South East Asia Is An Emerging Market For India's T&C Industry

Market conditions in the West are dragging down India's overall textile and apparel exports. However, India's trade with South East Asia has been growing over the last few years. This trend will get stronger as regional connectivity improves further and ASEAN retail markets grow mature. We take a look at India's textile and apparel trade with South East Asia, and the economic outlook for the region.

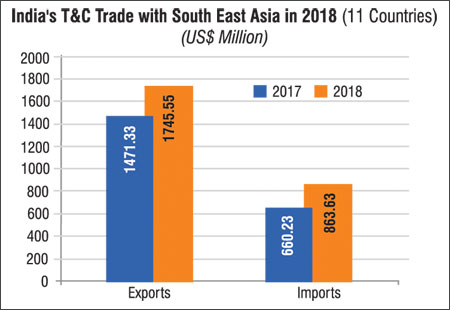

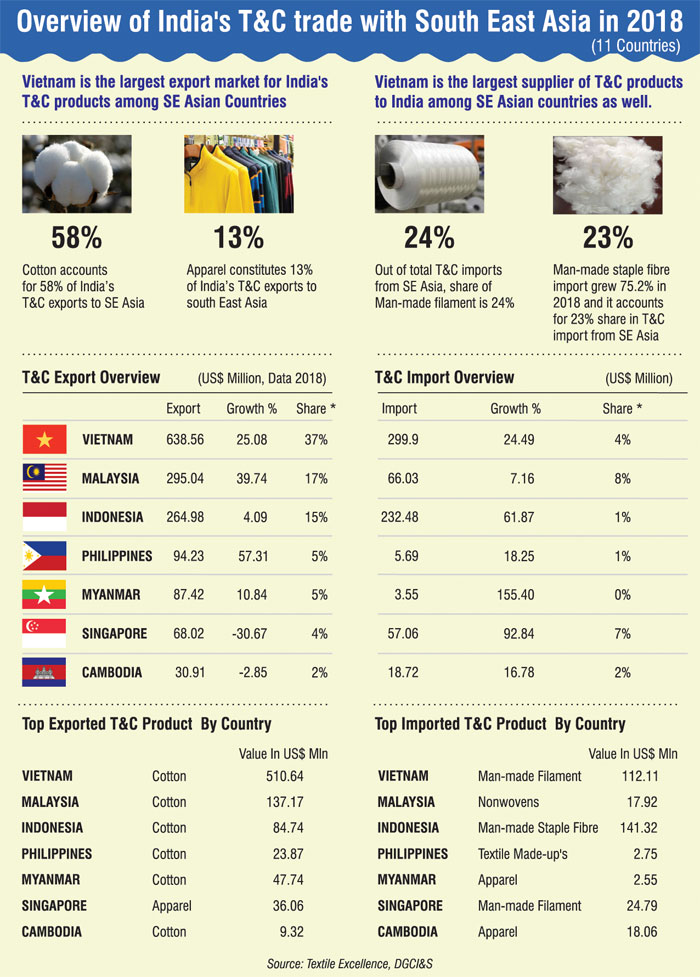

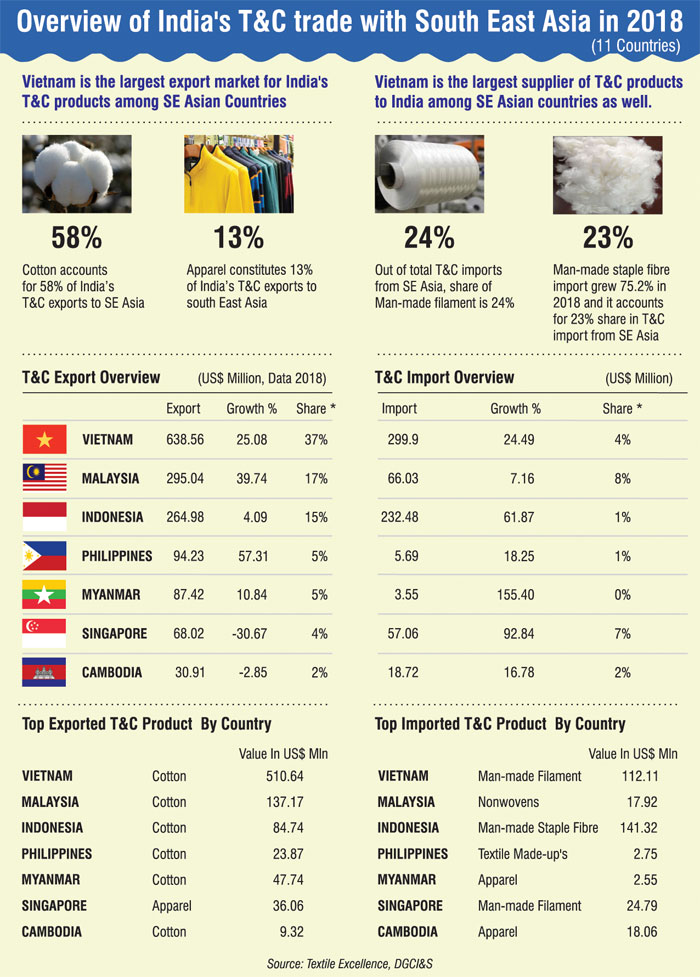

India's T&C exports to South East Asian countries have been improving and witnessed a positive growth of 18.64% to US$ 1745.51 million in 2018 over the corresponding year. Cotton is the major commodity export to the region, giving it a share of 58% in the total T&C exports to South East Asia and exports of cotton totaled to US$ 1008.92 million in 2018 with a growth of 29.29% over the corresponding period.

Amongst the eleven countries from the South East Asia, Vietnam is the top export market for India's T&C goods. In 2018, the T&C exports to Vietnam totaled to US$ 638.56 million with a growth of 25.08% over the corresponding period. And Vietnam stakes 37% share in Indi's total T&C exports to the South East Asia region.

Cotton, the largest commodity exported to Southeast Asia, has surpassed its own records in 2018 to US$ 1008.92 million, while in 2011 cotton exports to the region were US$ 478.06 million. Followed by cotton are apparel exports with a total of US$ 218.92 million, but registered a negative growth of 6.54% over the corresponding period.

Under apparel exports, knitted apparel registered negative growth of 7.55% to US$ 65.26 million and woven apparel exports fell by 6.11% to US$ 153.66 million in 2018 over the corresponding period. Man-made filament is the third largest commodity exported to the Southeast Asia region, while man-made staple fibre is just behind MMF with an export value of US$ 131.62 million with growth of 18.89%.

