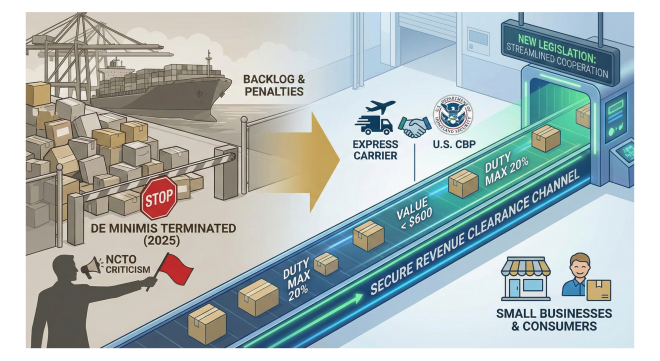

US House Lawmakers Again Introduce Legislation For Low-Value Package Entry

Newly introduced legislation aims to provide a new channel

for low-value shipments to enter the United States duty free, mimicking

elements of the de minimis provision that was terminated for commercial

shipments last year.

Congresswoman Carol Miller (R-W.V.) and Congressman Don

Beyer (D-Va.) authored the Secure Revenue Clearance Channel Act, which they

said will address a "growing backlog" of imports at America's ports

of entry by facilitating streamlined cooperation between express carriers and

U.S. Customs and Border Protection (CBP).

According to the lawmakers, the bill would allow shipments

valued at US$ 600 or less to move more quickly through the importation and

customs process. Under the proposed legislation, importers that rely on select

express shippers would be responsible for tariffs worth a maximum of 20% of the

value of the shipment in question. These parcels would be exempted from the

customs reporting requirements that larger shipments face.

"Shipments have recently faced significant backlogs at

our ports of entry. This bill creates a critical mechanism to help small

businesses, manufacturers, and hardworking Americans by allowing express

shippers to move goods more efficiently through the system, while also cutting

unnecessary penalties and fees that slow commerce and raise costs," Rep.

Miller said.

"I am committed to supporting our supply chains while

ensuring shipments enter our country securely and responsibly, with strong

safeguards in place to keep dangerous and illicit products far from our

communities," she added.

Beyer spoke to the impact that the termination of de minimis

has had on the American economy.

"In recent months, American consumers and small

businesses have suffered as their goods, particularly lower cost but still

time-sensitive items, have been held up waiting to be cleared by Customs. The

expedited shipping channel this bill creates would help resolve this growing

problem while also maintaining a high level of security at our ports of entry

to keep out drugs, counterfeits, and other illicit products," he said.

The Trump administration ended the longstanding rule-which

allowed small shipments worth $800 or less to enter the country duty free-under

the International Emergency Economic Powers Act (IEEPA), the same law used to

impose double-digit tariffs on more than 90 U.S. trading partners.

Critics of de minimis also pointed to the deluge of

cheaply-made, China-originating products from e-commerce juggernauts like

Shein, Temu and AliExpress using what they deemed a "loophole" in

trade policy. De minimis parcels are subject to much less stringent processing

by CBP, and many US brands believe they have been undermined by offshore

players. In 2024, 1.4 billion packages entered the US using de minimis, and

experts estimate that at least half, if not more, originated in China.

CBP said in December that it had collected US$ 1 billion in

tariff revenue on low-value packages since the exemption was rolled back on

August 29, 2025.

Calling the proposal "damaging," National Council

of Textile Organizations (NCTO) CEO and president Kim Glas said its passage

"would provide a workaround to President Trump's executive order closing

the dangerous de minimis loophole," which Congress passed legislation to

codify.

"This legislative proposal would replicate the

underlying problem with de minimis and it would require less information than

normal entries-making it impossible to enforce and rewarding these packages

skirting normal duty collections and costs," Glas said. "With the end

of de minimis, low-value shipments must come in under a system that is fair,

transparent, and enforceable. CBP is equipped to handle this change and has the

systems in place. Now, all small package shipments regardless of delivery

method have the necessary inspection, information, and duty collection."

According to the lawmakers, the bill would allow shipments valued at US$ 600 or less to move more quickly through the importation and customs process. Under the proposed legislation, importers that rely on select express shippers would be responsible for tariffs worth a maximum of 20% of the value of the shipment in question. These parcels would be exempted from the customs reporting requirements that larger shipments face.

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.