Brazil Cotton Exports Hit Record, Global Trade Shifts

Record Brazilian exports

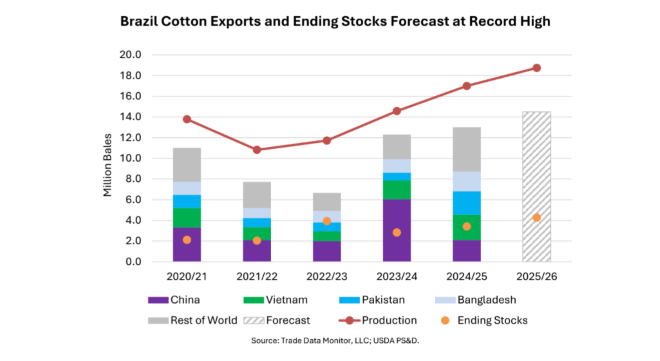

Brazil’s cotton exports are forecast at 14.5 million bales

for the 2025/26 season (August 2025–July 2026), up 1.5 million bales from last

year. This marks a record level for the third consecutive year.

Production growth - both in harvested area and yield -

drives this surge. Domestic consumption has remained stable, so ending stocks

are climbing, projected at 4.3 million bales. Prices in Brazil have softened

over the past three years, tracking global trends.

Key export markets

China, Bangladesh, Turkey, and India are major buyers.

Vietnam, once the top destination, has cut imports from Brazil, favouring US

cotton. China has reclaimed the lead in year-to-date shipments, though volumes

are half of 2023/24 levels when it was replenishing reserves.

December 2025 saw record monthly exports. The industry is

also diversifying ports: 10% of cotton shipped from alternatives to Santos,

compared to a 5-year average of 4%.

Looking ahead: 2026/27

Brazil’s 2026/27 crop is expected to fall slightly. Higher

input costs and lower cotton prices may reduce yields and harvested area. But

elevated stocks from previous years may keep exports stable.

Global production and trade

Global cotton production is projected at 119.9 million

bales, up 425,000 bales, mainly from a larger crop in China. Global consumption

is slightly down to 118.7 million bales. Overall, production grows while

consumption is flat.

Global trade is steady at 43.7 million bales. Lower exports

from the US and Argentina are offset by Australia. Reduced imports by Pakistan,

Turkey, and some Southeast Asian countries are balanced by higher imports by

China and India.

Global ending stocks rise to 75.1 million bales, mainly due

to higher stocks in China, India, and the US. The US season-average farm price

is projected down 1 cent to 60 cents per pound.

Major trade movements

Imports (1,000 480-lb bales)

China: 5,600 (up 200)

India: 3,200 (up 200)

Pakistan: 5,700 (down 200)

Turkey: 4,500 (down 100)

Exports (1,000 480-lb bales)

Argentina: 525 (down 75)

Australia: 5,500 (up 200)

United States: 12,000 (down 200)

Implications for buyers and exporters

Brazil’s growing exports offer a reliable supply for global

buyers. Rising stocks and soft prices may ease short-term cost pressures.

Exporters must manage logistics and ports efficiently. Diversifying ports, as

seen in 2025/26, helps avoid congestion and ensures timely shipments.

For buyers in India, Bangladesh, and China, Brazil offers

competitive options. But global trade shifts, like increased US exports to

Vietnam, require careful sourcing strategies.

In conclusion

Brazil is now a dominant global cotton exporter. Strong

production, growing exports, and diversified logistics underpin this rise.

Global buyers can expect ample supply and competitive

prices. Yet, market shifts demand vigilance. Monitoring production, stocks, and

international demand will be key for sourcing and pricing decisions.

Brazil’s 2026/27 crop is expected to fall slightly. Higher input costs and lower cotton prices may reduce yields and harvested area. But elevated stocks from previous years may keep exports stable. Brazil’s growing exports offer a reliable supply for global buyers. Rising stocks and soft prices may ease short-term cost pressures. Exporters must manage logistics and ports efficiently. Diversifying ports, as seen in 2025/26, helps avoid congestion and ensures timely shipments.

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.