India's T&C imports from South East Asia have increased last year by 30.81% to US$ 863.63 million in 2018 over the corresponding period. India majorly imports man-made filament products from the region, the imports totaled to US$ 209.88 million with a growth of 5.45%.

The commodity shares 24% in the total T&C imports of India from South East Asia region. Following MMF, is man-made staple fibre which share of 23% in the total T&C imports of India from South East Asia region. The imports of MMSF totaled to US$ 200.71 million with a growth of 75.17% in 2018 over the corresponding period.

From the 11 countries of South East Asia, here too Vietnam is the largest supplier to India for T&C goods. Imports from Vietnam totaled to US$ 299.90 million in 2018 over the corresponding period and it stakes 35% in the total imports of India from South East Asia region.

Vietnam, A Bright Spot For India's T&C Industry

With the growing foreign investment and low labour cost, Vietnam has now become top destination for the textile industry. For India, Vietnam is the top export market as well the top supplier of T&C goods in South East Asia region.

India's exports to Vietnam in 2018 totaled to US$ 638.56 million with a growth of 25.08% over the corresponding period. India's T&C exports stake 10% share in the total export to Vietnam. To Vietnam, India majorly exports cotton products. Cotton commodity stakes 80% share in the total T&C export to Vietnam. The exports of cotton to Vietnam totaled to US$ 510.64 million with a growth of 30.24% in 2018 over the corresponding period.

Under the cotton commodity, cotton not carded or combed was exported the most with a total to US$ 342.97 million with a growth of 18.11% in 2018 over the corresponding period and the quantity increased by 13.73% to 183219.17 kgs. Cotton not carded or combed was traded at an average price of US$ 0.56 per kg in 2018, while in the corresponding period it was traded at US$ 0.59 per kg.

Single yarn of combed fibre is the second largest commodity to be exported to Vietnam. The exports of the yarn totaled to US$ 106.18 million in 2018 with a growth of 98.28% over the corresponding period and product was traded at US$ 0.31 per kg.

