New US Senate Bill Targets First Sale Rule: Trade Cost Shock Or Compliance Reset?

On 12 February 2026, US Senators Bill Cassidy

(Republican–Louisiana) and Sheldon Whitehouse (Democrat–Rhode Island)

introduced legislation that would eliminate the long-standing “first sale rule”

in US customs valuation. If enacted, the measure would mark a fundamental shift

in import valuation policy, overturning nearly four decades of judicial

precedent and established commercial practice.

What Is the First Sale Rule?

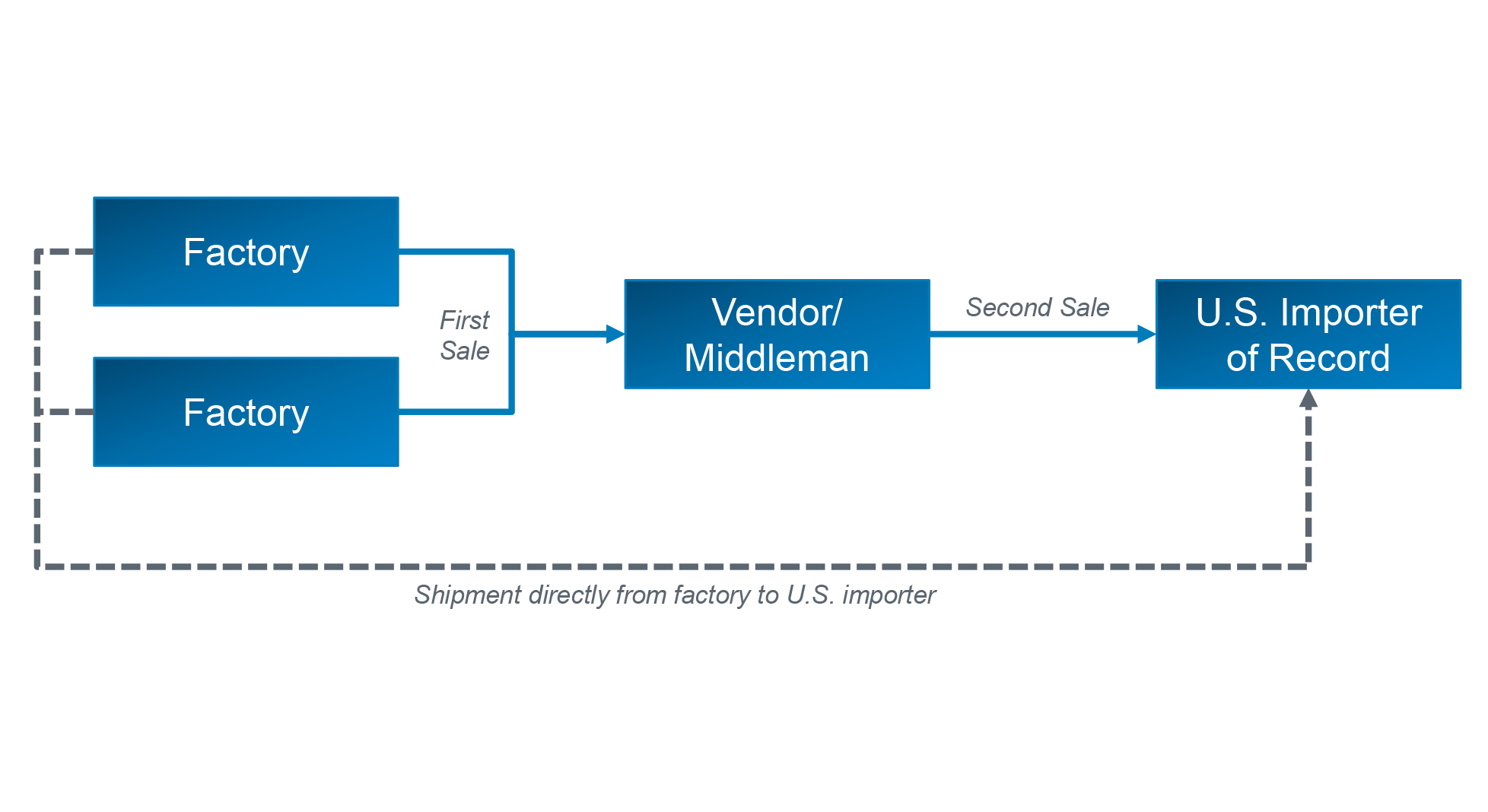

Under current U.S. customs law, importers may declare the

dutiable value of goods based on the price paid in the first bona fide sale in

a multi-tiered transaction, typically the sale between a manufacturer and a

middleman, rather than the higher price paid by the US buyer to the

intermediary.

