India’s Growth Story Signals Opportunity For Textiles—But Execution Will Matter

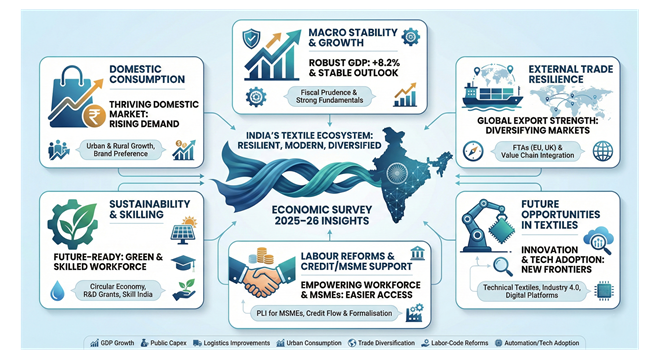

The Economic Survey 2025–26 paints a picture of resilience amid global uncertainty, with India expected to sustain growth of 6.8–7.2% in FY27 despite rising geopolitical fragmentation, trade protectionism and cost pressures worldwide. For the textile and apparel sector, deeply embedded in global value chains, this macro stability offers both reassurance and a clear call to action.

Macro

stability underpins manufacturing confidence

The

Survey underscores strong macro fundamentals, anchored by disciplined fiscal

management, steady private consumption and a sustained push on capital

expenditure. Effective public capex has risen from a pre-pandemic average of

2.7% per cent of GDP to around 4%, improving logistics, infrastructure and

industrial connectivity.

This

translates into lower transit times, improved port and rail efficiency, and a

gradual reduction in logistics costs, long a competitive handicap for Indian

exporters. Manufacturing gross value added (GVA) growth has shown renewed

momentum, with real manufacturing GVA accelerating through FY25 and FY26.

Consumption-led

growth

Private

consumption continues to account for over 60% of nominal GDP, providing a

stable base for demand-driven industries such as apparel and home textiles.

Rising

urban employment, over 61.9% of urban jobs are now in services - is supporting

discretionary spending, especially in branded apparel, athleisure and home

furnishings.

For

textile manufacturers supplying the domestic market, this consumption

resilience offers a hedge against export volatility. The message is clear:

balancing export ambitions with sharper domestic-market strategies is no longer

optional.

External

trade: Resilience amid rising uncertainty

On

the external front, the Survey notes that global trade policy uncertainty is

intensifying, with restrictive measures outpacing trade facilitation worldwide.

Merchandise exports have remained resilient in FY26 (April–December 2025), even

as imports rose, reflecting steady domestic demand and investment activity.

For

textiles and apparel - sectors vulnerable to tariff changes, non-tariff

barriers and compliance regimes - this environment reinforces the need to

diversify markets and products. India’s recent Free Trade Agreements and

Comprehensive Economic Partnership Agreements provide potential tailwinds, but

capturing value will depend on speed, compliance readiness and scale.

Employment

reforms reshape the labour landscape

The

Survey highlights a major structural shift with the consolidation of 29 labour

laws into four labour codes, aimed at balancing worker protection with

flexibility. Formalisation, fixed-term employment recognition and simplified

compliance could be game-changers here.

Industry

estimates suggest that effective implementation of these reforms could create

up to 77 lakh jobs across sectors.

For

apparel and made-ups, where seasonal demand and export cycles dominate,

flexible yet formal employment frameworks could significantly improve

productivity and compliance outcomes, provided states move swiftly on

implementation.

Credit,

MSMEs and the textile backbone

Access

to credit continues to improve, with bank lending to micro and small

enterprises maintaining a strong upward trend. Given that India’s textile

ecosystem is heavily MSME-driven, this credit momentum is critical.

However,

rising compliance standards, sustainability mandates and traceability

requirements mean that credit availability must be matched with technical

upgradation and skill development to prevent smaller firms from being squeezed

out of global supply chains.

Sustainability,

skills and the next leap

While

the Survey focuses more broadly on industry, its emphasis on productivity,

skilling and technology adoption is highly relevant for textiles. As medium-

and high-technology activities account for a growing share of manufacturing

value added, textiles must accelerate investments in automation, technical

textiles, recycling and energy-efficient processes.

Equally

important is skill alignment. The Survey’s focus on “getting skilling right”

highlights the urgency of industry-led training models, particularly in apparel

manufacturing, where quality, speed and compliance increasingly determine

competitiveness.

The

road ahead

The

Economic Survey 2025–26 offers cautious optimism for Indian economy. Stable

growth, infrastructure investment, labour reforms and improving credit

conditions form a supportive backdrop. Yet, global trade headwinds,

sustainability pressures and execution gaps remain real challenges.

For

the industry, the opportunity lies in moving decisively - scaling up,

modernising operations, and aligning with evolving global and domestic demand.

In a world where resilience is as valuable as cost competitiveness, India’s

textile sector has the macro tailwinds it needs. The next leap will depend on

how effectively the value chain converts policy intent into on-ground

performance.

The Economic Survey 2025–26 offers cautious optimism for Indian economy. Stable growth, infrastructure investment, labour reforms and improving credit conditions form a supportive backdrop. Yet, global trade headwinds, sustainability pressures and execution gaps remain real challenges.

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.