India's T&C imports from Vietnam totaled to US$ 299.9 million with growth of 24.49% in 2018 over the corresponding period, making Vietnam the largest supplier to India for T&C goods in South East Asia region. In the imports segment, Vietnam stakes 4% share in the total imports of India from Vietnam. Here man-made filament is the major commodity imported to India from Vietnam.

The imports totaled to US$ 112.11 million with growth of 0.84% only in 2018 over the corresponding period and stakes 37% in the total T&C imports from Vietnam to India. Under MMF, elastomeric yarn was largely imported to the India with import value of US$ 78.29 million with growth of 24.99% in 2018, while the quantity moved up by 23.41% to 14433.21 kgs. On an average, elastomeric yarn was imported at US$ 0.18 per kg in 2018 and US$ 0.19 per kg in 2017.

Imports of cotton from Vietnam have registered a growth of 571.21% in 2018 to US$ 11.47 in 2018 over the corresponding period. Textile fabric imports also perceived a good growth of 168.15% to US$ 40.80 million.

Indian Cotton Demand Rises In Malaysia

Malaysia which is the third largest economy in South East Asia region, is the second largest T&C export market for India's T&C goods. The exports of T&C from India to the country totaled to US$ 295.04 million in 2018 over the corresponding period with a growth of 39.74%. Here too cotton is majorly exported to Malaysia, with an export of US$ 137.17 million, with a growth of 230.91% in 2018. Under the cotton commodity, cotton not carded or combed was exported the most to Malaysia with a value of US$ 93.8 million with a huge growth of 553.57% in 2018 over the corresponding period. On an average the commodity was traded at US$ 0.56 per kg last year, while in the year before that trading price was US$ 0.61 per kg and quantity traded was 52,211.10 kgs for 2018.

Under the import segment, India’s T&C imports from Malaysia have registered a negative grwoth of 7.16% to US$ 66.03 million in 2018 over the corresponding period and the country stakes 8% in its total T&C imports with India. Nonwoven products was imoprted the most from Malaysia with a total of US$ 17.92 million and a growth of 20.73%.

The commodity shares 24% in the total T&C imports of India from South East Asia region. Following MMF, is man-made staple fibre which share of 23% in the total T&C imports of India from South East Asia region. The imports of MMSF totaled to US$ 200.71 million with a growth of 75.17% in 2018 over the corresponding period.

From the 11 countries of South East Asia, here too Vietnam is the largest supplier to India for T&C goods. Imports from Vietnam totaled to US$ 299.90 million in 2018 over the corresponding period and it stakes 35% in the total imports of India from South East Asia region.

Vietnam, A Bright Spot For India's T&C Industry

With the growing foreign investment and low labour cost, Vietnam has now become top destination for the textile industry. For India, Vietnam is the top export market as well the top supplier of T&C goods in South East Asia region.

India's exports to Vietnam in 2018 totaled to US$ 638.56 million with a growth of 25.08% over the corresponding period. India's T&C exports stake 10% share in the total export to Vietnam. To Vietnam, India majorly exports cotton products. Cotton commodity stakes 80% share in the total T&C export to Vietnam. The exports of cotton to Vietnam totaled to US$ 510.64 million with a growth of 30.24% in 2018 over the corresponding period.

Under the cotton commodity, cotton not carded or combed was exported the most with a total to US$ 342.97 million with a growth of 18.11% in 2018 over the corresponding period and the quantity increased by 13.73% to 183219.17 kgs. Cotton not carded or combed was traded at an average price of US$ 0.56 per kg in 2018, while in the corresponding period it was traded at US$ 0.59 per kg.

Single yarn of combed fibre is the second largest commodity to be exported to Vietnam. The exports of the yarn totaled to US$ 106.18 million in 2018 with a growth of 98.28% over the corresponding period and product was traded at US$ 0.31 per kg.

India's T&C imports from Vietnam totaled to US$ 299.9 million with growth of 24.49% in 2018 over the corresponding period, making Vietnam the largest supplier to India for T&C goods in South East Asia region. In the imports segment, Vietnam stakes 4% share in the total imports of India from Vietnam. Here man-made filament is the major commodity imported to India from Vietnam.