The doctrine was established through litigation led by

Sandler, Travis & Rosenberg in the late 1980s and later reaffirmed by

Congress in 2008. Over time, it has become a mainstream cost-management

mechanism for US importers operating within complex global supply chains.

What the new bill proposes

The proposed legislation would amend the customs valuation

statute to require that imported goods be appraised based on the “price paid or

payable by the buyer in the United States for the merchandise in the last sale

that introduces the merchandise into the United States.”

In effect, this would mandate “last sale” valuation across

the board. For multi-tiered sourcing structures, common in apparel,

electronics, footwear, and consumer goods, the dutiable base would shift upward

to the highest transactional value prior to US entry.

Economic and trade implications

1. Direct cost increases

Eliminating first sale would increase the customs value of

many imported goods, thereby raising duty liability.

At a time when tariff volatility and supply chain

reconfiguration have constrained traditional cost-optimisation levers, this

change would remove one of the few remaining lawful valuation efficiencies

available to importers.

2. Inflationary pressures

Higher landed costs are likely to be passed through the

supply chain. In sectors such as apparel and consumer goods, where margins are

thin and price sensitivity is high, the result could be upward pressure on

retail pricing.

3. Competitive rebalancing

Smaller importers that lack multi-tiered sourcing structures

may see less relative impact. Larger multinational sourcing networks, which

rely heavily on intermediary structures for operational efficiency, would face

disproportionately higher exposure.

4. Supply chain transparency trade-off

Proponents of first sale argue that its structured

compliance requirements, particularly documentation standards mandated by U.S.

Customs and Border Protection, drive deeper visibility into upstream supply

chains. In practice, companies using first sale must map transactional flows

precisely, which can strengthen compliance with forced labour regulations and

other trade enforcement measures.

Eliminating the rule may simplify valuation from a

regulatory perspective but could reduce incentives for granular upstream

transparency.

Legal and policy significance

The first sale doctrine represents nearly 40 years of

judicially affirmed interpretation under U.S. customs valuation principles

aligned with WTO standards. Removing it would signal a broader policy pivot

toward revenue maximization and potentially protectionist valuation

methodology.

It would also represent a rare instance of Congress

reversing a long-standing, compliance-validated customs practice that has been

embedded in importer systems, transfer pricing models, and ERP frameworks for

decades.

Strategic considerations for importers

If the legislation advances, companies will need to:

-

Model duty exposure under last-sale-only

valuation

-

Reassess sourcing structures and intermediary

relationships

-

Evaluate transfer pricing alignment with customs

valuation

-

Strengthen landed cost forecasting and pricing

strategies

For sectors with heavy reliance on Asian manufacturing hubs,

the financial implications could be immediate and material.

The proposed elimination of the first sale rule is more than

a technical customs amendment, it is a structural recalibration of how the

United States values imports.

In an era defined by tariff escalation, geopolitical

realignment, and compliance intensification, the bill would remove a

long-standing cost mitigation mechanism and shift the balance toward higher

effective duty burdens.

Whether framed as revenue reform or trade tightening, the

outcome - if enacted - would reshape import economics across multiple

industries.

Not surprisingly, the proposed elimination is finding favour

with US textile and apparel industry.

NCTO backs Senate bill to end ‘first sale’ rule in US

imports

The National Council of Textile Organizations (NCTO) has

announced its support for the Last Sale Valuation Act, legislation.

NCTO president and CEO Kim Glas said: “NCTO and the US

textile industry strongly support the Last Sale Valuation Act, a bill that

would eliminate a harmful CBP rule that significantly lowers duties paid by

importers on textile and apparel goods and disadvantages US textile

manufacturers in favour of countries that often employ predatory trade

practices and fail to provide reciprocal market access.

“We sincerely thank Sens. Bill Cassidy (R-LA) and Sheldon

Whitehouse (D-RI) for their leadership on this bill. Closing this loophole will

help level the playing field, bolster the US textile industry, and spur more

onshoring and investment here and in our Western Hemisphere.”

Besides NCTO, the legislation has received endorsements from

the Rhode Island Textile Innovation Network, Rethink Trade, and Coalition for a

Prosperous America.

The Last Sale Valuation Act aims to ensure that duty

assessments reflect the actual transaction between foreign sellers and US

importers before goods enter US markets. Supporters believe this adjustment

would create more equitable conditions for small businesses and domestic

producers.

NCTO president and CEO Kim Glas said: “NCTO and the US textile industry strongly support the Last Sale Valuation Act, a bill that would eliminate a harmful CBP rule that significantly lowers duties paid by importers on textile and apparel goods and disadvantages US textile manufacturers in favour of countries that often employ predatory trade practices and fail to provide reciprocal market access.

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.