual role as both a market and a

sourcing base. China, Indonesia, Brazil, and Egypt remain key suppliers,

particularly in yarns, fabrics, and intermediate inputs.

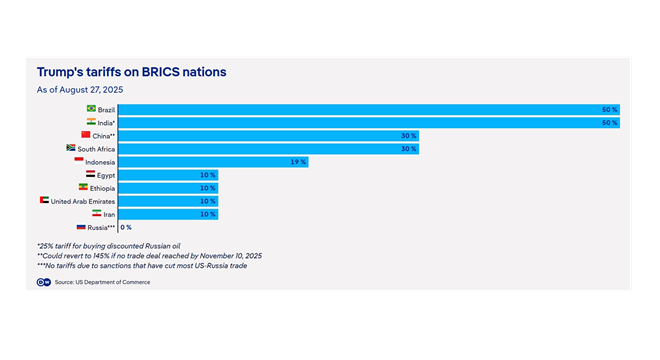

What

is accelerating BRICS’ relevance is geopolitics. Washington’s tariff aggression

has unintentionally strengthened the bloc, creating a shared incentive among

BRICS members to reduce exposure to the U.S., even where political agendas

diverge.

The

response is already visible. BRICS countries are expanding bilateral trade in

national currencies, steadily reducing reliance on the U.S. dollar. In

parallel, BRICS central banks have sharply increased gold purchases, a clear

signal that de-dollarisation is moving from rhetoric to policy.

Nine

ASEAN countries move toward BRICS currency adoption

In

2026, nine ASEAN countries - Brunei, Cambodia, Laos, Malaysia, Myanmar, the

Philippines, Singapore, Thailand, and Vietnam - reached a joint understanding

to accept a future BRICS currency, even before its formal launch. Growing

unease over dollar dominance, sanctions exposure, and U.S. policy

unpredictability is driving this alignment.

With

Indonesia now a full BRICS member, nearly 19 countries could adopt the BRICS

currency for trade. Including 13 BRICS partner countries, the push toward

de-dollarisation reflects a broader realignment, one that is quietly but

steadily shifting financial influence eastward.

RBI

pushes digital de-dollarisation

India

is positioning itself at the centre of this shift. The Reserve Bank of India

has urged the government to place a proposal to link BRICS central bank digital

currencies (CBDCs) on the agenda of the 2026 BRICS summit, to be hosted by

India. The plan aims to connect CBDC systems to ease cross-border trade and

tourism while reducing dollar dependence, marking the first formal attempt to

create a shared BRICS CBDC framework.

While

no BRICS nation has fully rolled out a CBDC, all core members are running

pilots. India’s e-rupee, launched in December 2022, reportedly has 7 million

retail users, supported by offline payments, programmable subsidies, and

fintech wallet integration. China, meanwhile, has pledged to expand the digital

yuan globally and is reportedly allowing commercial banks to pay interest on

digital-yuan holdings.

Why

BRICS is moving away from dollar-based trade

BRICS

economies are increasingly exposed to U.S. monetary policy and sanctions.

Federal Reserve rate hikes and Washington’s tariff decisions transmit shocks

across emerging markets. Russia’s post-Ukraine isolation and Iran’s

long-standing exclusion from dollar systems demonstrated how swiftly access to

SWIFT and dollar liquidity can be weaponised. Reducing dollar dependence has

become a question of economic sovereignty.

Dollar-intermediated

trade also imposes real costs. Multiple currency conversions add 3–5% per

transaction and amplify exchange-rate risk. Direct settlement delivers scale

benefits: China–Russia trade has already cut transaction costs by 2–3%, a

material saving on nearly US$190 billion in annual trade.

Beyond

cost, local-currency trade reduces exposure to dollar volatility and stabilises

pricing. Early evidence from China-Russia transactions shows contract price

volatility falling by nearly 25% versus dollar-denominated deals. With friction

reduced, intra-BRICS trade, currently about US$ 500 billion, has the potential

to scale far faster than under dollar-routed systems.

How

BRICS local-currency trade works

BRICS

is not rushing toward a single currency. Instead, it is advancing

de-dollarisation through bilateral currency swap agreements, allowing trade to

be settled directly in local currencies. These swaps establish pre-agreed

exchange rates and central-bank credit lines, removing the dollar from

transactions. China has led this effort; its swap arrangement with Brazil now

covers nearly 30% of bilateral trade.

On

the infrastructure side, China’s CIPS and Russia’s SPFS provide alternatives to

SWIFT. The New Development Bank (NDB) underpins the system by offering

liquidity and settlement support, helping members bypass Western-led

institutions such as the IMF and World Bank.

Constraints

and caution

Local-currency

trade within BRICS faces hard structural limits. As one analyst put it bluntly,

“These are disparate economies—there’s a long way to go before they can be

married.” China’s economic dominance creates asymmetries in liquidity and

pricing power. Russia remains resource-centric, India more diversified, while

newer members add further complexity. Designing fair exchange mechanisms across

such uneven profiles is inherently difficult.

Institutional

barriers compound the challenge. Financial systems built around the dollar

operate on incompatible standards, regulatory regimes, and settlement

timelines. Aligning payment protocols, risk frameworks, and compliance rules

requires sustained technical coordination, especially for smaller economies.

BRICS

policymakers are acutely aware of the Eurozone’s cautionary tale. As one

observer noted, attempts to bind structurally mismatched economies without

fiscal integration or shock absorbers were “flawed from the start.” The lesson

is clear: avoid premature monetary union.

Instead,

BRICS is pursuing a building-blocks strategy. Local-currency trade is the

pragmatic starting point, preserving policy autonomy while testing

interoperability. As one commentator put it, “Until those foundations exist,

debating a BRICS currency is premature.”

The

New Development Bank and the BRICS financial playbook

The

New Development Bank anchors BRICS’ financial strategy. Launched in 2015 with

US$ 100 billion in capital, it was designed not just to fund infrastructure,

but to build an alternative financial ecosystem. Beyond lending, the NDB

supports local capital markets, payment systems, trade finance, and currency

settlement.

Alongside

the US$ 100 billion BRICS Contingent Reserve Arrangement, it provides liquidity

without IMF-style conditionalities, giving members strategic autonomy. While

the dollar still dominates, BRICS local-currency trade represents the first

serious post-Bretton Woods effort to construct parallel financial channels. As

one analyst observed, “Trump’s response shows how seriously Washington views

BRICS de-dollarisation.”

BRICS economies are increasingly exposed to U.S. monetary policy and sanctions. Federal Reserve rate hikes and Washington’s tariff decisions transmit shocks across emerging markets. Russia’s post-Ukraine isolation and Iran’s long-standing exclusion from dollar systems demonstrated how swiftly access to SWIFT and dollar liquidity can be weaponised. Reducing dollar dependence has become a question of economic sovereignty.

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.