The imports totaled to US$ 112.11 million with growth of 0.84% only in 2018 over the corresponding period and stakes 37% in the total T&C imports from Vietnam to India. Under MMF, elastomeric yarn was largely imported to the India with import value of US$ 78.29 million with growth of 24.99% in 2018, while the quantity moved up by 23.41% to 14433.21 kgs. On an average, elastomeric yarn was imported at US$ 0.18 per kg in 2018 and US$ 0.19 per kg in 2017.

Imports of cotton from Vietnam have registered a growth of 571.21% in 2018 to US$ 11.47 in 2018 over the corresponding period. Textile fabric imports also perceived a good growth of 168.15% to US$ 40.80 million.

Indian Cotton Demand Rises In Malaysia

Malaysia which is the third largest economy in South East Asia region, is the second largest T&C export market for India's T&C goods. The exports of T&C from India to the country totaled to US$ 295.04 million in 2018 over the corresponding period with a growth of 39.74%. Here too cotton is majorly exported to Malaysia, with an export of US$ 137.17 million, with a growth of 230.91% in 2018. Under the cotton commodity, cotton not carded or combed was exported the most to Malaysia with a value of US$ 93.8 million with a huge growth of 553.57% in 2018 over the corresponding period. On an average the commodity was traded at US$ 0.56 per kg last year, while in the year before that trading price was US$ 0.61 per kg and quantity traded was 52,211.10 kgs for 2018.

Under the import segment, India’s T&C imports from Malaysia have registered a negative grwoth of 7.16% to US$ 66.03 million in 2018 over the corresponding period and the country stakes 8% in its total T&C imports with India. Nonwoven products was imoprted the most from Malaysia with a total of US$ 17.92 million and a growth of 20.73%.

India's Demand For Indonesia's MMF Upswings

Indonesia is emerging as a major export market for India's T&C goods. The export for the segment totaled to US$ 264.98 million with a growth of 4.09% in 2018 over the corresponding period. Indonesia T&C imports stakes 6% share in India's total export to the country.

Here too cotton is the majorly exported commodity to Indonesia, but it has perceived a fall by 11.53% to US$ US$ 138.44 million in 2018. Here too under the cotton commodity, cotton not carded or combed was traded the most to Indonesia, the commodity's export value totaled to US$ 84.74 million in 2018 over the corresponding period, while the growth declined by 26.67% for the same period.

Cotton was traded at an average price of US$ 0.58 per kg with a quantity of 48949.27 kgs in 2018. MMF and MMSF have done well in the export market of Indonesia, the export for MMF totaled to US$ 50.59 million with a growth of 48.04% and MMSF totaled to US$ 39.71 million with a growth of 44.51% in 2018 over the corresponding period.

Under the import segment, Indonesia is the second largest T&C supplier to India. The T&C imports from Indonesia totaled to US$ 232.48 million with a growth of 61.87% in 2018 over the corresponding period and it stakes only one percent share in the total T&C imports of India. Here man-made staple fibre is the largest commodity imported from Indonesia, imports of MMSF totaled to US$ 141.32 million with a growth of 100.60% in 2018 over the corresponding period.

Under the MMSF, viscose rayon staple fibre not carded or combed was imported the most, with a value of US$ 47.73 million, growth of 70.28% in 2018 and was traded at an average price of US$ 0.50 per kg. The total quantity imported was 24034.63 kgs. Cotton imports too have done well in the market. The imports of cotton totaled to US$ 5.63 million with growth of 124.26% in 2018 over the corresponding period. Even man-made filament has increased by 34.86% to US$ 36.09 million.

Philippines Is An Emerging Market For India's Cotton And Apparel Goods

India's T&C exports to the Philippines have been on the rise and it is an emerging market for India's T&C goods especially apparel and cotton.

The T&C exports to Philippines totaled to US$ 94.23 million with a growth of 57.31% in 2018 over the corresponding period. Philippines stakes 5% share in the total export of India to Philippines. Here cotton exports are ruling the basket with US$ 32.31 million and growth of 41.68% in 2018 over the corresponding period. Following cotton is apparel exports with growth of 154.14% to US$ 31.59 million in 2018.

Under the cotton commodity, single yarn of combed fabric was exported the most with an export value of US$ 23.87 million with growth of 22.66% in 2018 over the corresponding period. The commodity was traded at price of US$ 0.32 per kg and a quantity of 7544.67 kgs was exported in 2018. India's does not import much of T&C goods from Philippines. The imports totaled to US$ 5.69 million and have perceived a negative growth of 18.25% in 2018 over the corresponding period. Here other made-ups was imported the most by India.

The exports summed to US$ 2.75 million with a negative growth of 20.23% in 2018. The second most imported commodity, special woven fabric too have registered a negative growth of 17.72% to US$ 1.52 million in 2018 over the corresponding period.

Indian Knit Apparel & Fabric Exports To Myanmar Rises

India's T&C exports to Myanmar which stakes 7% share in the total export to Myanmar, has witnessed a growth of 10.84% to US$ 87.42 million in 2018 over the corresponding period. Cotton is ruling the export basket here too, with a value of US$ 47.71 million and has increased minimally by 1.18% in 2018 over the corresponding period. Knit apparel exports have gone up by 82.26% to US$ 21.04 million in 2018 over the corresponding period. Knitted fabric has shown an impressive growth of 445.24% to US$ 2.63 million.

Here under the cotton commodity, single yarn of uncombed fabric is the major exported product with a value of US$ 17.95 million, but the export fell by 15.45% in 2018 over the corresponding period. On an average, the commodity was traded at US$ 0.29/kg and 5208.85 kg was the total quantity of single yarn of uncombed fabric exported in 2018.

For knit apparel, T-shirt made of cotton was exported the most with a value of US$ 19.67 million and has perceived a magnificent growth of 247.04% in 2018 over the corresponding period.

Per t-shirt of cotton was traded to Myanmar at US$ 0.59 per piece in 2018 with total quantity of 11683 pieces. While in 2017 the same product was trade at US$ 0.74 per piece with a total quantity of 4207 pieces. T&C imports from Myanmar have been low at US$ 3.55 million and a growth of 155.40% in 2018 over the corresponding period. It's the apparel goods that are been imported the most from Myanmar, but the scale has been small. The imports totaled to US$ 2.55 million with a growth of 88.89% in 2018 over the corresponding period.

Exports To Singapore Have Dropped, While Imports Are Rising

India's T&C exports to Singapore have witnessed a fall in 2018 by 30.67% to US$ 68.02 million over the corresponding period where the exports totaled to US$ 98.11 million.

India's T&C exports to Singapore stakes only one percent share in India's total exports to Singapore. Apparel is ruling the export basket in Singapore market with an export value of US$ 36.06 million, but it perceived a negative growth of 34.83% in 2018 over the corresponding period and it stakes 81% in the total T&C exports to the country.

Other garments made for women were highly exported under the apparel commodity and totaled to US$ 2.39 million, falling 19.06% in 2018 over the corresponding period. The product was traded at price of US$ 0.15 per piece in 2018, while in 2017 it was US$ 0.13 per piece. Cotton exports to Singapore too have witnessed a drop of 65.86% to US$ 3.81 million in 2018 over the corresponding period. Woven fabric exports grew by 122.62% to US$ 1.4 million.Interestingly, the T&C imports from Singapore to India have gone up by 92.84% in 2018 with import value of US$ 57.06 million in 2018.

Man-made filament is the commodity majorly imported to India from the country with an import value of US$ 24.79 million and grew by 4.08% in 2018. Cotton imports have increased by 1436.09% just in a year's time to US$ 12.45 million in 2018 over the corresponding period where the imports totaled to US$ 0.81 million. Other commodities too have witnessed a positive trend in the import market.

Under the MMF commodity, elastomeric yarn was largely imported with an import of US$ 22.57 million, but perceived a negative growth of 2.35% in 2018 and the product was imported at a price of US$ 0.11 per kg, while in 2017 the price was US$ 0.12 per kg.

Cambodia's Apparel Attracts Indian Buyers

Overall exports to Cambodia have increased by 48.18%, but T&C exports have gone down by 2.85% to US$ 30.91 million in 2018 over the corresponding period. Currently Cambodia stakes 17% share in the total T&C export to Cambodia, whereas in 2017 it was 26%. Cotton was the commodity majorly exported to Cambodia from India, which totaled to US$ 9.32 million, but witnessed a negative growth of 18.79% in 2018 over the corresponding period. Denim made of woven fabric of cotton product stood out in the cotton commodity.

The exports of the product totaled to US$ 3.59 million with a growth of 39.95% in 2018 over the corresponding period. On an average the product was traded at a price of US$ 0.33 per sq. meter in 2018.

While exports have declined, India's T&C imports from Cambodia have increased by 16.78% to US$ 18.72 million in 2018 over the corresponding period. Here it's only the apparel products that get imported to India from Cambodia, which accumulated to US$ 18.06 million with growth of 13.37% in 2018 and share of 96% in the total imports of India T&C from Cambodia.

In the apparel segment, knit apparel are ruling the basket with US$ 12.25 million and growth of 7.57% in 2018. Under apparel, jerseys made of man-made fibres was the highest imported product withUS$ 1.71 million value, but perceived a negative growth of 11.02% in 2018 over the corresponding period.

The jersey was imported to India at an average price of US$ 0.16 per piece in 2018, while in 2017 it was US$ 0.14 per piece.

India's Demand For Indonesia's MMF Upswings

Indonesia is emerging as a major export market for India's T&C goods. The export for the segment totaled to US$ 264.98 million with a growth of 4.09% in 2018 over the corresponding period. Indonesia T&C imports stakes 6% share in India's total export to the country.

Here too cotton is the majorly exported commodity to Indonesia, but it has perceived a fall by 11.53% to US$ US$ 138.44 million in 2018. Here too under the cotton commodity, cotton not carded or combed was traded the most to Indonesia, the commodity's export value totaled to US$ 84.74 million in 2018 over the corresponding period, while the growth declined by 26.67% for the same period.

Cotton was traded at an average price of US$ 0.58 per kg with a quantity of 48949.27 kgs in 2018. MMF and MMSF have done well in the export market of Indonesia, the export for MMF totaled to US$ 50.59 million with a growth of 48.04% and MMSF totaled to US$ 39.71 million with a growth of 44.51% in 2018 over the corresponding period.

Under the import segment, Indonesia is the second largest T&C supplier to India. The T&C imports from Indonesia totaled to US$ 232.48 million with a growth of 61.87% in 2018 over the corresponding period and it stakes only one percent share in the total T&C imports of India. Here man-made staple fibre is the largest commodity imported from Indonesia, imports of MMSF totaled to US$ 141.32 million with a growth of 100.60% in 2018 over the corresponding period.

Under the MMSF, viscose rayon staple fibre not carded or combed was imported the most, with a value of US$ 47.73 million, growth of 70.28% in 2018 and was traded at an average price of US$ 0.50 per kg. The total quantity imported was 24034.63 kgs. Cotton imports too have done well in the market. The imports of cotton totaled to US$ 5.63 million with growth of 124.26% in 2018 over the corresponding period. Even man-made filament has increased by 34.86% to US$ 36.09 million.

Philippines Is An Emerging Market For India's Cotton And Apparel Goods

India's T&C exports to the Philippines have been on the rise and it is an emerging market for India's T&C goods especially apparel and cotton.

The T&C exports to Philippines totaled to US$ 94.23 million with a growth of 57.31% in 2018 over the corresponding period. Philippines stakes 5% share in the total export of India to Philippines. Here cotton exports are ruling the basket with US$ 32.31 million and growth of 41.68% in 2018 over the corresponding period. Following cotton is apparel exports with growth of 154.14% to US$ 31.59 million in 2018.

Under the cotton commodity, single yarn of combed fabric was exported the most with an export value of US$ 23.87 million with growth of 22.66% in 2018 over the corresponding period. The commodity was traded at price of US$ 0.32 per kg and a quantity of 7544.67 kgs was exported in 2018. India's does not import much of T&C goods from Philippines. The imports totaled to US$ 5.69 million and have perceived a negative growth of 18.25% in 2018 over the corresponding period. Here other made-ups was imported the most by India.

The exports summed to US$ 2.75 million with a negative growth of 20.23% in 2018. The second most imported commodity, special woven fabric too have registered a negative growth of 17.72% to US$ 1.52 million in 2018 over the corresponding period.

Indian Knit Apparel & Fabric Exports To Myanmar Rises

India's T&C exports to Myanmar which stakes 7% share in the total export to Myanmar, has witnessed a growth of 10.84% to US$ 87.42 million in 2018 over the corresponding period. Cotton is ruling the export basket here too, with a value of US$ 47.71 million and has increased minimally by 1.18% in 2018 over the corresponding period. Knit apparel exports have gone up by 82.26% to US$ 21.04 million in 2018 over the corresponding period. Knitted fabric has shown an impressive growth of 445.24% to US$ 2.63 million.

Here under the cotton commodity, single yarn of uncombed fabric is the major exported product with a value of US$ 17.95 million, but the export fell by 15.45% in 2018 over the corresponding period. On an average, the commodity was traded at US$ 0.29/kg and 5208.85 kg was the total quantity of single yarn of uncombed fabric exported in 2018.

For knit apparel, T-shirt made of cotton was exported the most with a value of US$ 19.67 million and has perceived a magnificent growth of 247.04% in 2018 over the corresponding period.

Per t-shirt of cotton was traded to Myanmar at US$ 0.59 per piece in 2018 with total quantity of 11683 pieces. While in 2017 the same product was trade at US$ 0.74 per piece with a total quantity of 4207 pieces. T&C imports from Myanmar have been low at US$ 3.55 million and a growth of 155.40% in 2018 over the corresponding period. It's the apparel goods that are been imported the most from Myanmar, but the scale has been small. The imports totaled to US$ 2.55 million with a growth of 88.89% in 2018 over the corresponding period.

Exports To Singapore Have Dropped, While Imports Are Rising

India's T&C exports to Singapore have witnessed a fall in 2018 by 30.67% to US$ 68.02 million over the corresponding period where the exports totaled to US$ 98.11 million.

India's T&C exports to Singapore stakes only one percent share in India's total exports to Singapore. Apparel is ruling the export basket in Singapore market with an export value of US$ 36.06 million, but it perceived a negative growth of 34.83% in 2018 over the corresponding period and it stakes 81% in the total T&C exports to the country.

Other garments made for women were highly exported under the apparel commodity and totaled to US$ 2.39 million, falling 19.06% in 2018 over the corresponding period. The product was traded at price of US$ 0.15 per piece in 2018, while in 2017 it was US$ 0.13 per piece. Cotton exports to Singapore too have witnessed a drop of 65.86% to US$ 3.81 million in 2018 over the corresponding period. Woven fabric exports grew by 122.62% to US$ 1.4 million.Interestingly, the T&C imports from Singapore to India have gone up by 92.84% in 2018 with import value of US$ 57.06 million in 2018.

Man-made filament is the commodity majorly imported to India from the country with an import value of US$ 24.79 million and grew by 4.08% in 2018. Cotton imports have increased by 1436.09% just in a year's time to US$ 12.45 million in 2018 over the corresponding period where the imports totaled to US$ 0.81 million. Other commodities too have witnessed a positive trend in the import market.

Under the MMF commodity, elastomeric yarn was largely imported with an import of US$ 22.57 million, but perceived a negative growth of 2.35% in 2018 and the product was imported at a price of US$ 0.11 per kg, while in 2017 the price was US$ 0.12 per kg.

Cambodia's Apparel Attracts Indian Buyers

Overall exports to Cambodia have increased by 48.18%, but T&C exports have gone down by 2.85% to US$ 30.91 million in 2018 over the corresponding period. Currently Cambodia stakes 17% share in the total T&C export to Cambodia, whereas in 2017 it was 26%. Cotton was the commodity majorly exported to Cambodia from India, which totaled to US$ 9.32 million, but witnessed a negative growth of 18.79% in 2018 over the corresponding period. Denim made of woven fabric of cotton product stood out in the cotton commodity.

The exports of the product totaled to US$ 3.59 million with a growth of 39.95% in 2018 over the corresponding period. On an average the product was traded at a price of US$ 0.33 per sq. meter in 2018.

While exports have declined, India's T&C imports from Cambodia have increased by 16.78% to US$ 18.72 million in 2018 over the corresponding period. Here it's only the apparel products that get imported to India from Cambodia, which accumulated to US$ 18.06 million with growth of 13.37% in 2018 and share of 96% in the total imports of India T&C from Cambodia.

In the apparel segment, knit apparel are ruling the basket with US$ 12.25 million and growth of 7.57% in 2018. Under apparel, jerseys made of man-made fibres was the highest imported product withUS$ 1.71 million value, but perceived a negative growth of 11.02% in 2018 over the corresponding period.

The jersey was imported to India at an average price of US$ 0.16 per piece in 2018, while in 2017 it was US$ 0.14 per piece.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.